A market veteran warns traders and investors against the use of leverage for Bitcoin trades despite admitting Bitcoin’s appeal.

While Bitcoin‘s recent rally to new highs has sparked a flurry of ‘up only’ calls, recent market volatility has offered a reminder about the need for caution in the nascent market.

Say No to Leverage?

Seasoned finance expert Fred Krueger has warned Bitcoin investors against leverage. In an X post on Thursday, December 19, the angel investor described the leading digital asset as likely the single best trade ever but warned that many risked blowing it with leverage.

Similarly, pro-crypto lawyer and former U.S. Senate candidate John Deaton contended that leverage trading made no sense with Bitcoin and crypto. This is likely due to the greater volatility involved. He instead advocated for interested investors to simply hold the asset, which he described as “the best performing asset of all time.”

I’ll admit, at times, in the past, I’ve used margin to buy stocks. I’ve been burnt and done well. But I’ll never understand using leverage with bitcoin or crypto. Just employ the KISS method: Keep it simple stupid. Bitcoin’s the best performing asset of all time. Just own it. https://t.co/uGC0FegTVW

— John E Deaton (@JohnEDeaton1) December 19, 2024

Leverage allows traders and investors to control a larger amount of capital than they have by borrowing from their broker in the hopes of multiplying returns. However, with the higher profit potential also comes greater risks.

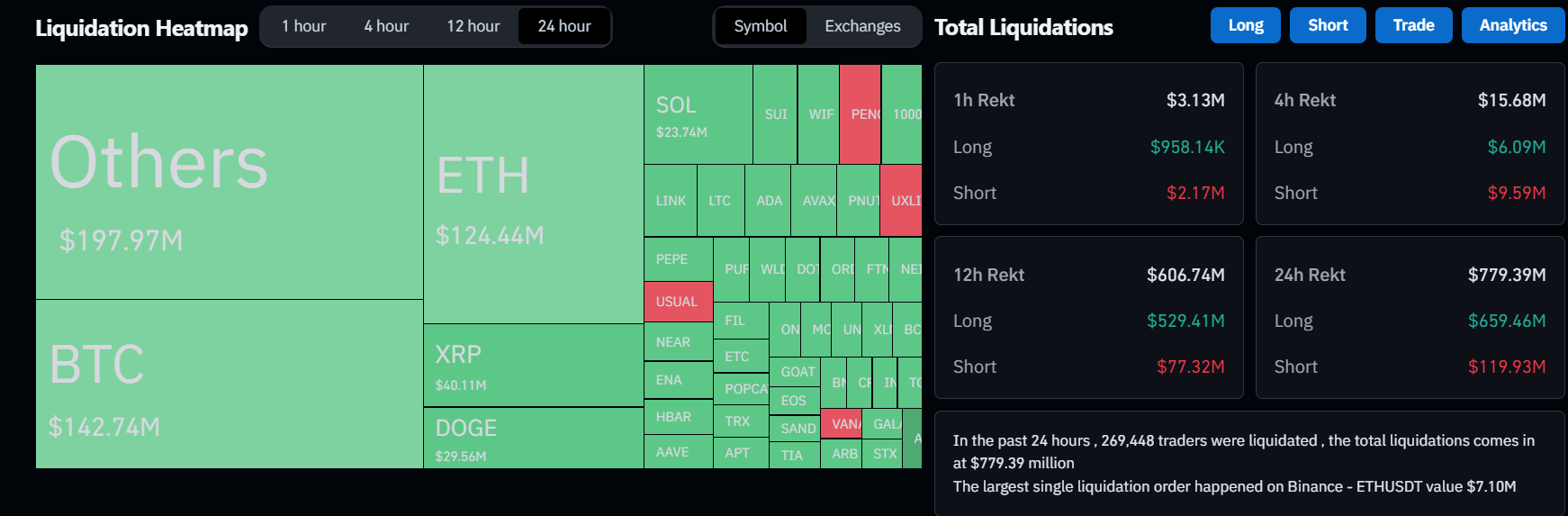

These risks include amplified losses, margin calls, which require traders to put up additional capital when their account balance falls below a set threshold, and liquidations, where traders’ assets are forcibly sold to cover losses.

The warnings from Krueger and Deaton come as several Bitcoin traders have felt the brunt of these risks over the past 24 hours.

Bitcoin Traders Lose Over $140M

Leveraged Bitcoin traders have lost over $140 million in the past 24 hours, according to CoinGlass data at the time of writing.

The losses come as the asset took many by surprise with a sharp decline from highs of over $106,500 on Wednesday, December 18, to lows of $98,800 amid hawkish comments from Fed Chair Jerome Powell.

In a press conference following the December 2024 Federal Open Market Committee (FOMC) meeting, Powell stressed that the central bank’s fight with inflation was not over and that interest rates were likely to remain higher for longer. The Fed now projects only two quarter-point rate cuts in 2025, as opposed to the initial projection of four.

thecryptobasic.com

thecryptobasic.com