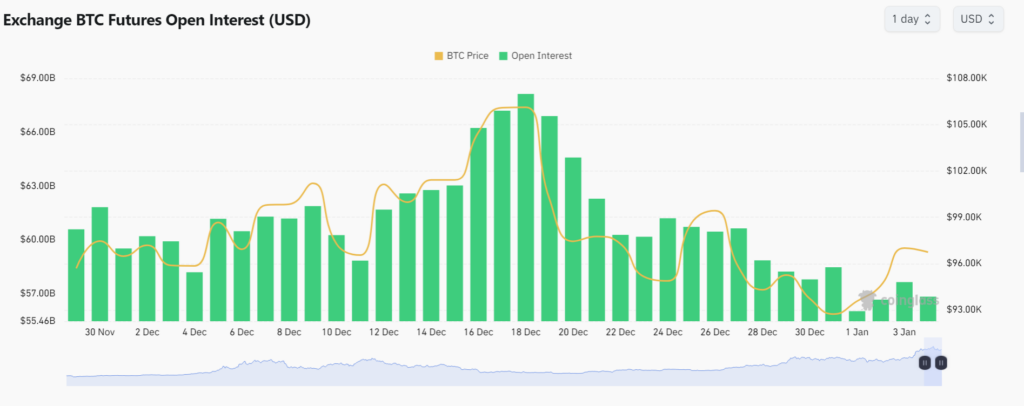

Bitcoin futures open interest has gone down to $56.6 billion, after taking a plunge at the start of 2025. Since then, $BTC OI has not been able to recover and has reverted to its November $ATH.

According to data from Coinglass, Bitcoin ($BTC) OI has fallen to $56.6 billion on Jan. 3 despite showing signs of recovery just a day prior. On Jan. 1, $BTC OI fell to its lowest level in the past two months, only being able to reach a total of $56.03 billion.

Earlier today, $BTC OI appeared to give traders hope when it reached slightly above $57 billion, but it has since dropped to $56 billion.

Throughout December, Bitcoin’s total open interest has been reaching new heights. In fact, $BTC OI reached it most recent all-time high on Dec. 18 when it peaked at $68.13 billion, with CME being its biggest contributor with $22.7 billion.

Since it nearly reached $70 billion, $BTC OI has been on a downhill slope that ended on Jan. 1 when it fell to $56 billion.

Bitcoin open interest is a metric used to measure the amount of futures contracts tied to $BTC employed through crypto exchanges. The bigger the interest level, the more demand and liquidation that crypto asset has.

At the time of writing, $BTC OI has still failed to climb back past the $60 billion threshold. In fact, it has returned to its previous all-time high , which was $57 billion on Nov. 22. So far, it has not showed any signs of recovering any time soon.

Data from Coinglass shows that CME is the biggest contributor for $BTC OI. CME currently provides nearly 30% of the total Bitcoin futures open interest with 172,650 $BTC OI which is worth $16.7 billion at current prices.

Binance is the second biggest $BTC OI contributor, with 21.3% of the total coming from the leading crypto exchange. Binance holds 126.770 $BTC OI which is worth $12.3 billion. After Binance, Bybit takes third place with $7.83 billion in $BTC OI, equating to 13.5% of the total $BTC OI.