Bitcoin’s current price is $97,384, with a 24-hour trading volume of $69.42 billion and a market cap of $1.92 trillion. Today, it danced between $95,444 and $99,496, signaling a market in a state of flux. This rollercoaster ride has left traders on the edge of their seats, watching for the next big move as technical indicators flash both green and red lights.

Bitcoin

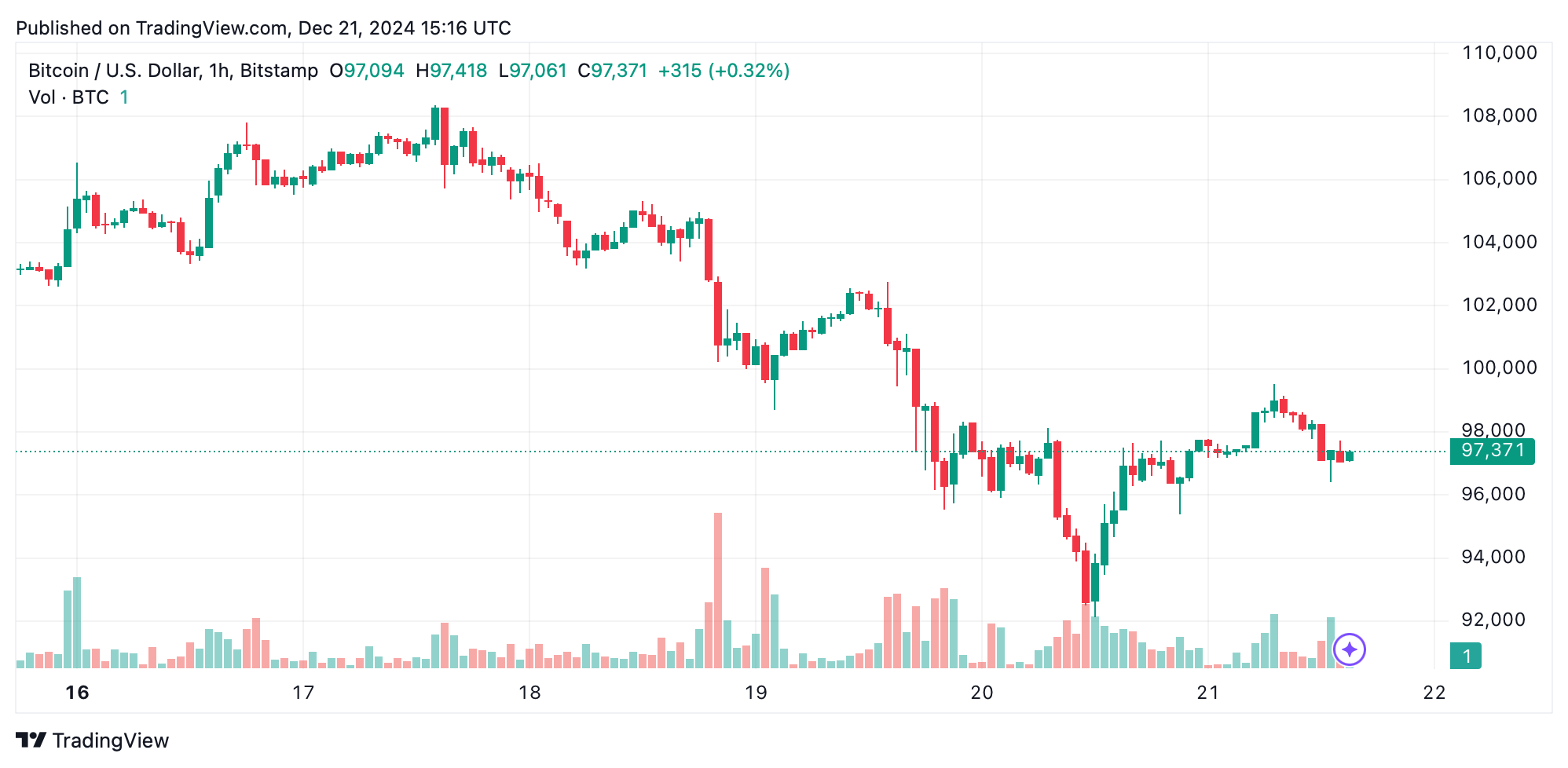

In the short-term 1 hour chart, bitcoin is sliding down a slippery slope, showing a clear trend of lower highs and lows. It recently slipped from $99,514, with the support at $97,000 looking shaky under heavy sell-offs. Key indicators like the relative strength index (RSI) at 49 and Stochastic at 29 are sitting on the fence, making it anyone’s guess which way the market will jump. Moving averages (MAs), both exponential (EMA) and simple (SMA) for 10 and 20 periods, are tilting towards the bears, hinting at more drops unless buyers show up in force at $95,000.

Zooming out to a mid-term 4-hour view, bitcoin is flirting with resistance at $99,500 after bouncing back from a low of $92,118. This resistance zone from $99,500 to $100,000 has been a tough nut to crack, with less enthusiasm in buying volumes as prices climb. Oscillators like the commodity channel index (CCI) at -55 and momentum at -4,079 are nudging towards bearish territory, while the mixed signals from the 30-period EMA and SMA leave us in a state of suspense. A strong push above $99,500 could set the stage for a leap towards $105,000; otherwise, a fall below $94,000 might confirm the bearish trend.

Looking at the long haul of the daily, bitcoin’s medium-term bullish trend seems to be holding, despite some hiccups. The support at $92,000 has been a solid ground, maintaining the long-term upward trajectory. However, resistance at $100,000 and $108,000 has been a ceiling for recent gains. The moving average convergence divergence (MACD) at 1,956 is flashing a sell signal, and the quiet trading volumes during consolidation periods suggest traders are playing it cool. A decisive close above $100,000 could spark a run to $108,000, but a dip under $92,000 might see prices tumbling to $88,000.

To sum up, key technical levels are defining the game. Support is anchored between $92,000 and $94,000, with resistance zones from $99,500 to $100,000, and another big hurdle at $108,000. Oscillators are generally sitting on the sidelines, yet the momentum hints at possible downward pressure. Moving averages are sending mixed messages, with short-term indicators leaning bearish while long-term ones continue to wave the bull flag, painting a picture of a market that’s all over the place.

Bull Verdict:

If bitcoin can reclaim $99,500 with strong volume and achieve a daily close above $100,000, bullish momentum could propel it toward $108,000 and reinforce the broader uptrend. Traders looking for long opportunities may find favorable entries near the $94,000–$95,000 support zone.

Bear Verdict:

Should bitcoin fail to hold the critical $92,000 support, bearish momentum could dominate, pushing prices toward $88,000 or lower. Mixed signals across oscillators and moving averages caution against aggressive long positions without clear confirmation of strength.

news.bitcoin.com

news.bitcoin.com