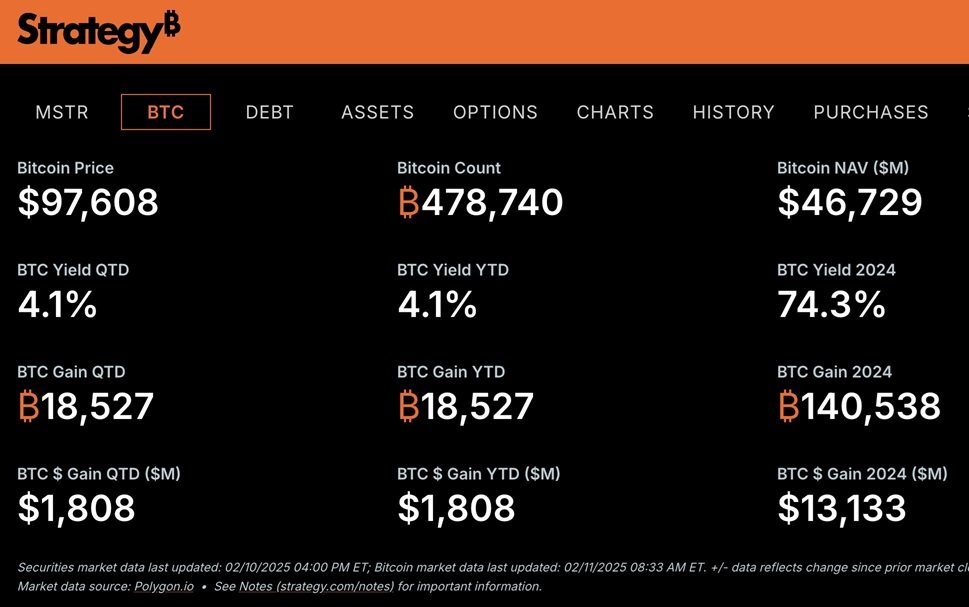

Microstrategy’s bitcoin strategy has generated $1.8 billion in gains for shareholders this year, with holdings reaching 478,740 $BTC—cementing its status as the ultimate bitcoin stock.

Microstrategy’s Bitcoin Strategy Yields $1.8B for MSTR Investors so far This Year

Michael Saylor, executive chairman of Microstrategy Inc. (Nasdaq: MSTR), highlighted the company’s latest bitcoin gains in a Feb. 11 post on social media platform X. The company recently rebranded to Strategy. He stated:

So far this year, Strategy treasury operations have resulted in a $BTC Gain of ₿18,527, which equates to a $BTC $ Gain of ~$1.8 billion for MSTR shareholders.

This announcement comes as Microstrategy’s bitcoin holdings reached 478,740 $BTC, with a total net asset value (NAV) of $46.7 billion. The company reported a 74.3% $BTC yield for 2024, reinforcing its position as the largest publicly traded corporate holder of bitcoin. The latest figures reflect the firm’s continued commitment to bitcoin as a primary treasury asset.

The company disclosed its latest bitcoin purchases in a filing with the U.S. Securities and Exchange Commission (SEC) on Feb. 10. Microstrategy acquired 7,633 $BTC for about $742.4 million at approximately $97,255 per bitcoin and has achieved $BTC Yield of 4.1% YTD 2025. The acquisition was funded through a combination of stock sales and a preferred stock offering, continuing the company’s strategy of using capital markets to expand its bitcoin reserves.

Earlier in the month, Microstrategy released its fourth-quarter earnings for 2024, marking key corporate milestones. Chief Financial Officer Andrew Kang stated: “The fourth quarter of 2024 marked our largest ever increase in quarterly bitcoin holdings, culminating in the acquisition of 218,887 bitcoins acquired for $20.5 billion since the end of Q3.” The company credited its capital-raising efforts, including an at-the-market equity offering and convertible note issuances, for fueling its bitcoin purchases.

Saylor has projected that bitcoin could reach $13 million per coin by 2045, representing his base-case scenario. He also outlined a bear-case scenario with Bitcoin at $3 million and a bull-case scenario at $49 million within the same timeframe. These predictions are based on varying annual growth rates and potential market adoption levels.

news.bitcoin.com

news.bitcoin.com