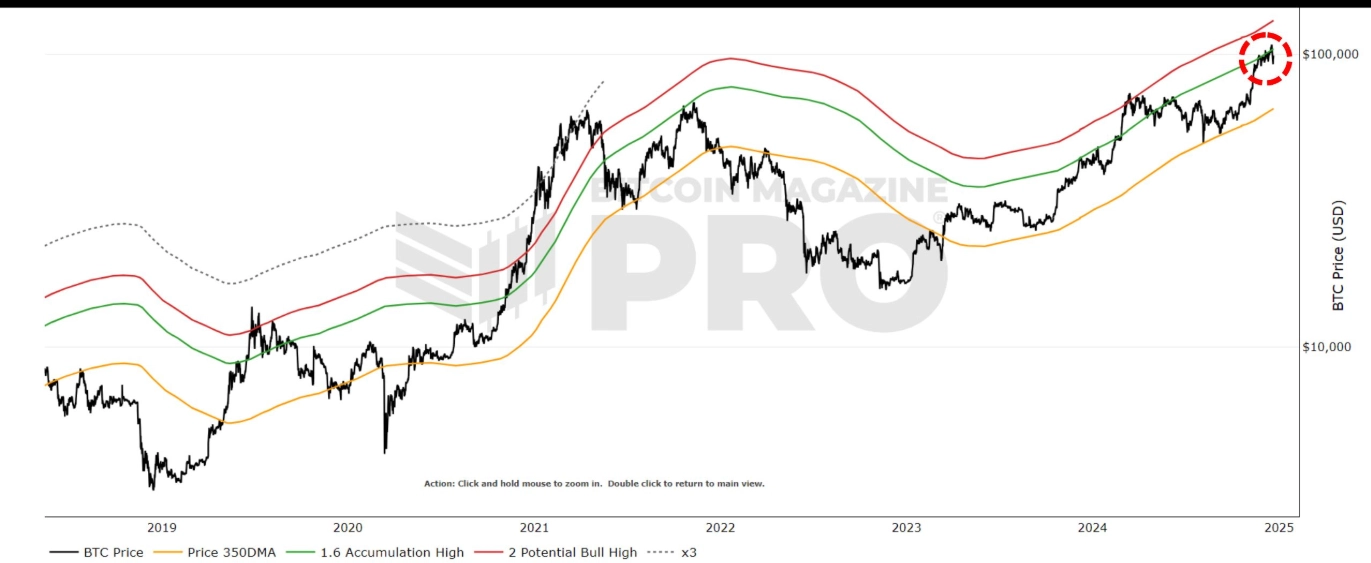

The biggest cryptocurrency, Bitcoin ($BTC) has once again been rejected at the 1.6x Golden Ratio Multiplier resistance, a level that coincides with its previous all-time high. Cryptocurrency is testing its resilience against this formidable barrier as the current all-time high revolves around the $108,000 mark.

(Source: Bitcoin Magazine Pro)

According to Bitcoin Magazine Pro, If $BTC breaks through this crucial resistance, it could trigger a possible rally toward the 2x multiplier resistance at $135,000. With the bullish sentiment growing in 2025, the upcoming days could determine if $BTC’s next leg of its historic run begins or if further consolidation is on the cards.

Bitcoin was rejected once again at the 1.6x Golden Ratio Multiplier resistance at our most recent all-time high! 🐻

Currently at ~$108,000 and rising, can $BTC connivingly break this level and rally to the upper 2x resistance at $135,000 in the near future? 🤔

Let me know! 👇 pic.twitter.com/spRoKHk7rf

— Bitcoin Magazine Pro (@BitcoinMagPro) January 2, 2025

The Golden Ratio Multiplier is a technical analysis tool designed to identify key support and resistance levels in an asset’s price based on the Golden Ratio (1.6). It multiplies the 350-day moving average by ratios like 0.618, 1.6x, or 2x to project these levels, which also aligns with critical psychological and market barriers.

Bitcoin ($BTC) Reclaims $97,000 Mark with a New Year Rally

$BTC prices climbed for the third consecutive day, rising above $97,000. The new year began on a positive note, with traders gearing up to refocus on the crypto market. Despite the momentum in $BTC’s price being hindered, optimism still prevails.

The crypto market’s confidence was boosted after President-elect Donald Trump’s commitment to expanding the U.S. role in the space with a top-tier team.

Meanwhile, $BTC ETFs saw minimal activity during the holiday season, with just $5.3 million in inflows on December 31, 2024, following $700 million in outflows earlier. However, these funds collectively manage over $100 billion in assets.

Also Read: A Strategic Bitcoin Reserve: Is This Wise?

cryptonewsz.com

cryptonewsz.com