Fidelity Digital Assets addressed a question in its 2025 outlook report that many investors have been asking: “Is it too late?”

The query isn’t absurd given BTC’s recent rise to an all-time high above $108,000 last month. Buying is of course more fun before a big run.

In the report, Fidelity Digital Assets research director Chris Kuiper mentions starting to see “early signs of mass diffusion and adoption.”

He adds: “Although this process will likely take decades, 2025 has the potential to be the year that is looked back on as the pivotal time where the ‘chasm was crossed’ as digital assets begin to take root and embed themselves into multiple fields and industries.”

Kuiper cites existing and discussed nation-state and corporate crypto adoption, which we’ve tracked here in recent weeks.

“Therefore, it may be too late for the speculators that want another frenzy,” he explained. “However, we believe we are still incredibly early in terms of this new era of sustainable adoption, diffusion and integration.”

This “Am I too late?” question reminded me of my conversation with Franklin Templeton’s Roger Bayston last month. He too mentioned this was something on the minds of institutions.

“We’ve seen this price run up and now I’m going to buy it?” he said, imitating an investor questioning that logic and wanting to buy cheap.

But with a more favorable US regulatory environment unfolding, it appears there’s “plenty of run room,” Bayston added. Bullish 2025 BTC price predictions range from $125,000 to $200,000.

Beyond the potential regulatory catalysts, Kuiper wrote that inflation could come back in a second wave (given inflation measures resisting a return to the 2% target, large fiscal deficits and the Fed’s rate-cutting cycle).

“If a recession does occur, it will likely be responded to with additional monetary and fiscal stimulus, which historically has been good for bitcoin,” he noted. “If risk assets continue to appreciate and inflation continues to run above the 2% target, bitcoin will also likely do well.”

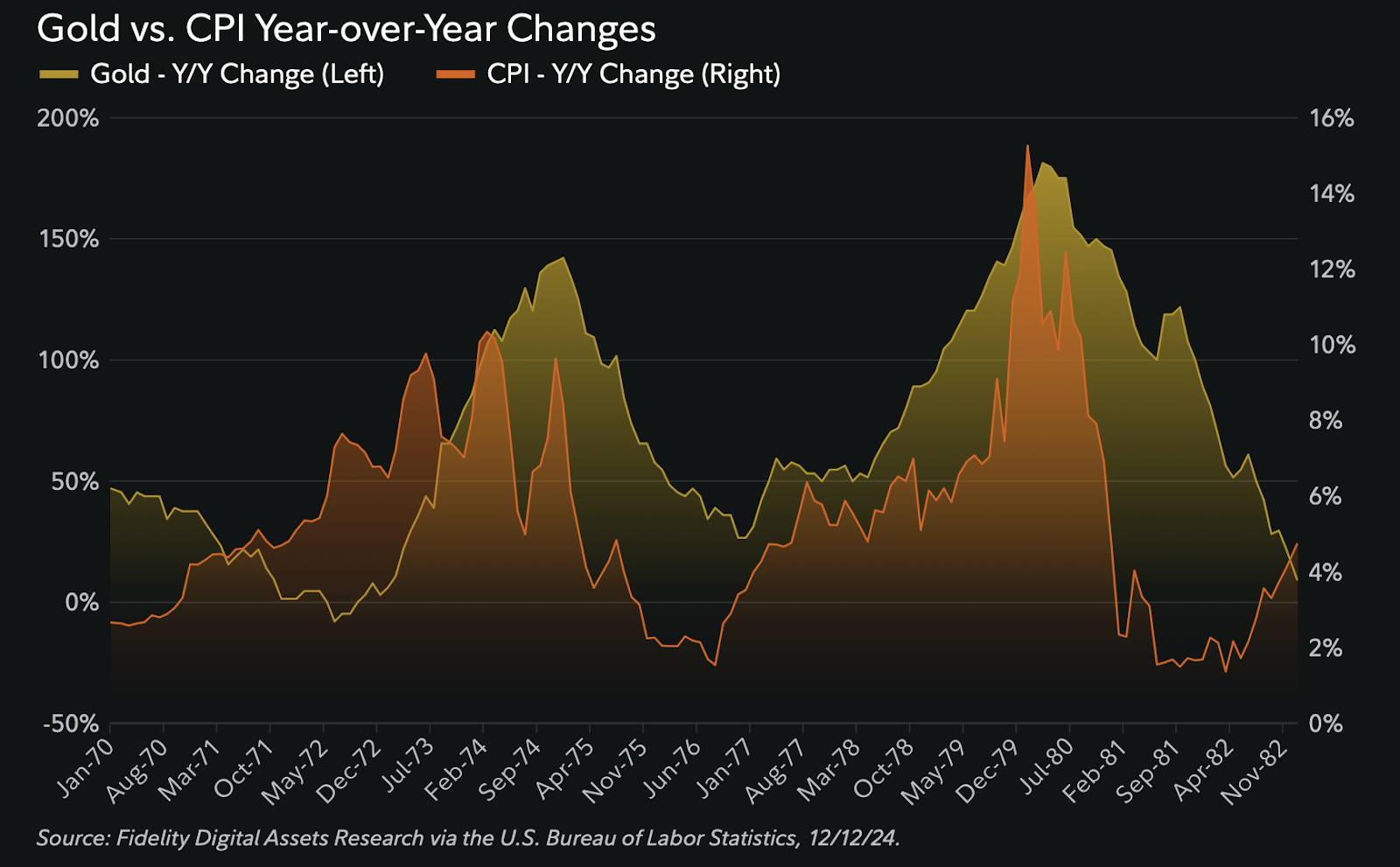

And then there’s the potential for a stagflationary environment, which Kuiper says BTC has not ever really encountered. A Fidelity Digital Assets chart illustrates gold’s performance during the stagflation era of the 1970s and early ’80s. It shows gold rallying most during the second wave of inflation, offering a potential parallel for how bitcoin might behave.

BTC is currently 13% below its all-time high, with potential corrections ahead that could present additional buying opportunities.

Swan Bitcoin co-founder Brady Swenson said it appears the market has largely priced in the creation of a strategic bitcoin reserve soon after Trump takes office.

He added in an email: “If that does not happen quickly, the inauguration could actually be a ‘buy the rumor, sell the news’ event, which would send bitcoin price temporarily downward.”

You don’t need me to say none of this is investment advice. But I’ll remind you anyway.

blockworks.co

blockworks.co