Larry Fink Suggests Bitcoin Could Reach $700,000 Amid Ongoing Inflation Worries and Currency Debasement Concerns

-

As inflationary pressures continue to loom, BlackRock CEO Larry Fink’s bold predictions about Bitcoin’s future have captured the crypto community’s attention.

-

The CEO’s remarks at the World Economic Forum suggest that small allocations from institutional investors could propel Bitcoin’s price to unprecedented heights.

-

Fink emphasized the role of Bitcoin as a hedge against inflation, stating, “If you’re frightened about the debasement of your currency… you can have an internationally based instrument called Bitcoin.”

BlackRock’s Larry Fink forecasts Bitcoin could reach $700,000 amid ongoing inflationary fears, advising asset managers to consider small allocations to BTC.

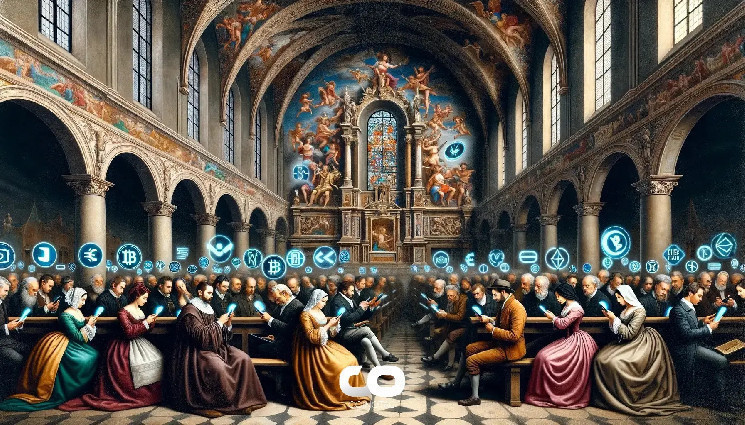

Understanding Bitcoin’s Role in Inflation Hedge Strategies

Amid rising concerns about inflation, Bitcoin is increasingly viewed as a potential hedge by both institutional and retail investors. Fink’s assertion that Bitcoin could soar to $700,000 is rooted in the fundamentals of supply and demand, particularly as it relates to the ongoing currency debasement fears that many economies face.

This perspective reflects a broader trend where traditional assets struggle to maintain their purchasing power. In light of this, Bitcoin’s finite supply makes it an attractive alternative for investors looking to mitigate risks associated with fiat currencies.

Moreover, the BlackRock CEO’s mention of “collective small allocations” hints at the growing institutional interest in cryptocurrency. Asset managers reallocating even a mere 2% to 5% of their portfolios to Bitcoin could generate massive liquidity and drive the price upward, changing the landscape of mainstream finance.

Analysis of the CPI Data and Its Implications

The recent Consumer Price Index (CPI) report showing a decline to 3.2% has provided some relief to nervous investors. However, skepticism remains regarding the accuracy of the CPI as a reliable measure of inflation. Critics argue that it does not fully capture the rising costs of essential goods and services.