This is a segment from the Forward Guidance newsletter. To read full editions, subscribe.

Just days into the new year, bitcoin’s price is back to six figures.

The asset’s price rose above $102,400 on Monday morning. It hovered around $101,750 at 2 pm ET — up nearly 9% from a week ago.

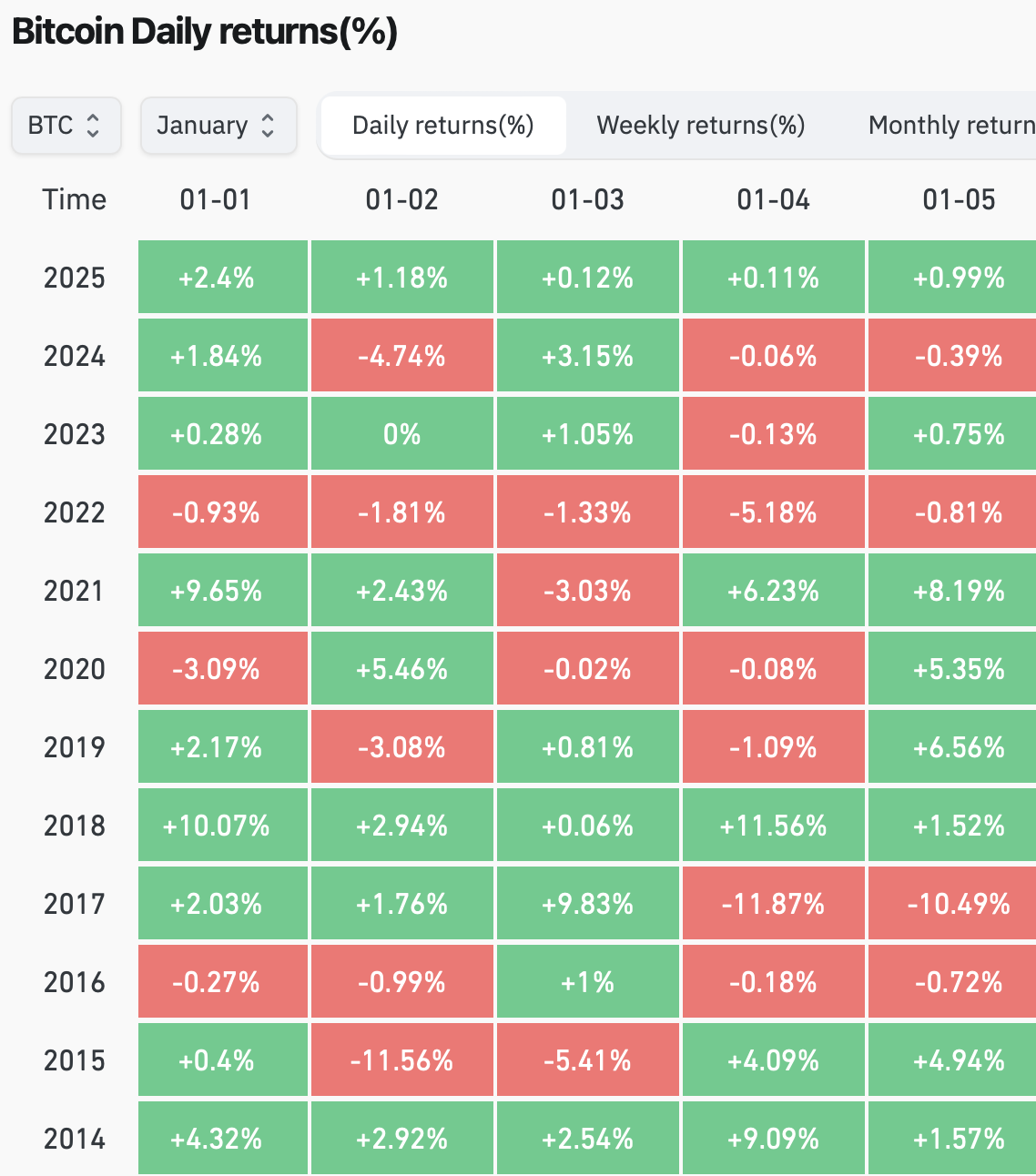

Crypto is so far seeing its own “January effect” — a term alluding to the potential rise of stock prices during the year’s first month. CoinGlass data shows bitcoin saw price gains — albeit slight ones — during each of the month’s first five days. That hasn’t happened since 2018.

You know by now about $BTC’s historic rise to an all-time peak of $108,000 a little over a month after Trump’s election win. Then there was what some called a “healthy” correction fueled by hawkish Fed vibes and profit-taking, with $BTC dropping below $92,000 on Dec. 30.

Grayscale product and research head Rayhaneh Sharif-Askary noted temporary drawdowns during bull markets are common, pointing out the FTSE/Grayscale Crypto Sectors Market Index’s 6% decline in December.

“However, strong demand from US-listed Bitcoin ETPs and treasuries like MicroStrategy’s may support bitcoin’s price,” she said when asked about the outlook for January.

The US bitcoin ETFs welcomed $908 million in net new assets on Friday — rebounding from a combined $940 million worth of outflows over the previous four trading days, Farside Investors data shows.

96% of financial advisers surveyed by Bitwise received a crypto-related question from clients in 2024. This finding jibes with the expected ongoing wealth manager-fueled capital influx into the crypto segment.

As for Sharif-Askary’s mentioning of treasuries, MicroStrategy’s latest bitcoin buy (on Dec. 30-31) was 1,070 $BTC for roughly $100 million. Though smaller than its $BTC buys in previous weeks, the company also just revealed targeting a $2 billion capital raise via perpetual preferred stock offerings to acquire more $BTC.

On that note, Metaplanet CEO Simon Gerovich just noted his company plans to boost its $BTC holdings (currently at 1,762 $BTC) to 10,000 $BTC in 2025. Then there’s KULR Technology Group, which said Monday it bought an additional $21 million worth of bitcoin.

Also set for January, of course, is Trump’s inauguration. And with members of the 119th Congress sworn in last week, hearings on the president-elect’s cabinet nominees are expected to kick off soon.

Confirmation hearing happenings, and subsequent signals on the pace and extent of future crypto regulatory clarity, could impact $BTC price throughout the month, Sharif-Askary told me.

“Delays or restrictive policy announcements may dampen sentiment,” she said, before adding: “Macro factors — including Federal Reserve signals on interest rates and market responses to a stronger US dollar — could also play a role.”

blockworks.co

blockworks.co