On Wednesday, the price of bitcoin plummeted below the $100,000 mark, hitting an intraday low of $99,997 per coin. The whole crypto market has taken a hit, dropping 5.74% in the past 24 hours, with numerous coins feeling the sting of heavy losses.

Bitcoin’s Rollercoaster Week: From Record High to Sub-$100K Slide

It feels like only yesterday when bitcoin soared to its all-time peak of $108,364. And guess what? It was! But then, the very next day on Wednesday afternoon, bitcoin slid into the $105K range. After the U.S. Federal Reserve’s Federal Open Market Committee (FOMC) meeting, bitcoin took another nosedive as the central bank hinted at a slower pace for future rate reductions.

In the end, BTC dipped under the $100K threshold, just a hair’s breadth away at $99,997 per coin, and as of 8 p.m. ET on Dec. 18, it’s cruising at $100,563 per coin. Bitcoin took a 4.8% tumble against the U.S. dollar, while ethereum (ETH) skidded by 5.5%. Although many leading coins only faced minor setbacks, meme coin assets took a much steeper plunge. The notorious meme coin peanut the squirrel (PNUT) plummeted by 19.24%, and popcat (POPCAT) wasn’t far behind, dropping 18.80%.

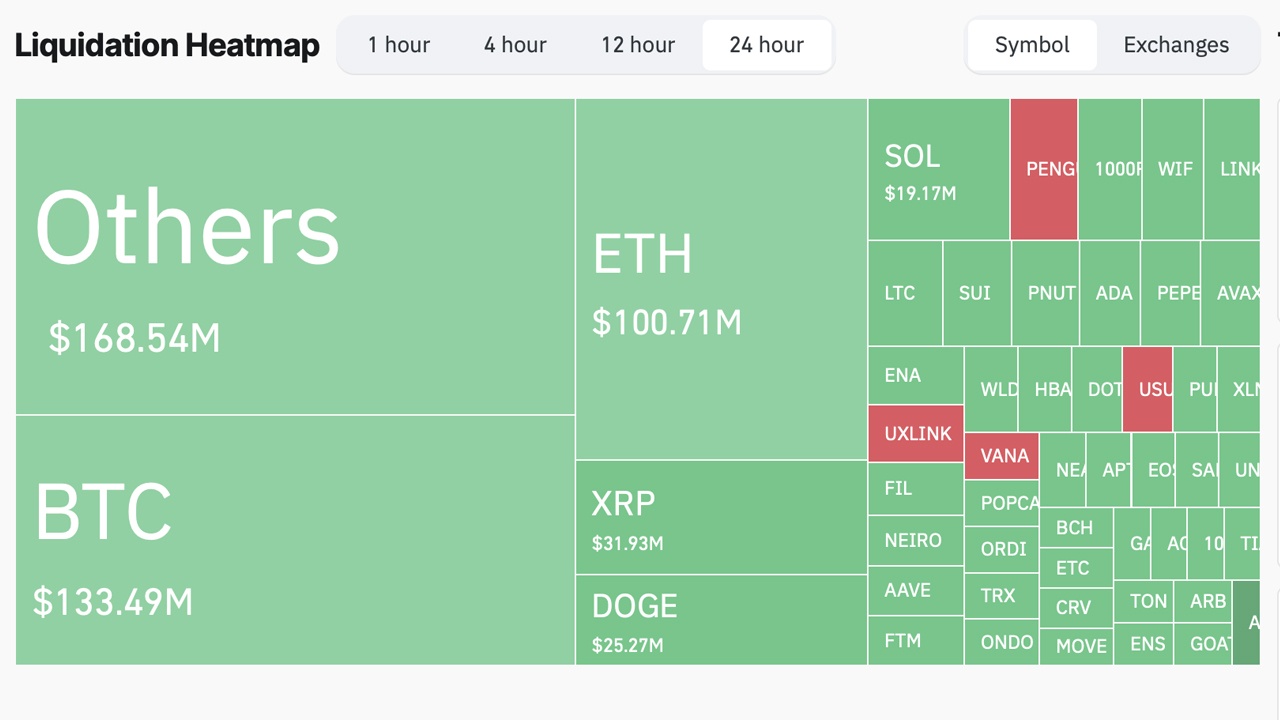

Beyond the slew of meme coins, fantom (FTM) slid down 12.52%, thorchain (RUNE) lost 12.47%, and theta token (THETA) was hit with a 12.33% decline. Despite the general slump in the crypto markets, global trading volume has jumped by 31%, reaching $248.41 billion in the last day. Tether (USDT), bitcoin (BTC), and ethereum (ETH) lead the pack in daily trading volumes. Meanwhile, over in the derivatives markets, $671.52 million in positions were wiped out in just 24 hours. Most of these liquidations were for long positions in BTC, ETH, XRP, DOGE, SOL, and LTC, according to coinglass.com metrics.

The latest dip in the market is a stark reminder that the bull run’s recent excitement can, once in a while, be as fragile as a house of cards, with even the slightest hint of macroeconomic change causing wild swings. As bitcoin bounces back just over the $100,000 threshold, the overall market’s response shows us just how whimsically investor mood swings with outside forces. Meme coins and those who bet big on leverage felt the pain the most, spotlighting the rollercoaster nature of this market cycle.

news.bitcoin.com

news.bitcoin.com