On-chain data reveals 1.45 million BTC accumulated at $97.5K, highlighting $141 billion in support as Bitcoin faces potential retracement below $100K.

Bitcoin’s recent price action showcased significant volatility, with the leading crypto briefly surpassing $108,000 on December 17. However, the crypto market faced a rapid reversal following the Federal Reserve’s Federal Open Market Committee (FOMC) meeting, which injected uncertainty into the financial sector.

After reaching its record high, Bitcoin retraced to $105,000 and later dipped below $99,000. Despite this pullback, the asset rebounded above $102,000, though it remains 2% lower than its daily opening price.

Bitcoin Sitting on $141B Support

Amid this recovery, an analysis shared by IntoTheBlock provides insights into potential support zones based on historical buying activity. Data from the blockchain analytics platform highlights a critical support zone for Bitcoin below the $100,000 mark, where a demand zone has been formed.

The platform notes that approximately 1.45 million BTC were accumulated at an average price of $97,500.

This accumulation, worth $141.37 billion, suggests robust demand below the six-figure threshold, potentially offering price stability if selling pressure intensifies.

On the resistance side, minor selling activity is noted just above the current trading levels. The platform identifies the closest resistance range between $102,351 and $102,458. The relative weakness of these resistance zones points to an opportunity for upward momentum if buying activity strengthens.

Will Bitcoin retrace below $100k?

Interestingly, a significant demand zone has formed just under $100k.

Over 1.45 million BTC was accumulated at an average price 97.5k, making this an important potential support zone. pic.twitter.com/vDcHEl8OKV

— IntoTheBlock (@intotheblock) December 19, 2024

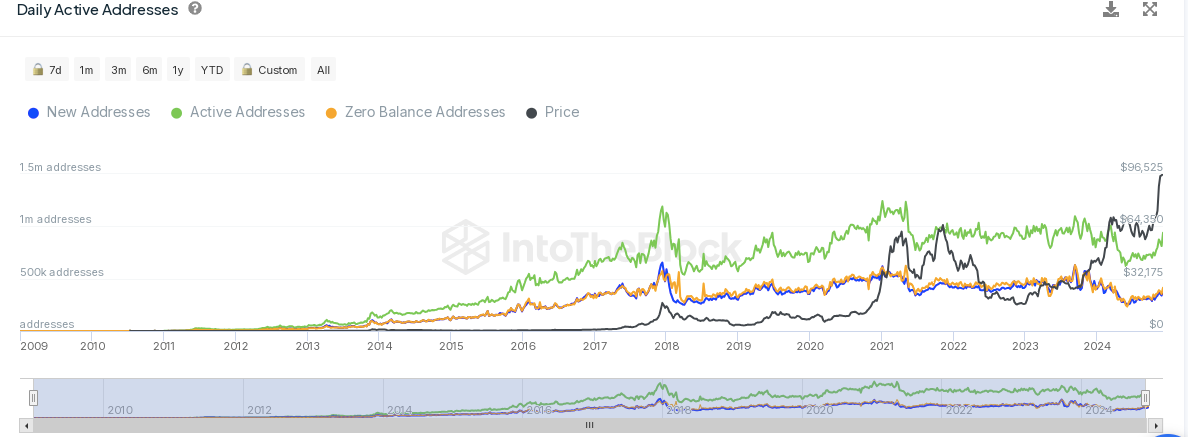

Address Activity Reflects Market Consolidation

Bitcoin’s network activity offers further insights into the market’s current phase. According to IntoTheBlock data, 364,870 new addresses were created over the past week, reflecting continued interest in the asset. Further, the 7-day new address metric declined by 10.14%, signaling a slowdown in new participant entry.

Meanwhile, active wallets remain stable, with 899,370 addresses transacting, showing a slight 0.23% decline over the same period. Interestingly, the number of zero-balance addresses increased by 14.55% in the past week, reaching 401,690.

Dynamics Amid Federal Reserve Policy

Elsewhere, an analysis by Santiment highlighted the macroeconomic context of Bitcoin’s price fluctuations. The intelligence platform recalled how the Federal Reserve’s 25-basis-point interest rate cut, coupled with cautious comments by Chairman Jerome Powell, tempered market expectations, particularly Bitcoin.

However, Santiment noted a slightly reduced correlation between Bitcoin and the S&P 500 during the past month. This trend is particularly significant in bullish periods, and considering that Bitcoin has stayed over $100,000, it could position itself for recovery once market volatility subsides.

thecryptobasic.com

thecryptobasic.com