10x Research and its CEO and Head of Research, Markus Thielen, have recently taken a more cautious stance on bitcoin (BTC), prompting a re-evaluation of market conditions.

Has Bitcoin Peaked? Analysts Spot Ominous Signals

In a market update published on Dec. 29, 2024, the firm acknowledges the cryptocurrency’s resilience, however, emerging technical patterns suggest the market may be entering a new phase. 10x Research is a digital asset research service catering to asset managers, wealth managers, and cryptocurrency service providers. Over the past two weeks, 10x Research has raised questions about whether the bitcoin bull market has reached its peak.

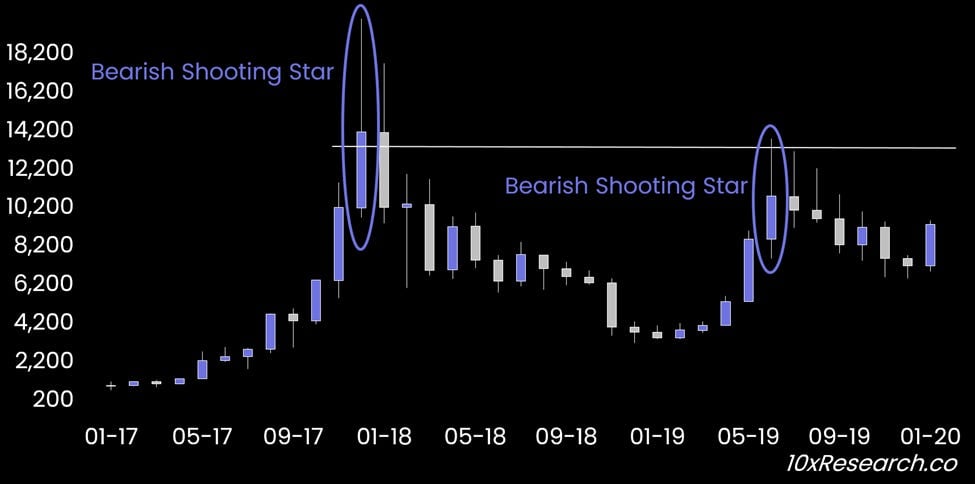

Historical analysis of prior bull markets, including 2017 and 2019, reveals a recurring trend: early-month rallies followed by end-of-month profit-taking. This behavior often signals the later stages of a bull market. In December 2024, a “shooting star” candlestick pattern—a bearish indicator characterized by a long upper wick and small body—was observed. This pattern has historically signaled a market top, notably in December 2017 and November 2021.

Thielen explains that the shooting star pattern is a critical technical signal that “serves as a bearish reversal signal, indicating weakening buying pressure and potential price reversals.”

Bitcoin rallied to a new all-time high of $108,364 on Dec. 16, 2024 before retreating to close at $92,000. Analysts at 10x Research stress the importance of the $90,000–$92,000 support range. A break below this zone could lead to significant declines. “While there may be an early-month rally in January 2025, possibly leading into Trump’s inauguration, another wave of profit-taking by month-end could confirm that the December 2024 shooting star signaled at least an intermediate top,” Thielen’s report explains.

Despite the bearish signals, 10x Research and Thielen maintain that the current bull market is not definitively over. However, entering 2025, investors should expect heightened volatility, with the possibility of wild rallies and sell-offs likely to define the year.

Another Outlook Claims ‘Bitcoin Bull Run Is 80% Complete’

10x Research highlights that mastering risk management will be key to thriving in the ever-changing market scene. As bitcoin ventures into what seems like a tougher trading zone, investors must keep a sharp eye on technical indicators and hold onto their discipline. Furthermore, there’s a variety of perspectives among other researchers and analysts. The X account Crypto Birb, from The Birb Nest, a hub for trading education, fundamental analysis, and live trading tactics, claims the bull run is more than three quarters done.

“Bitcoin will peak at $225,000+ by June 2025,” Crypto Birb wrote. “Bitcoin bull run is 80% complete. Next 20% is most fun. Real altseason will happen after BTC top. Don’t take screenshots. Realize gains and run before 2025 ends. 2026 is bear market (80-90% loss). (Big release on Dec 27 – mark date).”

The X account dubbed Tutor declares that the bitcoin bull is currently in its grand finale. “We’re in the third consecutive bullish year in bitcoin, historically the final act of a bull run. The challenge of 2025 will be: Emotional decision (staying in the market thinking it will go to $1 million given the FA-developments) vs Rational decisions (exiting BTC in a timely manner based on charts),” Tutor explained.

The X account added:

FOMO and bias can cloud judgment, but history rewards those who prepare and stay rational.

As 2025 begins, the possibility of a market slowdown looms large. Bitcoin investors face a delicate balancing act, having to decide between riding out potential final rallies and securing profits before a downturn. While some could care less and insist 1 BTC is simply 1 BTC. The decisions made in these uncertain times will likely have lasting consequences on portfolios, demanding careful risk management and sharp market insight.

While some analysts predict a final rally for bitcoin, others stress caution, with market patterns suggesting the bull run may be nearing its end. As investors and crypto traders navigate through increased volatility and shifting trends, maintaining a disciplined approach will be essential to weather any impending market corrections.

news.bitcoin.com

news.bitcoin.com