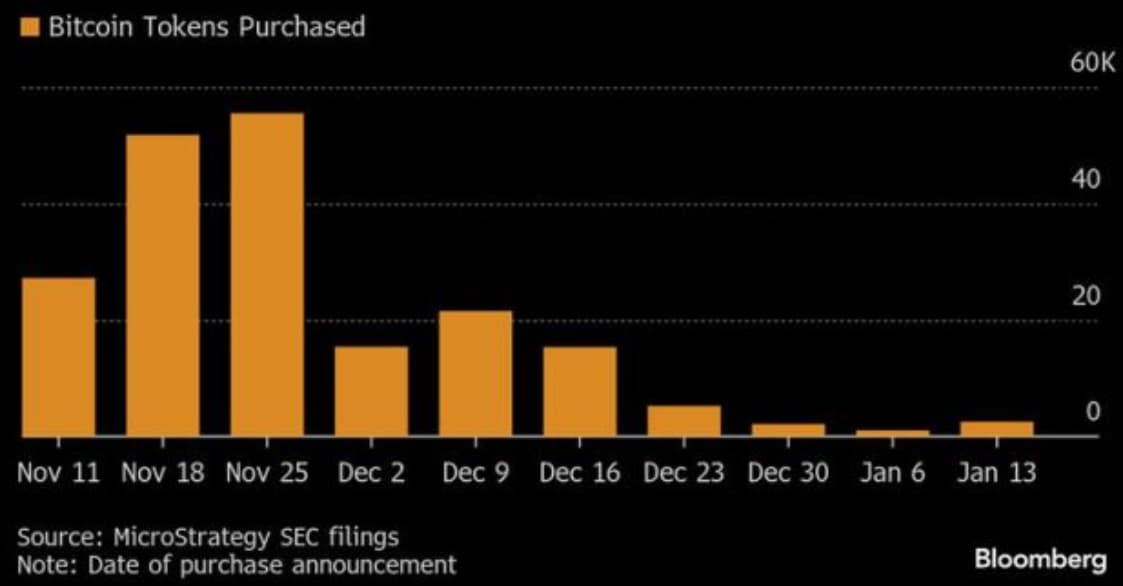

MicroStrategy (NASDAQ: MSTR), the world’s largest corporate Bitcoin holder, announced on January 13, the purchase of 2,530 Bitcoin ($BTC) for $243 million, acquired at an average price of $95,972 per $BTC.

The latest purchase marks the company’s tenth consecutive weekly Bitcoin acquisition since October 31, 2024, when it revealed its ‘21/21 Plan.’

This acquisition brings MicroStrategy’s total holdings to 450,000 $BTC, acquired for a cumulative $28.2 billion, averaging $62,691 per Bitcoin.

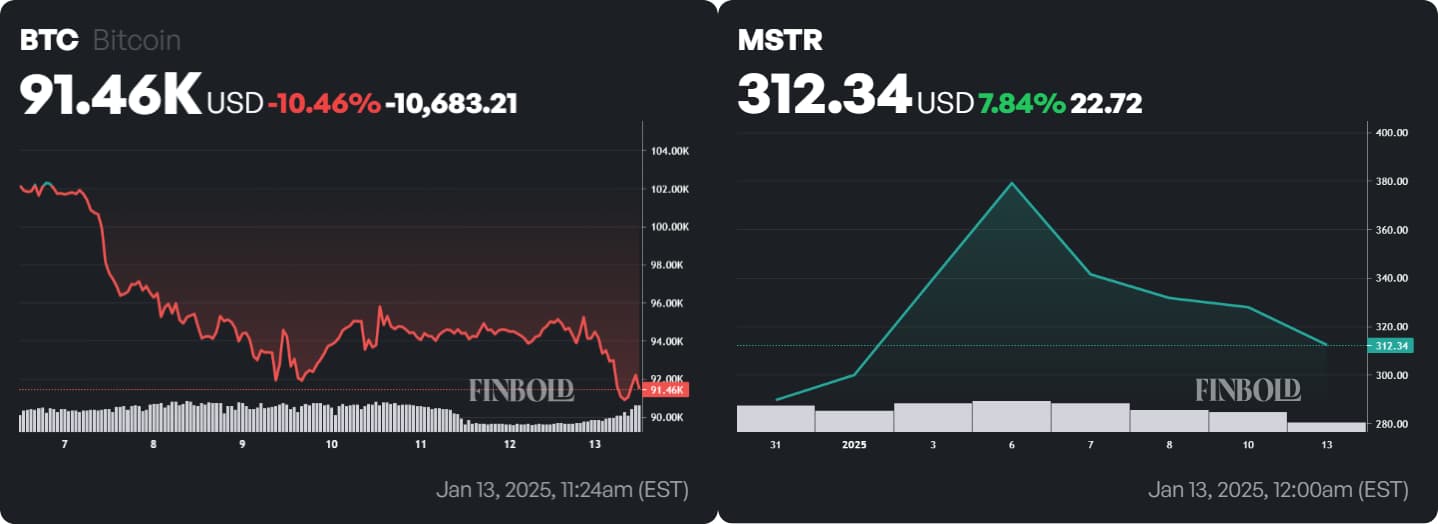

With Bitcoin currently trading at approximately $91,472, the value of the company’s Bitcoin holdings has surged to $41.3 billion, representing 2.13% of all Bitcoin in existence, according to data from BitcoinTreasuries.

Broader market uncertainties, including President-elect Donald Trump’s proposed tariff plans and the Federal Reserve’s interest rate decisions, are adding pressure to the cryptocurrency market.

Despite Bitcoin’s challenges, MicroStrategy’s stock has gained 7% year-to-date, trading at $312.53 at press time. However, it remains significantly below its all-time high of $474, reached in November 2024.

Featured image via Shutterstock

finbold.com

finbold.com