Bitcoin (BTC) was visibly flowing into large-scale wallets for the most of 2024. However, shrimp accumulation accelerated in the past few months, turning small-scale holders into a significant factor.

For most of 2024, it looked like retail investors were skipping out on the bull market. However, shrimp accumulation accelerated, creating new wallets holding under 1 BTC. Buying by small-scale retail holders concentrated in the last quarter of 2024, through the most active part of the bull market.

Wallets with less than 1 BTC are re-accumulating, as their count was historically higher ahead of the 2022 crash. At one point, those wallets held more than 15% of the supply, or over 3M BTC. The balance shifted into whale wallets during the bear market, but the trend may be turning again.

The trend of shrimp accumulation is shifting the absorption of new BTC, both from mining and from sellers. After retail traders joined, their absorption rate increased to more than 17.6K monthly. Once again, shrimp are buying up more than the month’s mined supply. During previous rallies, shrimp have also accumulated even faster, at over 33,000 BTC per month. However, this type of investor is sometimes reluctant to buy the dip, as accumulation stalled after the correction of August 2024.

Shrimp buying is also regular, suggesting the small-scale owners are ‘stacking sats’, unlike ETF where large-scale inflows are often followed by selling. For some analysts, whales may be more level-headed, while retail buyers tend to panic. The latest buying, however, only saw profit-taking at the top, while accumulation continued after every BTC dip.

Shrimp investors now hold over 6.9% of all BTC produced, surpassing even the actively accumulating ETF, which control around 4% of the BTC supply. The new small-scale wallets already hold a total of 1.36M BTC, comparable with the holdings of corporate buyers. Shrimp holders now own more BTC than is left to be mined for the full supply of 21M coins.

During the latest accumulation period, new whales also increased their holdings to over 1.97M BTC. Miners remain a steady factor, holding around 1.9M coins for long-term favorable selling. Whales remain more agile in buying BTC during drawdowns, but retail is turning into a constant factor in creating demand for more BTC.

Small investors and new buyers support BTC

The renewed retail buying near BTC’s higher range follows a period where sideways trading would shake down small-scale investors. However, buyers returned during another period of accumulation, turning into one of the regular factors for absorbing and holding BTC.

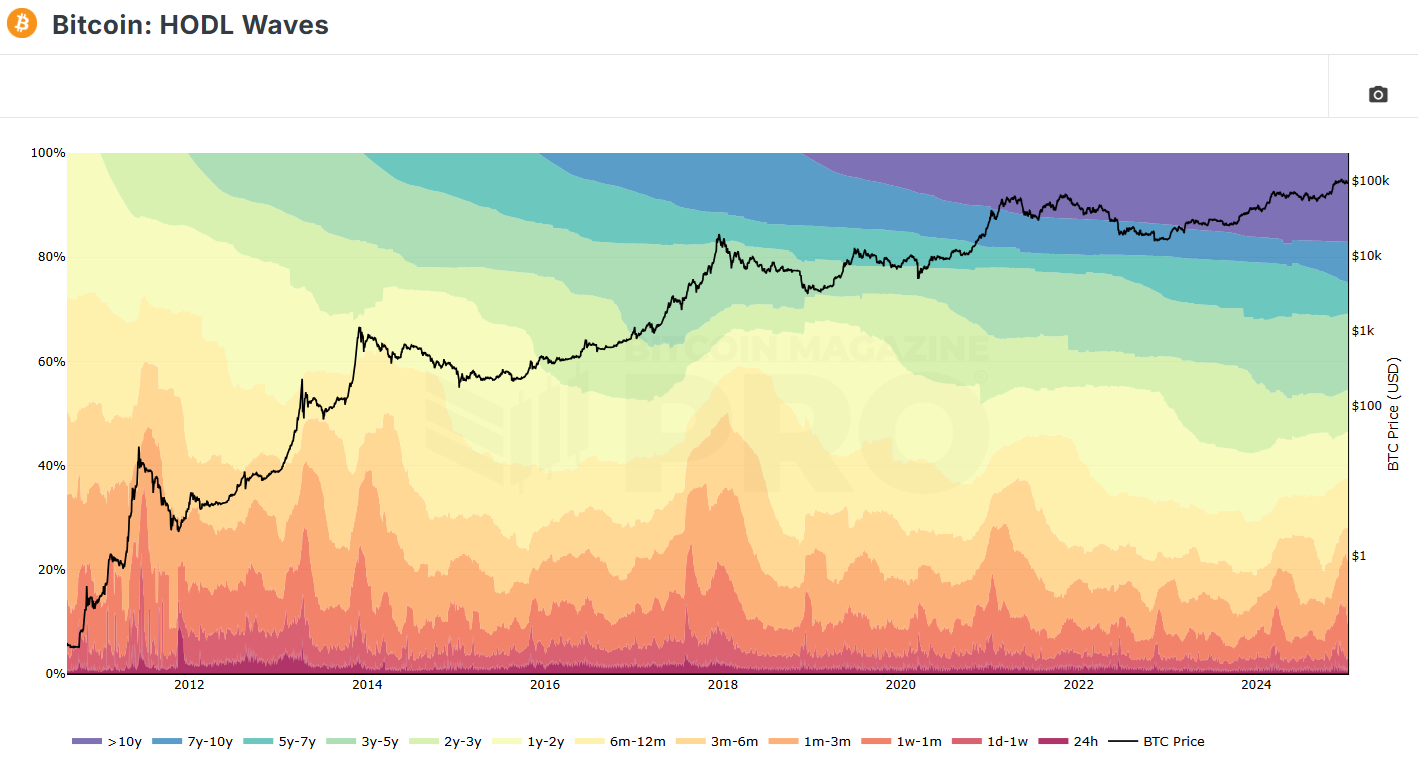

The last cohorts of buyers are also the ones expanding the most quickly, while older whales remain passive. Based on the chart of HODL waves, the latest cohorts of buyers with wallets younger than six months take up around 25% of the BTC supply. Newer holders are not necessarily shrimp buyers, but small-scale accumulation is part of the trend.

The overall consensus is that BTC may soon face a supply crunch, as individual wallets are mopping up a larger part of the supply. The recent bull rally above $108K was the first one to happen with constantly dropping exchange reserves, as buyers were in no rush to liquidate.

For short-term speculation, futures markets completed the task, avoiding the exposure of valuable BTC to exchange wallets. The shift to self-custodial accumulation follows the experience with the FTX exchange, where holders would be compensated at $16,000 per BTC.

BTC shows quick price recovery

BTC recovered above $94,000, gaining close to $5,000 in a single day of trading. The asset showed resilience, even though the Bitcoin Fear and Greed index dipped from 78 to 50 points within a day.

The market sentiment shifted again in the short term, to 61%, as traders showed short-term optimism. BTC relies on multiple support levels, for now settled above $90,000. The presence of constant buying and exchange withdrawals signals fewer panic episodes for spot traders.

cryptopolitan.com

cryptopolitan.com