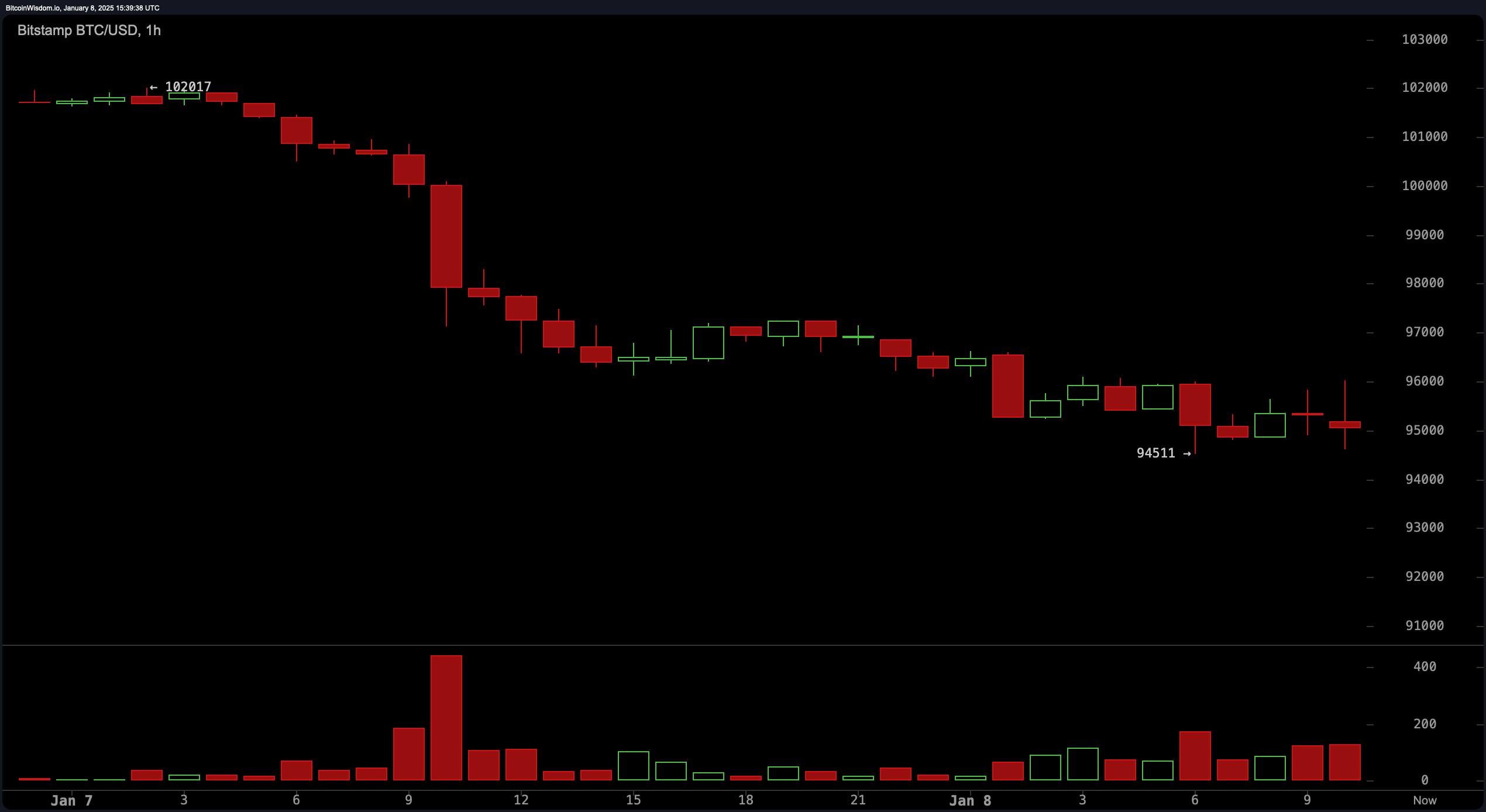

Bitcoin is trading at $94,790 to $95,277 over the two hours with a market cap of $1.88 trillion, 24-hour volume of $67.64 billion, and a 24-hour intraday range between $94,511 and $98,202.

Bitcoin

Bitcoin‘s hourly chart indicates a recent steep decline from $102,017, with support forming near $94,500, suggesting a period of potential accumulation. Resistance is observed at $96,000, with short-term sellers likely reemerging near $97,500 and $98,000. Low trading volumes following the decline highlight indecision among market participants, making this a critical level for traders to monitor.

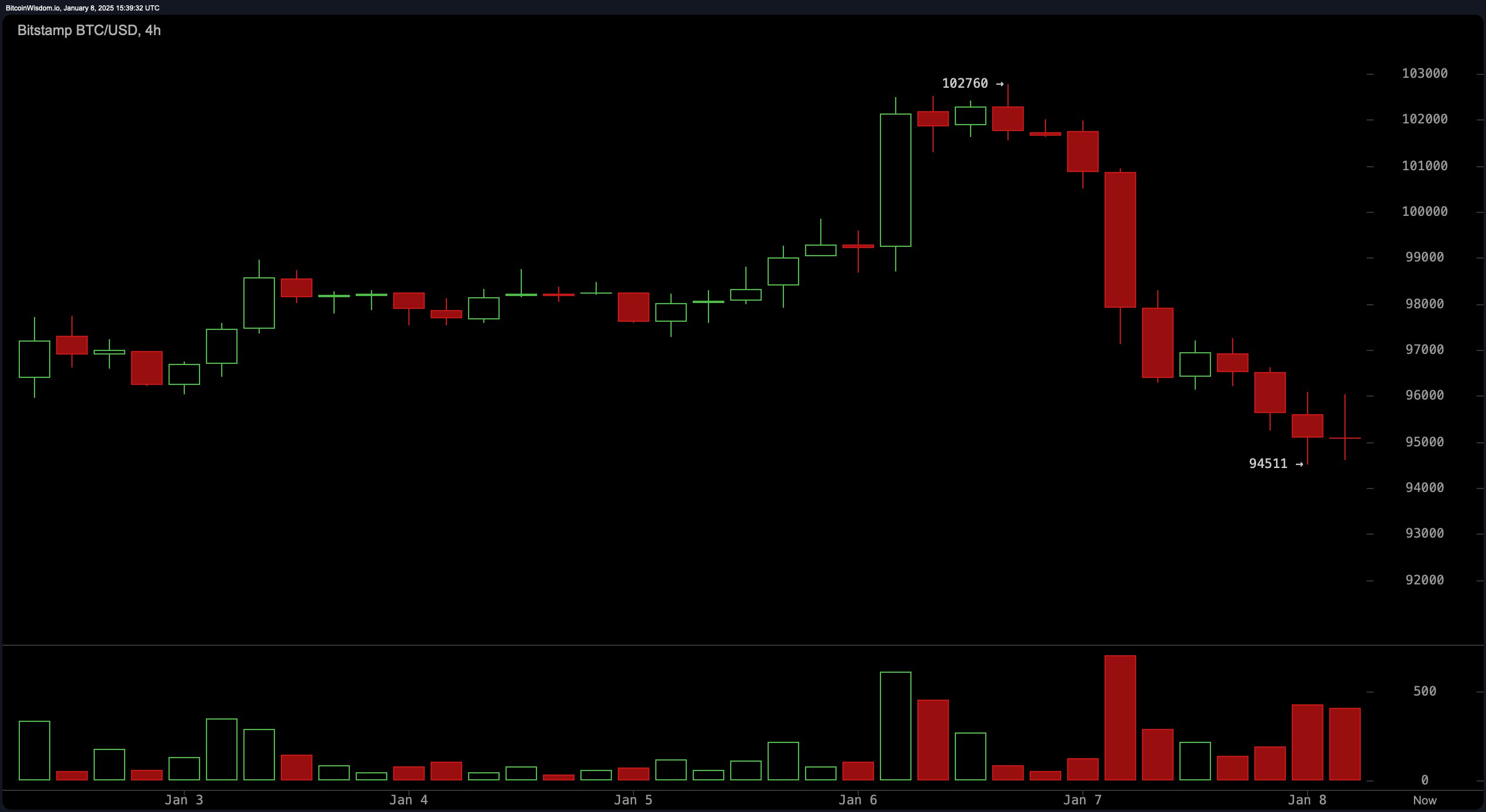

On the four-hour chart, bitcoin has shown signs of consolidation near $94,500, aligning with the lower levels observed on the daily chart. Resistance at $97,500 to $98,000 remains a significant hurdle, with entry points near support advised only upon confirmation of a breakout pattern. The minor recovery seen post-sell-off hints at possible exhaustion among sellers, though a bearish bias persists in the short term.

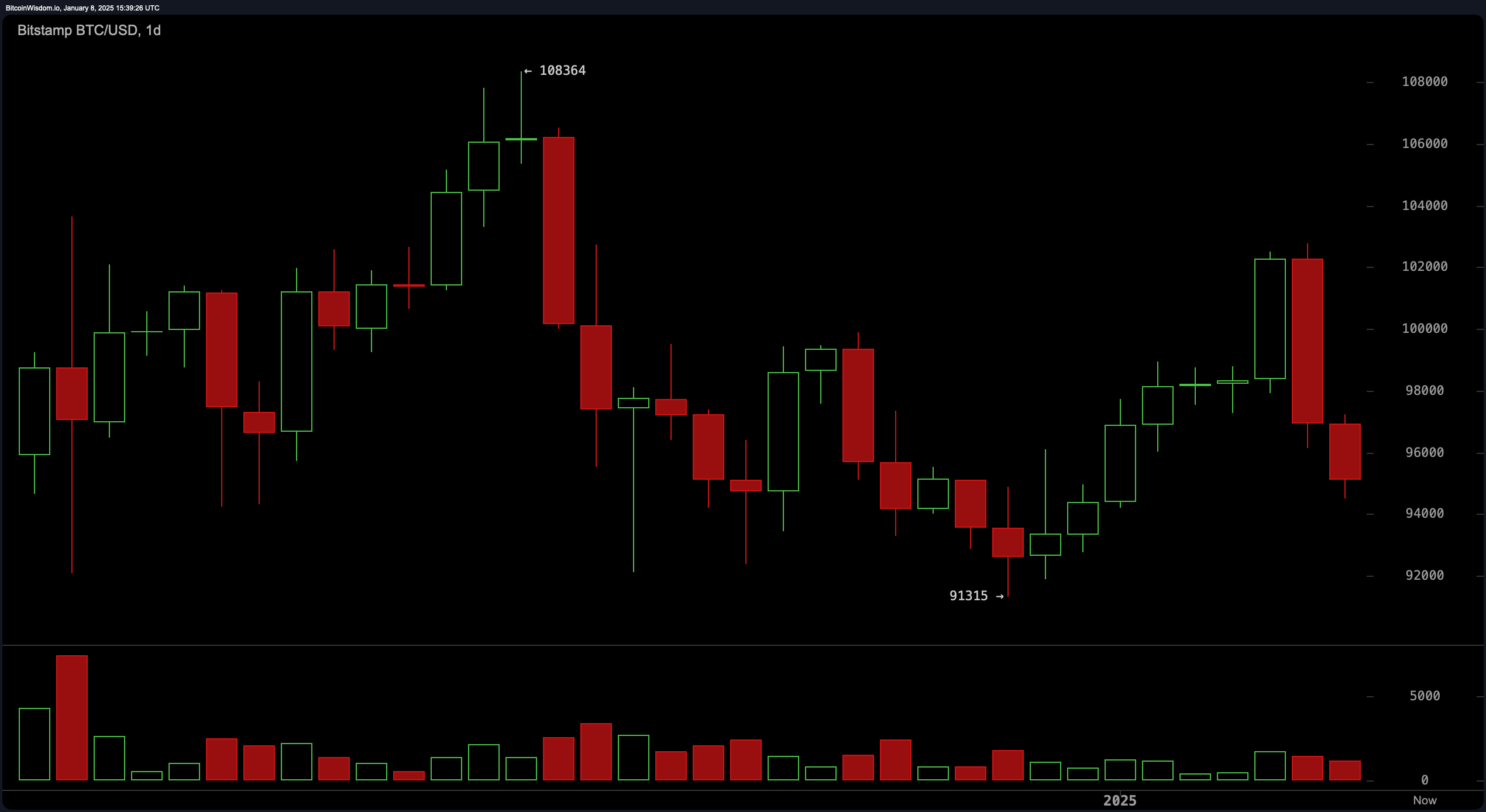

Daily chart analysis confirms a retracement below $96,000, reinforcing bearish momentum following a sharp reversal from the $108,364 high. Key support is established around $94,000, with resistance positioned near $102,000 to $103,000. Any long positions should be entered cautiously, with stop-loss orders tightly set below $94,000 due to prevailing selling pressure.

An oscillator analysis shows a neutral outlook from the relative strength index (RSI), Stochastic, average directional index (ADX), and awesome oscillator. However, momentum indicators suggest selling pressure, while the moving average convergence divergence (MACD) supports a buy signal. The mixed signals call for prudent trade management and careful observation of volume trends for confirmation.

Moving averages reflect a predominantly bearish sentiment, with short-term indicators such as the exponential moving average (EMA) and simple moving average (SMA) across 10, 20, and 30 periods signaling sell. Longer-term indicators, including the EMA and SMA for 50, 100, and 200 periods, lean towards buy, reflecting underlying market strength. Traders should balance these opposing signals when planning their strategies.

Bull Verdict:

Bitcoin’s ability to hold the critical $94,500 support level while longer-term moving averages signal a buy provides hope for a bullish recovery. A breakout above $97,500 could trigger a rally toward $102,000 and beyond, especially if volume confirms buyer strength. The mixed oscillator signals, combined with solid historical support, suggest bulls may still have a chance to reclaim momentum.

Bear Verdict:

With short-term moving averages and momentum indicators firmly in sell territory, bitcoin faces significant bearish pressure. Failure to sustain the $94,000 support could lead to a steep decline, potentially targeting $90,000 or lower. The lack of strong recovery signals and resistance near $98,000 indicate bears remain firmly in control of the market’s direction.

news.bitcoin.com

news.bitcoin.com