On the third day of 2025, the Bitcoin price showcased a bullish outlook as it celebrated its 16th anniversary. The coin price regained the $95,000 level and witnessed a notable spike in computational power, indicating renewed bullish momentum in the market.

By press time, BTC exchanged hands at $97404 with an intraday gain of 0.5%. Consecutively, the asset’s market cap reverted to $1.92 Trillion, while the 24-hour trading volume is at $36 Billion.

Key Highlights:

- Bitcoin’s 16th anniversary— on January 3, 2029, at 1:15 p.m. Eastern Standard Time, Satoshi Nakamoto launched the Genesis Block, marking the birth of the Bitcoin network.

- A record high in Bitcoin’s hashrate and a drop in miners’ sentiment signals the potential for a bullish price reversal.

- The Bitcoin price surge above the 20-and-50-day exponential moving average hints at renewed bullish momentum

Bitcoin Hashrate Breaks Records Amid Sentiment Shifts

A recent analysis by CryptoQuant reveals that Bitcoin miner sentiment has sharply declined, a pattern often associated with major price recoveries or the formation of market bottoms.

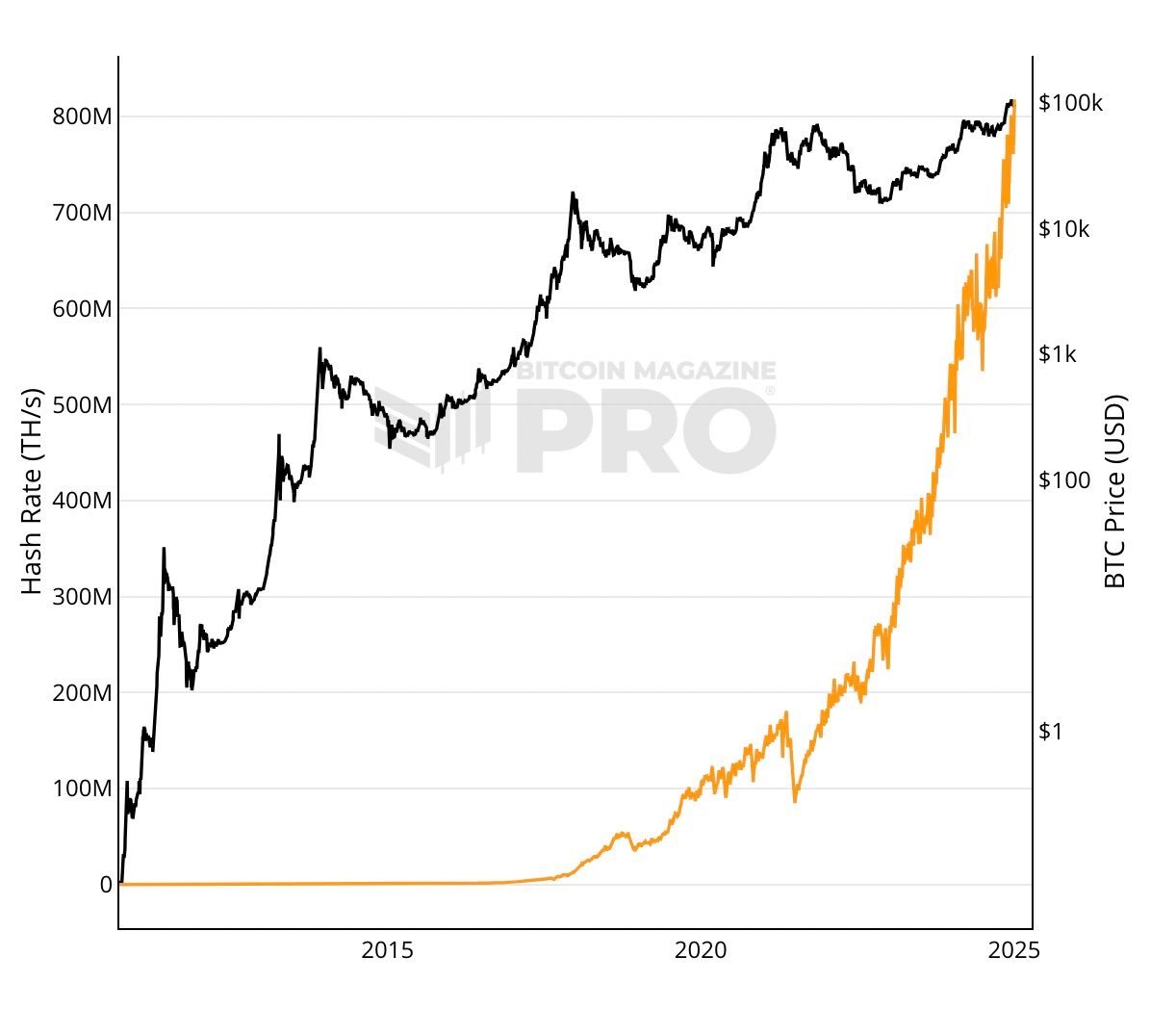

Historical data from 2017 and 2018, as well as the pandemic-triggered drop in March 2020, highlight how declines in sentiment preceded sharp price rebounds. The years 2021 onward saw increased fluctuations during bull markets, while 2023 and 2024 displayed heightened volatility influenced by miner behavior.

Adding to the bullish note, the Bitcoin network’s hashrate has reached a record-breaking range of 813 to 823 exahashes per second (EH/s). This surge in computational power highlights growing miner participation and investment, further strengthening the network’s security and resilience.

This analysis reinforces the Bitcoin price reversal from $92,000, bolstering a potential for a new high shortly.

Bitcoin Price Rebound Eyes Rally to $120k

A 4-day rally in Bitcoin price has recorded a surge from $91,900 to $98,350— accounting for a 7% surge. This upswing underscores BTC’s sustainability above the $92k level and common pullback support of the 50-day EMA.

The asset price surge above the fast-moving 20-and-50-day EMAs indicates the recuperate bullish momentum after a recent market correction. With sustained buying, the buyers could flip the last lower high formation at $100k, offering them suitable support for a higher rally.

The post-breakout rally could drive the Bitcoin price to $114,700, followed by $121,400, the horizontal levels coinciding with pivot levels R2 and R3.

Also Read: China’s Cango Inc. Now Holds $91M in Bitcoin

cryptonewsz.com

cryptonewsz.com