On Friday, as the weekend looms, bitcoin (BTC) is holding its ground at $96,751 per coin. Over at Coinbase, a curious twist has appeared over the past 11 days with a negative premium gap of $122, while South Korea is displaying a premium of 3.3% on bitcoin’s price.

Bitcoin Price Divide

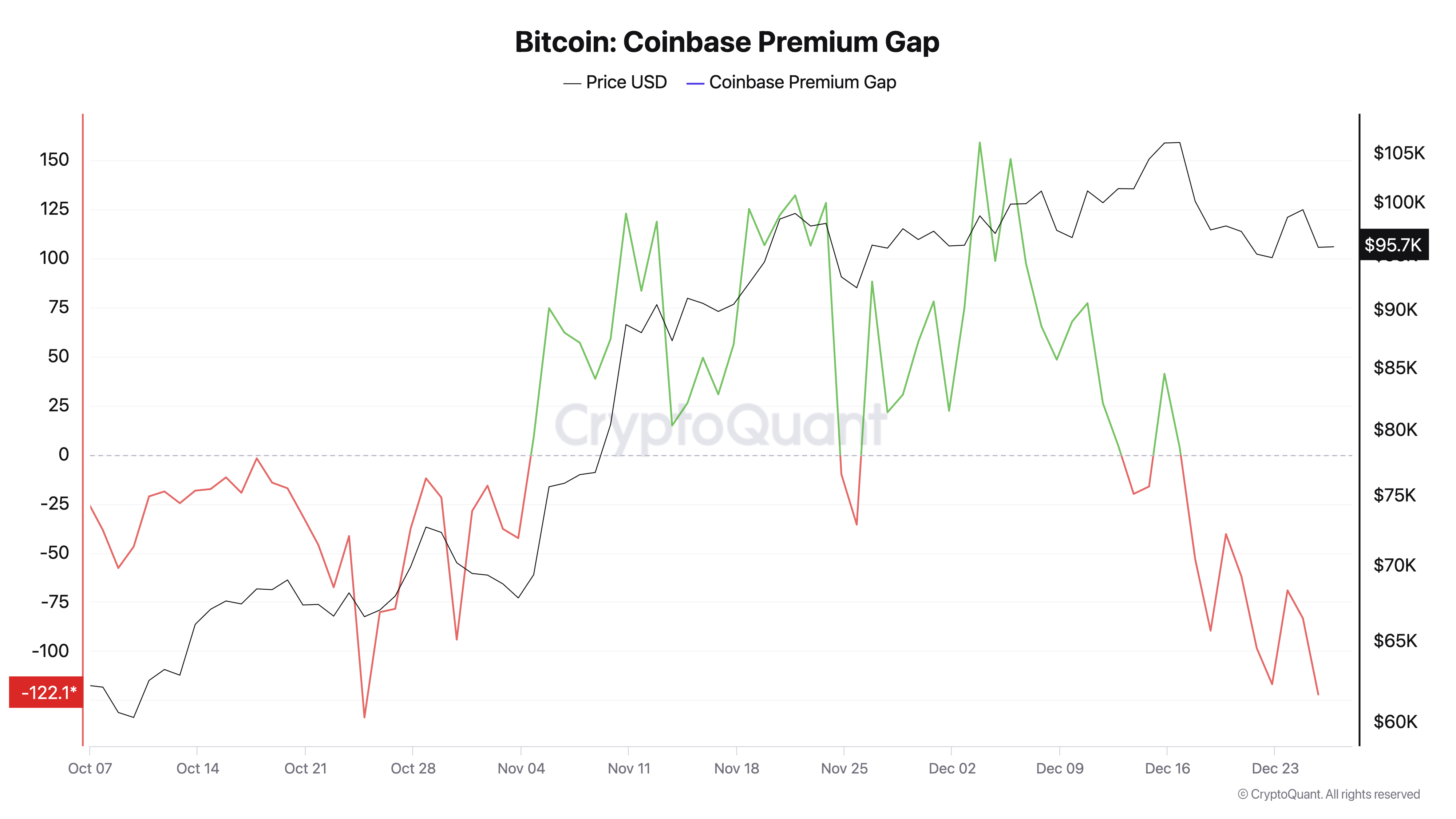

Prior to bitcoin reaching its all-time high of $108,364 per coin, the Coinbase premium and premium gap had largely stayed consistent and positive, with just a brief dip on Nov. 24–25. To clarify, the Coinbase Premium Gap index from Cryptoquant tracks the price difference between bitcoin (BTC) traded on Coinbase Pro (BTC/USD pair) and Binance (BTC/USDT pair). When this figure is positive, it signals strong buying activity from U.S. investors.

At present, it sits at negative $122, signaling that U.S. investors on Coinbase Pro are paying slightly less for bitcoin compared to their counterparts on Binance. The Coinbase Premium Gap index hasn’t dipped this low since Oct. 24, 2024, when it hit negative $133. Meanwhile, halfway across the globe, the premium in South Korea—widely known as the ‘Kimchi Premium’—is climbing once again.

Data from Cryptoquant further shows that the South Korean premium spiked to 5.26% above the global average on Dec. 21. Much like the Coinbase Premium Gap index, this premium has been in effect since Dec. 15, when it moved out of discount territory. For perspective, back on Dec. 6, BTC was trading at a 2.42% discount in South Korea compared to the global average. Fast forward to today, Dec. 27, and the ‘Kimchi Premium’ is still holding steady at 3.3%, according to cryptoquant.com.

As of 8:45 a.m. Eastern Time on Friday, BTC is trading globally at $96,177 per coin, while on South Korea’s Upbit exchange, it’s fetching 2.06% more—$98,162 per coin. The divergence in bitcoin pricing between regions highlights the complex interplay of local market dynamics and global sentiment. Factors such as regulatory environments, investor behavior, and demand patterns seem to be influencing these premiums and discounts.

For traders, these discrepancies might present arbitrage opportunities, while for analysts, they offer valuable insights into regional influences shaping bitcoin’s valuation. As bitcoin trades near $96,177 globally, regional price variances suggest a broader story of market participation and sentiment. The contrast between South Korea’s premium and the U.S.’s discount reflects differing local demands and liquidity conditions. These shifts may hint at emerging trends or external pressures that could shape how bitcoin’s value is perceived and traded across the world.

news.bitcoin.com

news.bitcoin.com