Main Takeaways

-

The growing retail adoption, long-term holding behavior, and institutional interest underscore Bitcoin's evolving role as a reliable store of value.

Bitcoin has rolled into 2025 having surpassed the once-elusive $100,000 mark in the final month of last year. The crypto market is still experiencing remarkable momentum that underscores its strength and resilience. However, what was a monumental milestone just months ago now feels like old news, prompting questions about whether the rally might be nearing its end. Not long ago, the idea of Bitcoin at $100K seemed almost unattainable – but here we are. Where is $BTC headed next?

Some find it hard to believe that substantial further growth is possible now that the coveted milestone is achieved. But is this sentiment rooted in data and systematic thinking, or simply in a failure of imagination? As we know all too well, after all, is that the boundaries of what’s imaginable are extremely malleable.

A closer look at key metrics beyond price reveals a strong picture of robust network health and activity. These indicators point to immense potential for sustained growth, highlighting an ecosystem brimming with innovation, adoption, and long-term promise. Below, we dig into the data and trends that affirm Bitcoin’s enduring dominance and tremendous potential for further growth.

ETF Boost, Decoupling From Stocks, Computational Strength

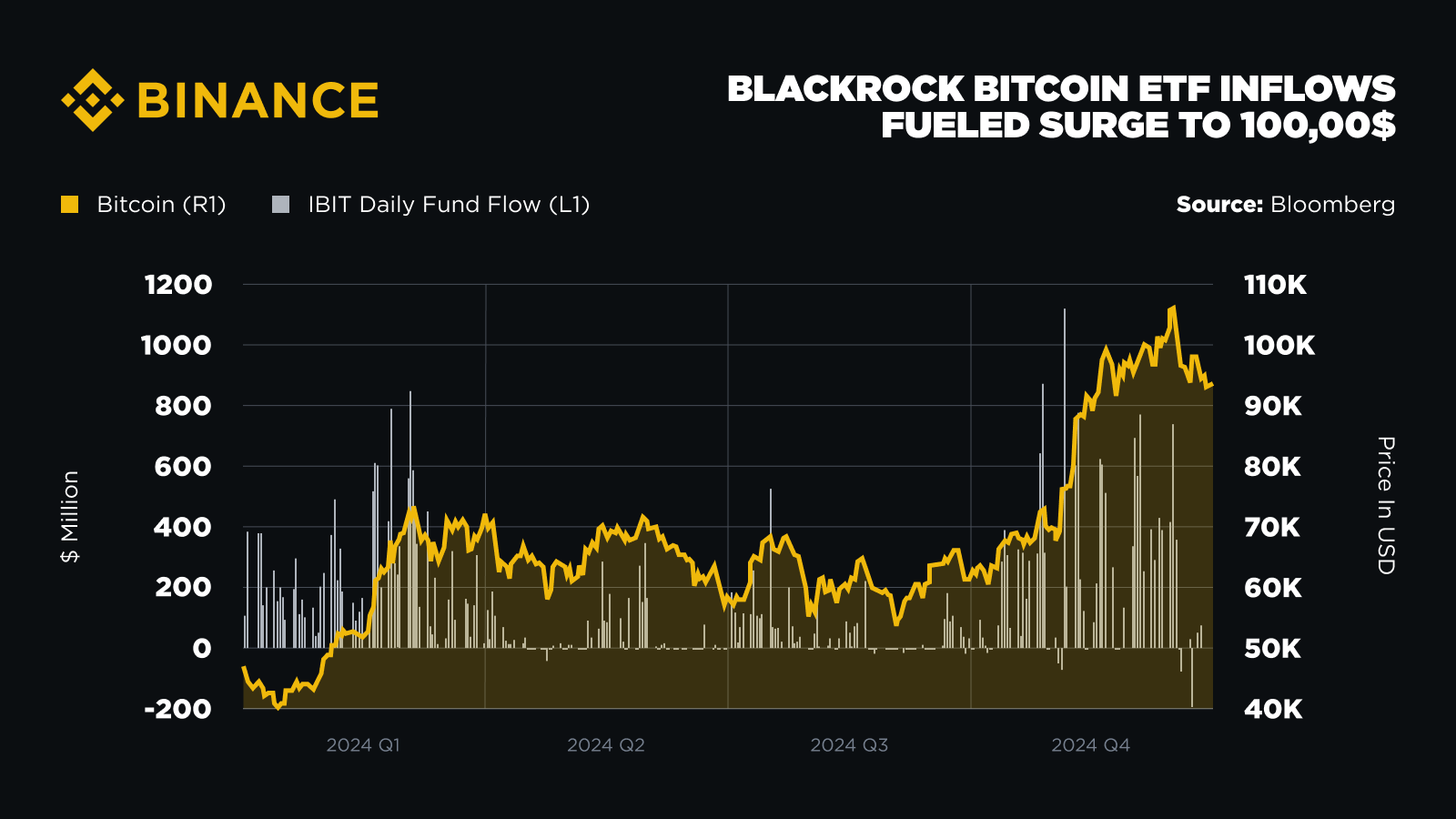

The approval of spot Bitcoin ETFs in early 2024 marked a monumental step for the mainstream adoption of crypto assets globally. This milestone not only signaled a larger acceptance of cryptocurrency by traditional finance players but also both reflected and spurred institutional appetite for digital assets. Over the course of the year, U.S.-traded Bitcoin ETFs experienced exponential growth, with holdings doubling from 650,000 $BTC in January 2024 to over 1,250,000 $BTC by year-end. Leading this transformation was BlackRock’s iShares Bitcoin Trust (IBIT), which shattered industry records by amassing over $50 billion in assets within just 11 months, making it the most successful ETF launch to date among the more than 1,400 ETFs offered globally by BlackRock’s iShares.

This unprecedented growth not only highlights Bitcoin's growing appeal but also underscores the broader market's recognition of its long-term potential. Institutional players are increasingly integrating crypto into their portfolios, further solidifying its role in global finance.

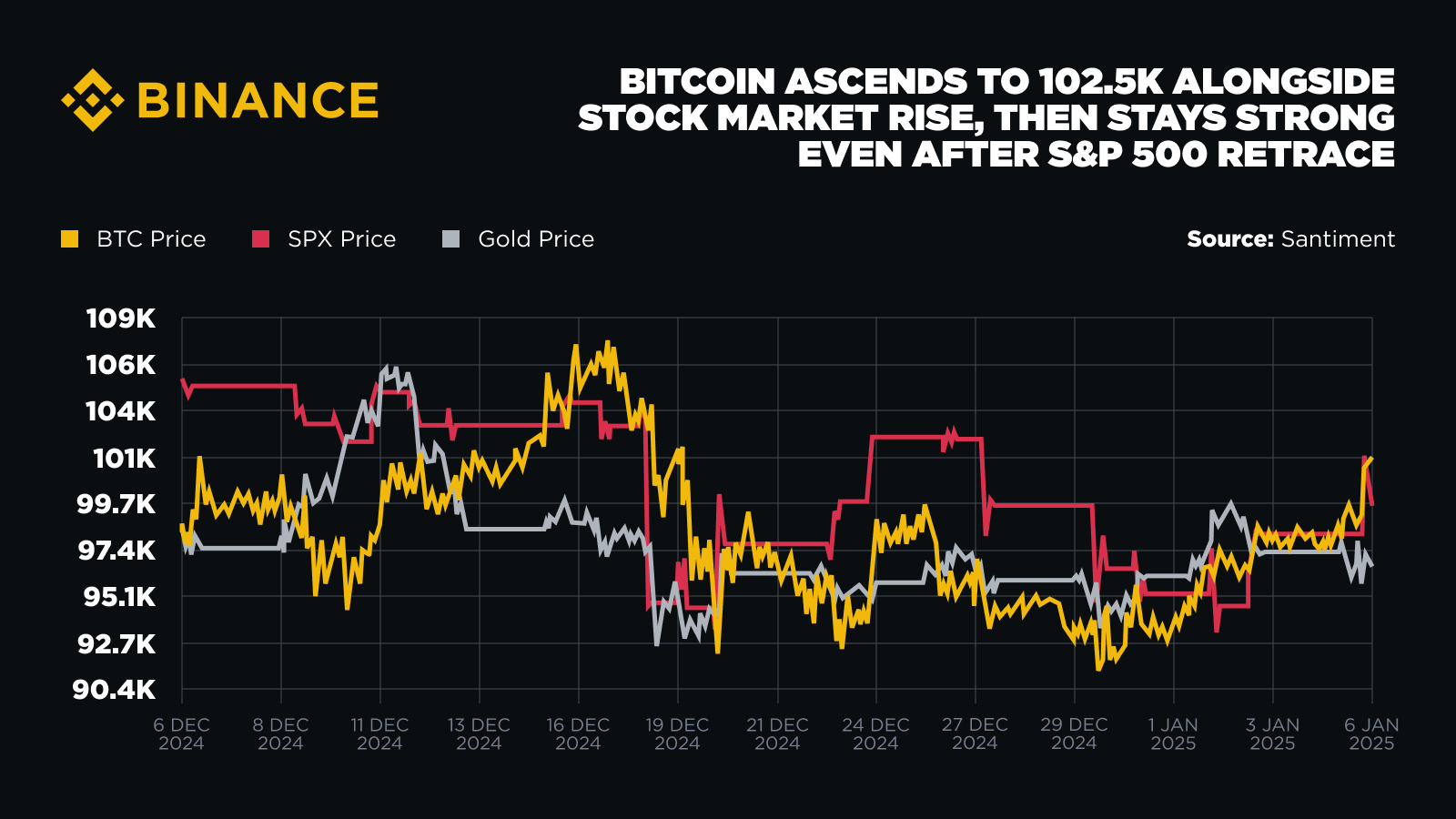

In early 2025, Bitcoin has also shown signs of decoupling from traditional equity markets, outperforming the S&P 500 index and signaling a shift away from its prior behavior as a “high-leveraged tech stock.” This divergence reinforces Bitcoin’s position as a unique asset standing apart from traditional market trends – while demonstrating its potential to thrive in the evolving financial landscape.

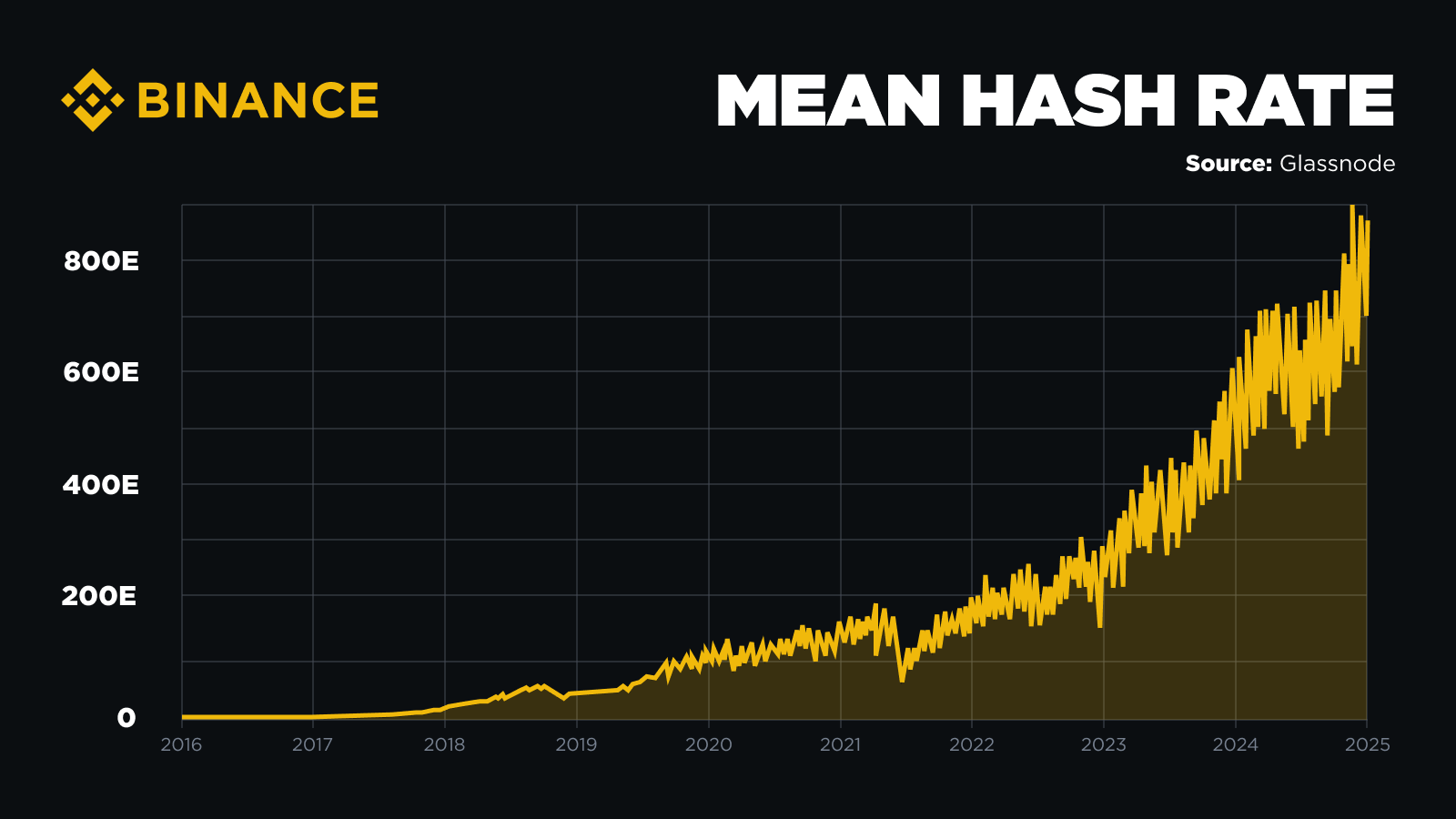

Yet, while institutions are becoming increasingly influential with the approval of ETFs, the true power of Bitcoin remains in its decentralized structure. A key reflection of this decentralization is Bitcoin's hashrate — an essential gauge of the blockchain’s security and computational strength.

Bitcoin’s hashrate has recently reached an all-time high, surpassing the combined computing power of tech giants such as Amazon AWS, Google Cloud, and Microsoft Azure, which together contribute less than 1% of Bitcoin’s total network capacity. This extraordinary level of decentralization showcases the remarkable coordination among miners and node operators globally. It reinforces the network’s resilience and highlights the trust it continues to build, from early pioneers to new entrants in the ecosystem.

Crossing the Chasm: Growing Retail Adoption

Crypto’s ongoing momentum has also prompted noticeable changes in user behavior. These shifts highlight Bitcoin’s evolving adoption story, with many users holding $BTC for the first time. The growing shift from speculative trading to long-term holding reflects increasing trust in the crypto ecosystem and its leading players.

A significant milestone highlighting this progress was Binance surpassing a quarter of a billion users on the last day of 2024 – achieved by adding 50 million users in less than six months. This remarkable achievement aligns with broader trends of adoption, where users increasingly view $BTC as a store of wealth and a hedge against economic uncertainty. Such behavioral changes are strong indicators that the adoption chasm – a critical stage in the lifecycle of any innovative technology – is being crossed. As trust deepens and more individuals recognize Bitcoin’s intrinsic value, the foundation for its mainstream adoption continues to solidify, setting the stage for the next wave of growth in the cryptocurrency ecosystem.

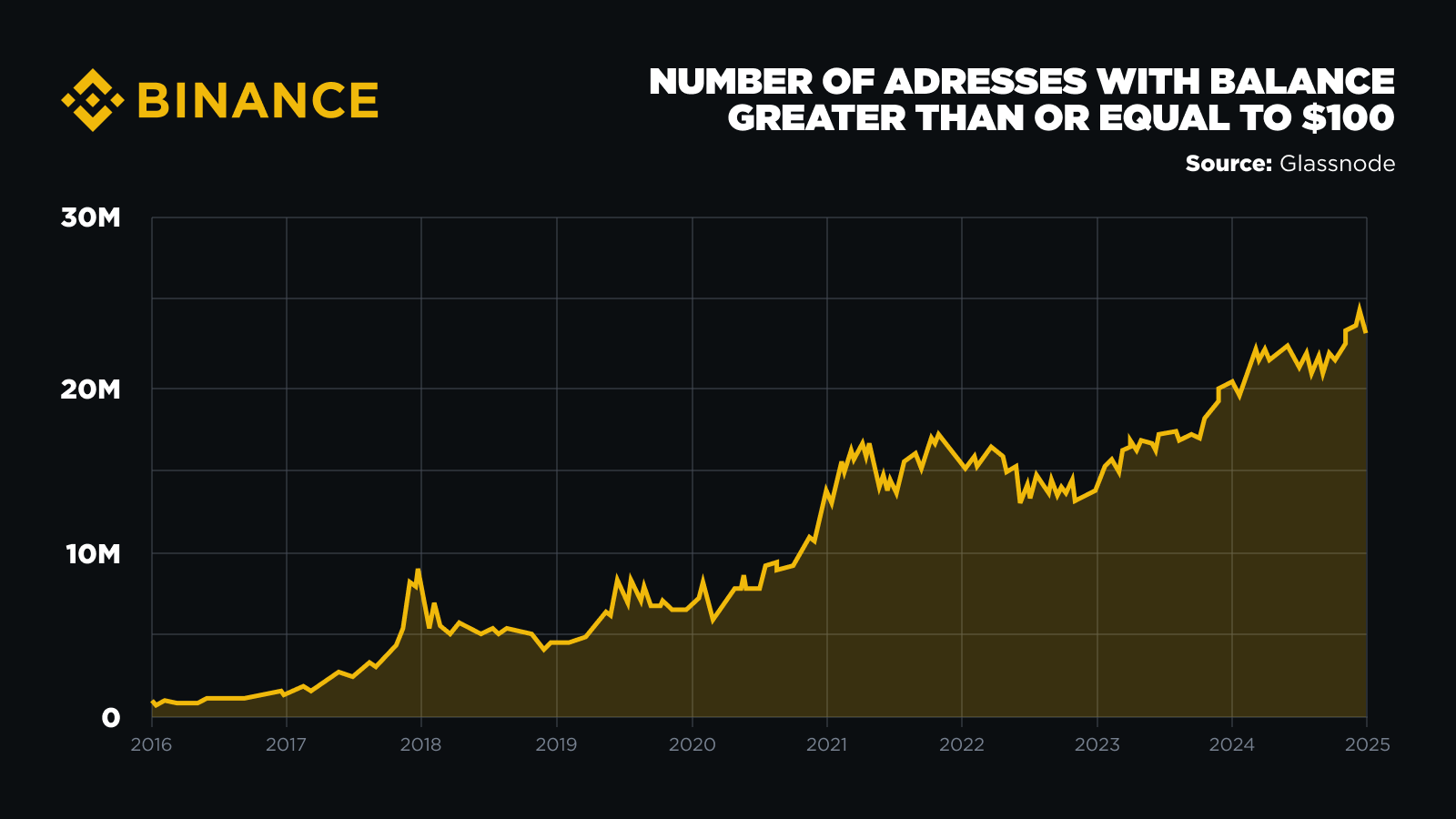

This growing trust and recognition of Bitcoin’s value are further supported by on-chain data, which reveals a surge in wallet addresses holding at least $100 or $1,000 worth of Bitcoin, approaching all-time highs.

This trend reflects an influx of new participants into the market, signaling renewed interest and optimism for the cryptocurrency. While institutional players have certainly played a significant role this cycle with the ETF launches and the establishment of bitcoin treasuries by various public companies, the rate of individual investor adoption remains robust. Their increasing presence is broadening Bitcoin’s user base and solidifying its role as a cornerstone of the evolving financial landscape.

Bitcoin's Surging Demand

The most compelling Bitcoin story isn’t just in the price – it’s in the behavior of Bitcoin investors. Over 50% of $BTC in circulation has remained unmoved for the past two years, underscoring the growing conviction of long-term holders. This shift towards "HODLing" reflects increasing optimism and trust in Bitcoin's future as a reliable store of value.

The market sentiment remains robust, with 86% of Bitcoin currently in circulation “in profit,” signaling resilience and widespread confidence among investors. Demand momentum has surged since late 2024, with CryptoQuant data showing an expansion of 228,000 $BTC monthly. Notably, accumulator addresses – wallets that consistently buy Bitcoin without selling – have reached a record pace of 495,000 $BTC per month, further indicating a strong belief in Bitcoin's long-term potential.

End of Cycle Soon?

Throughout the past year, Bitcoin reached several all-time highs. While some investors questioned whether the bull market had peaked, a closer examination of key metrics suggests that the upward trajectory is far from over.

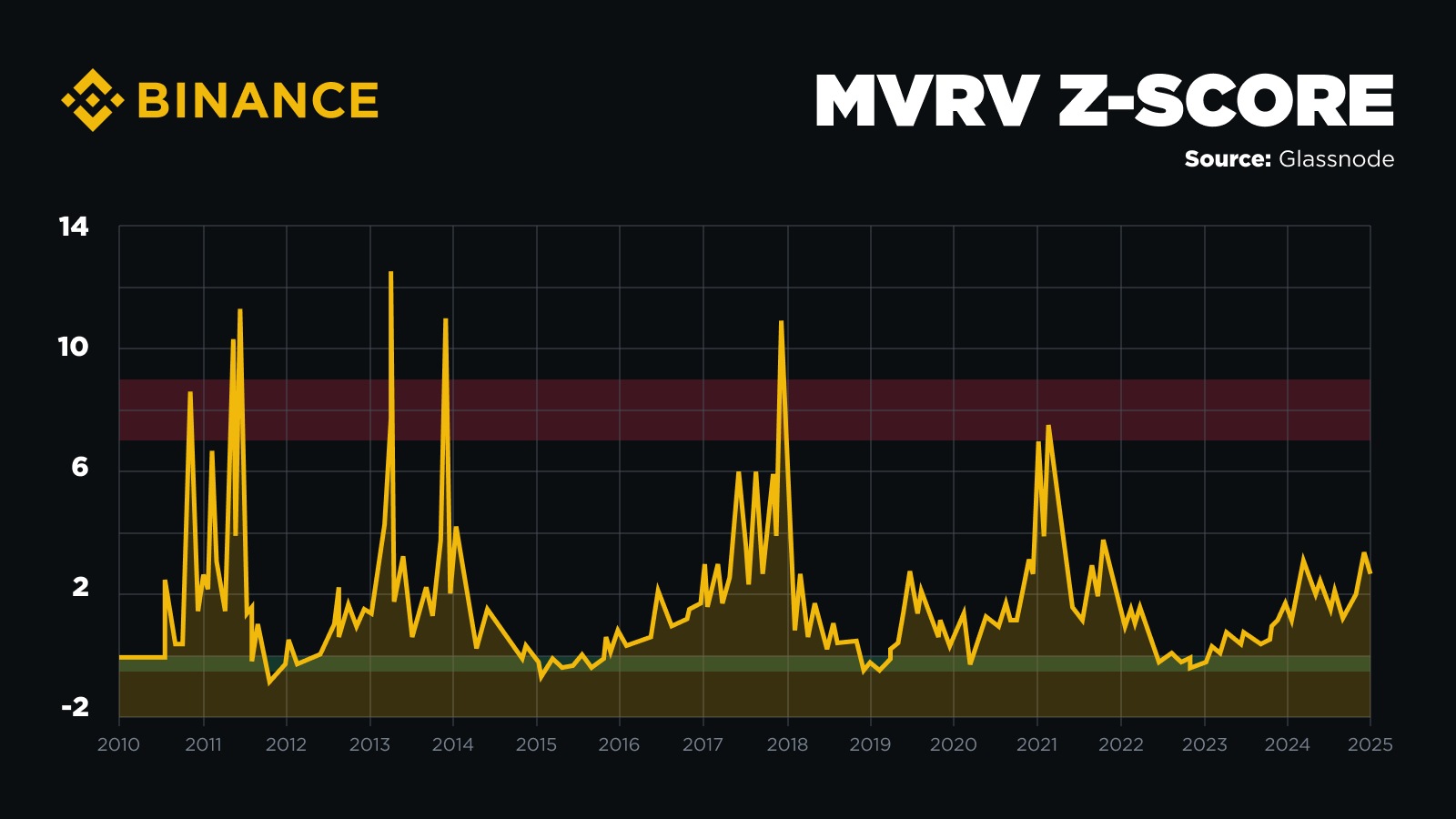

One of the most insightful tools in understanding Bitcoin’s future potential is the MVRV Z-Score. This metric offers valuable information about Bitcoin’s market valuation by comparing the market value to $BTC’s "fair value" and thus determining whether Bitcoin is overvalued or undervalued. Currently, Bitcoin remains far from the "red zone," where overvaluation signals a market top, suggesting that it has significant room for growth.

Additionally, Bitcoin's dominance among long-term holders is playing a crucial role in its bright outlook. The increasing accumulation is reducing market liquidity, creating a supply crunch that keeps pushing prices upward. This trend, coupled with the positive signals from the Crypto Fear and Greed Index, paints an optimistic picture. Entering 2025, the index shows a healthy level of greed with a 30-day Simple Moving Average at 75%, reflecting strong bullish “greed” sentiment without the extreme irrational exuberance that often precedes market corrections. This sustainable momentum points to Bitcoin’s growing acceptance and trust.

Final Thoughts

As we move into 2025, Bitcoin's potential seems boundless. The asset keeps breaking new ground in terms of price, and data points to an even more exciting year ahead. With major financial institutions flocking into the crypto space and increasing retail adoption, Bitcoin is no longer viewed as a niche asset but as a legitimate, scalable financial instrument.

With solid fundamentals, increasing adoption, and a healthy market environment, Bitcoin is poised for continued success. The metrics paint a picture of an asset that is more resilient and promising than ever, with 2025 shaping up to be a year that could surpass even the excitement of 2024. The balance between institutional involvement and Bitcoin's decentralized power continues to set it apart, reinforcing its long-term viability and positioning it as a transformative force in the global financial system.

Start your Bitcoin journey with Binance today!

Further Reading

-

From Our CEO: It’s Still Early For Crypto

-

From Bars to Bytes: Gold, Bitcoin, and the Future of Value

-

Bitcoin Hits $100K: From Slices to Surges, the Journey of a Lifetime

Disclaimer: Digital assets are subject to high market risk and price volatility. The value of your investment may go down or up, and you may not get back the amount invested. You are solely responsible for your investment decisions and Binance is not liable for any losses you may incur. Past performance is not a reliable predictor of future performance. You should only invest in products you are familiar with and where you understand the risks. You should carefully consider your investment experience, financial situation, investment objectives and risk tolerance and consult an independent financial adviser prior to making any investment. This material should not be construed as financial advice. For more information, see our Terms of Use and Risk Warning.

binance.com

binance.com