Bitcoin’s price has once again experienced a downturn over the last few days, as the market has failed to hold above $100K.

This price action has caused a lot of uncertainty among market participants.

Technical Analysis

By Edris Derakhshi (TradingRage)

The Daily Chart

On the daily chart, it is evident that the price broke above $100K a few days ago but failed to remain there, as the next day’s candle erased all the gains and closed back below the six-digit mark.

As a result, the market is now dropping toward the $91K support level, which might be broken to the downside this time. A breakdown of this level could result in a potential drop toward the $85K mark and even the $80K support zone.

The 4-Hour Chart

Looking at the 4-hour chart, the recent price action becomes a lot more clear. The market has been consolidating between the $92K and $100K levels over the past couple of months. While the asset has briefly broken the $100K level twice, it has struggled to continue higher.

At the moment, the market is bound to retest the $92K support level once again, and its reaction to this zone would determine the short-term market trend. With the RSI also showing values below 50%, the momentum is clearly bearish, and the market is more likely to drop even lower.

On-Chain Analysis

By Edris Derakhshi (TradingRage)

Exchange Reserve

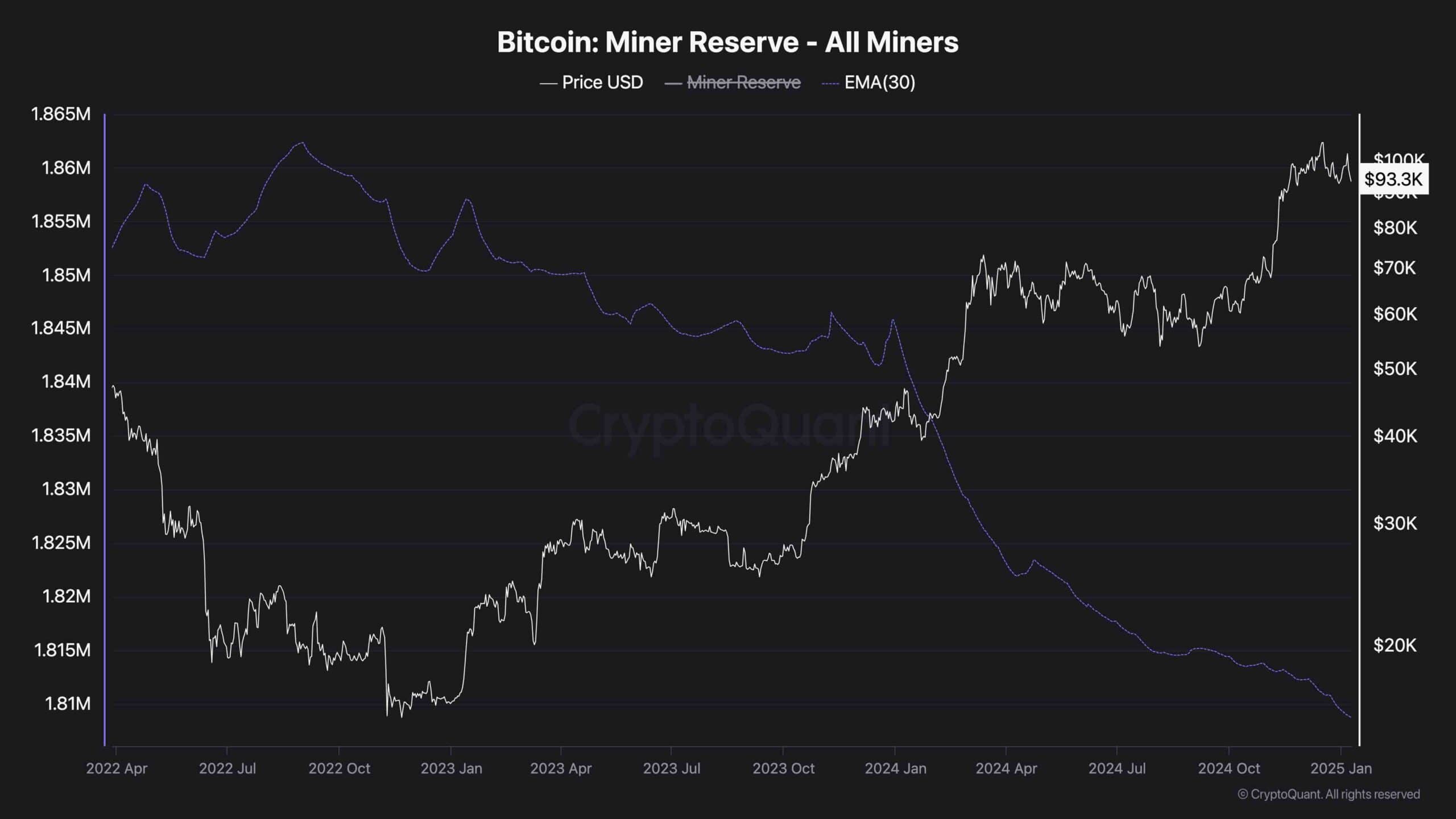

While Bitcoin’s price has been trending higher in recent months, miners have been behaving as they usually do during bull markets. Yet, this behavior might cause a downturn soon.

This chart presents the Bitcoin miner reserve metric, which measures the amount of BTC miners hold. As evident, this metric has been falling rapidly since the market broke above $40K last year and is yet to slow down. While this profit realization is typical behavior by the miners, the resulting selling pressure is likely one of the reasons that the market is struggling to move past the $100K level.

cryptopotato.com

cryptopotato.com