On-chain analysts have not made a good showing for themselves regarding Bitcoin price moves. However, instead of dismissing such indicators, they should be placed in proper historical context.

Why Did On-Chain-Based Forecasts Fail?

Both external market moves and on-chain data need to be accounted for when attempting to forecast Bitcoin’s price. However, over the last couple of months, you might have noticed that all Bitcoin forecasts based on on-chain metrics at the end of 2021 failed to materialize.

Does this mean on-chain-based forecasts are not valid? Not quite.

On-chain metrics are quantifiable, so it appears that valid conclusions can be drawn from them. However, the same cannot be said of wider off-chain market moves. Last week, we covered 3 reasons why Bitcoin is on the verge of a death cross, signifying bearish momentum.

In other words, when the market is affected by external factors, the on-chain metrics move too, but with a lag. On-chain indicators are, however, good at painting the contours of market sentiment following either a recent price correction or a pump.

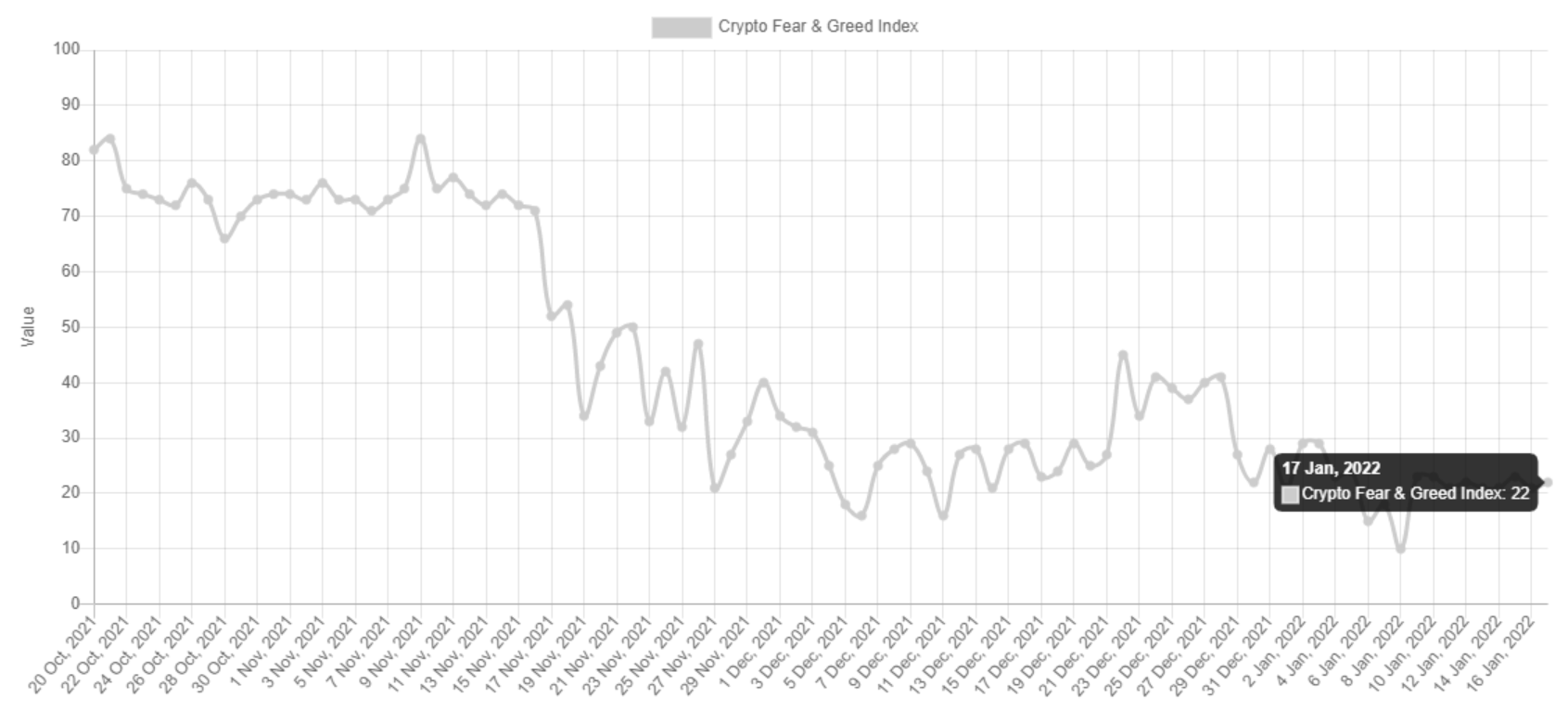

With the Fear & Greed Index in the extreme fear zone, which traditionally signals a buying opportunity, do on-chain indicators tell the same story?

Join our Telegram group and never miss a breaking digital asset story.

Does Extreme Fear Affect HODLers?

Imagine buying Bitcoin at $20k or lower. At today’s price, this would yield over 100% profit if those HODLers chose to sell. In turn, this would exert a selling pressure, and plummet the price. This is why the behavior of BTC HODLers is important when placed into the context of extreme fear market sentiment.

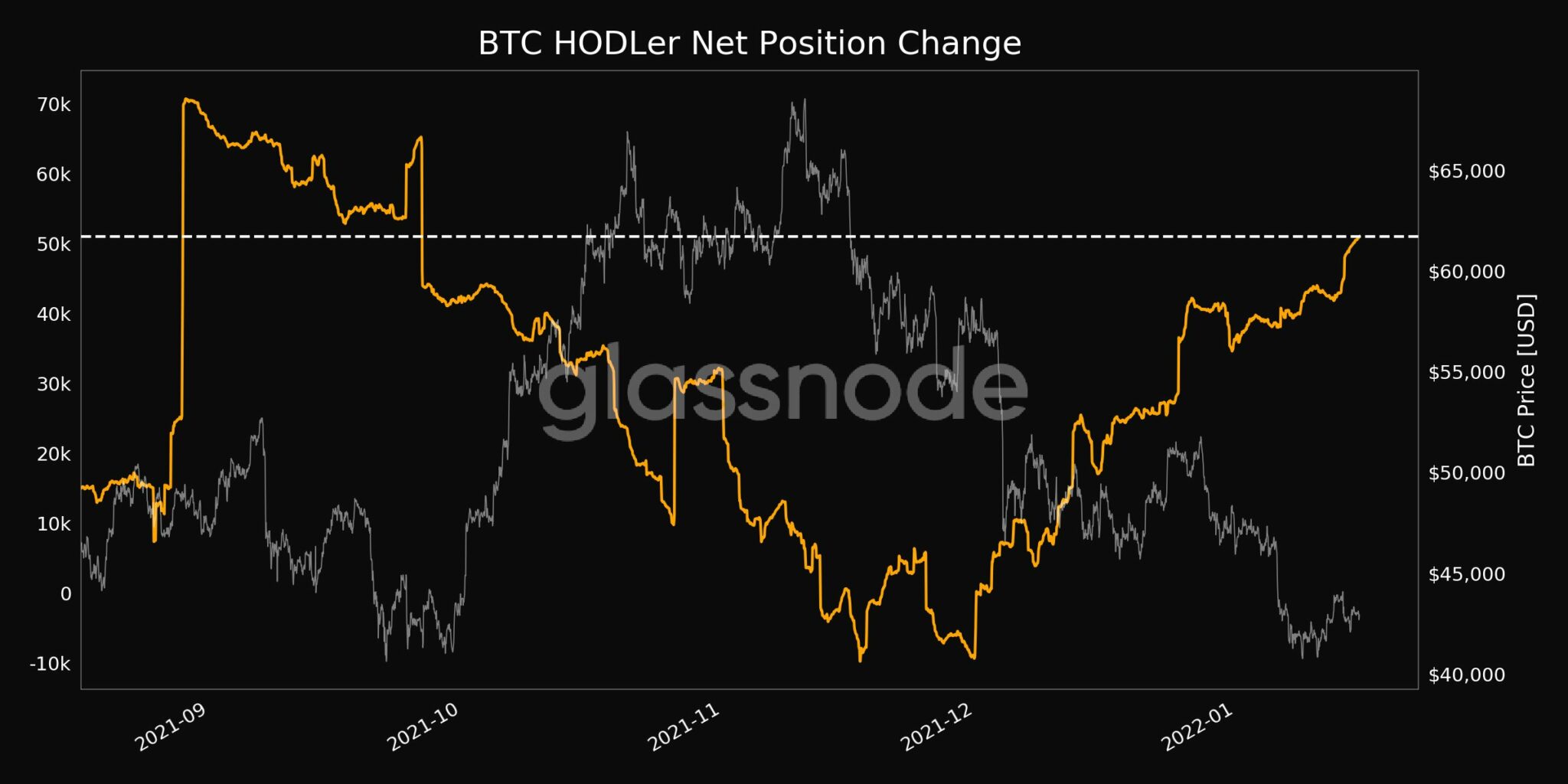

From this BTC HODLer net position change chart, we can see they have been accumulating bitcoins (yellow graph) as the price was going down. In fact, it has reached a 3-month high of 51,047 accumulated BTC. On an even longer scale, roughly 57% of circulated BTC has been sitting still, representing long-term holders’ outlook. This illiquid supply metric is another important indicator to consider with the current market sentiment.

If there is a greater outflow from crypto exchanges, that signifies reserve accumulation. From the chart above, we can see that all exchanges’ reserves are decreasing, as Bitcoin moves to illiquid wallets. If we then compare illiquid vs. liquid supply, about 75% of Bitcoin is currently held up in illiquid addresses – those that have spent less than 25% of their incoming coins.

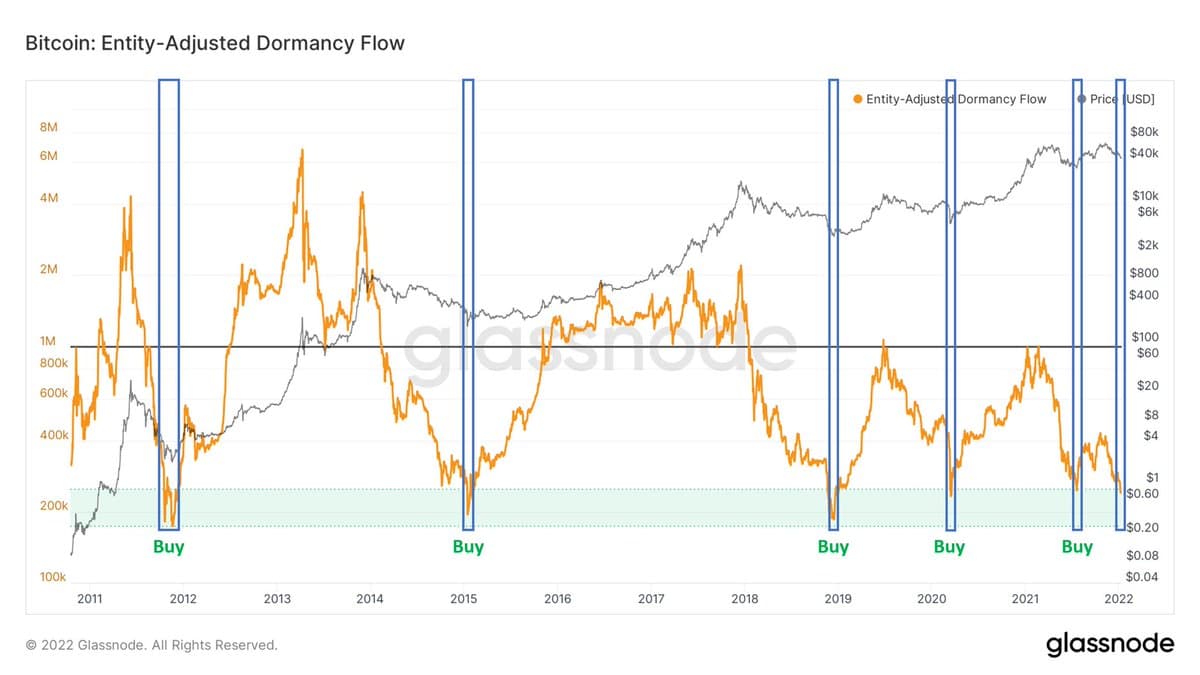

Lastly, we have the Bitcoin dormancy flow indicator. As the name suggests, this on-chain metric tells us how much of BTC was spent vs. how much is dormant, i.e., unmoved from wallet addresses.

As you can see, historically, unspent bitcoins under 250k have signaled price bottoming and then a price upsurge. Another way to look at it is that Bitcoin has reached oversold levels previously leading to a rally. A similar dynamic exists in the stock market, which is why it is important to learn how to value stocks.

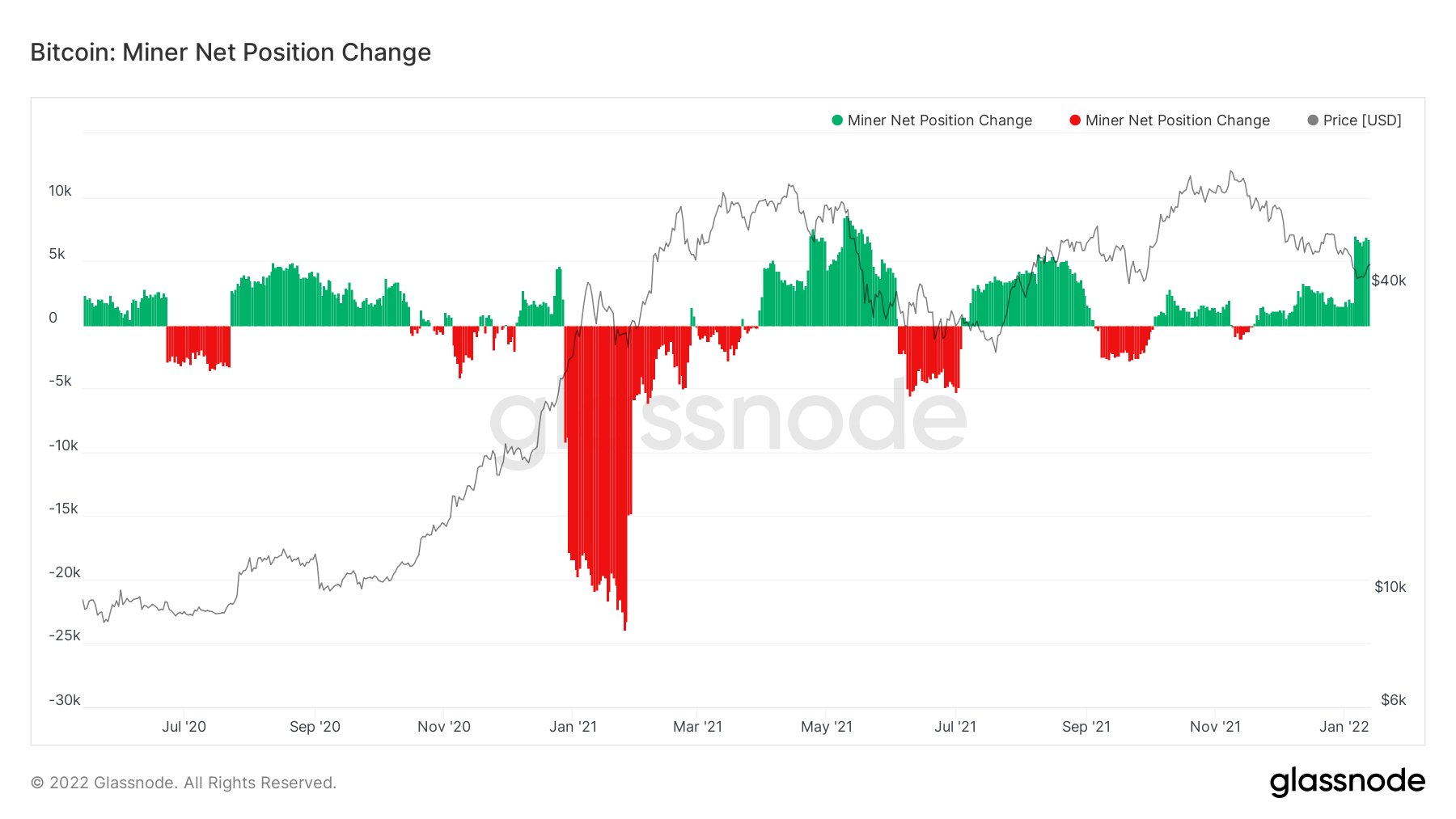

Continuing with positive on-chain metrics, Bitcoin miners have been accumulating as well.

When the bars are green, it shows that more bitcoins are being held in the reserve than sold. In turn, another BTC sell pressure factor is off the table for now. In a nutshell, most traders would see these as bullish indicators, as the majority of Bitcoin holders prefer holding it instead of selling.

Bitcoin Volatility Is Simmering Down

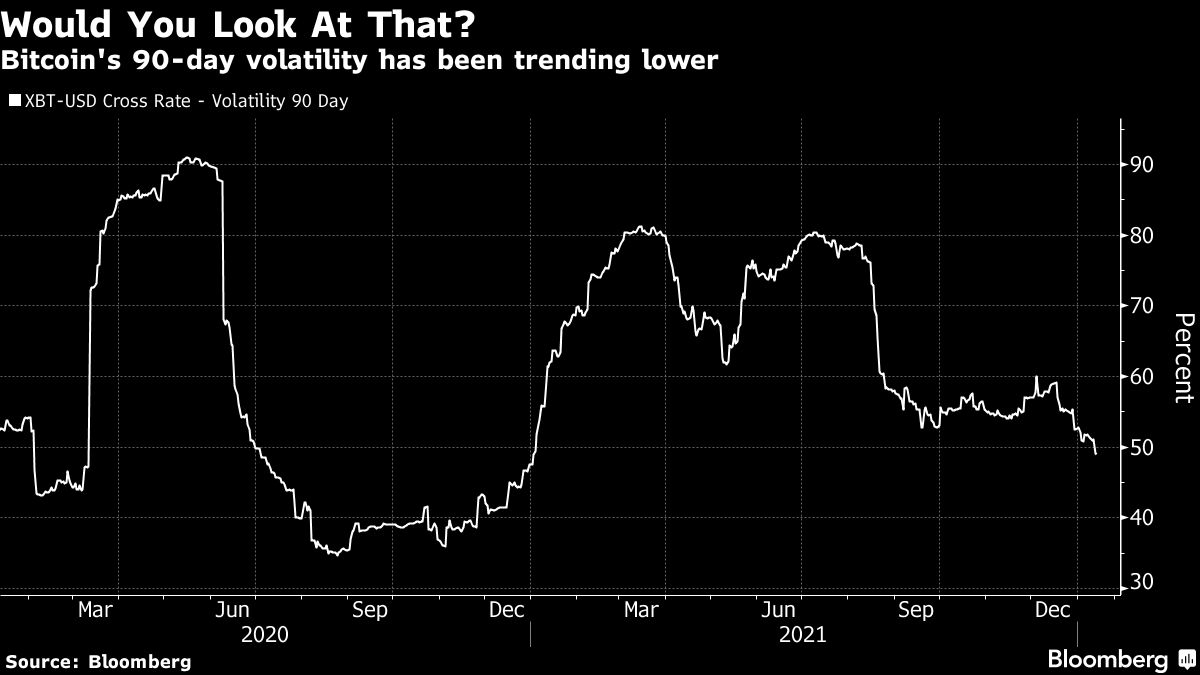

This year, on-chain-based Bitcoin forecasts have been thwarted many times by Elon Musk’s tweets, China’s crypto mining ban, the Federal Reserve’s tapering, Kazakhstan’s internet shutdown, and Covid-19 fears. However, according to Bloomberg, Bitcoin’s 90-day volatility has been the most stable yet.

This indicates that the era of Bitcoin’s hyper-turbulent cycles is closing to an end. Even at its worst extreme fear sentiment, BTC price ended up in the same range as when it started the bull run in February 2021. Furthermore, since July, there has been a steady BTC accumulation period.

Nonetheless, in the near future, if on-chain bullish indicators are to materialize the trend, Bitcoin’s 200-day moving average (MA) will have to reclaim the price range at around $48.5k. With such a consolidated price breakout, we may see Bitcoin gaining lost ground.

With that said, indicators deal with likelihoods. In the end, nobody knows the intentions of crypto whales, and if some external factor is yet to pop up to sour the market sentiment. Naturally, we can only examine the data but can offer no guaranteed forecast or predictions.

Last year, JPMorgan analysts pinned the BTC price range for 2022 between $73k – $146k. Do you think Bitcoin will exceed these expectations? Let us know in the comments below.

tokenist.com

tokenist.com