Presto Research, the analytical division of the algorithmic trading firm Presto, has just dropped its debut annual report titled “From Chaos to Clarity,” shining a spotlight on the wild ride of crypto trends in 2024 and throwing some daring forecasts for 2025.

Presto Research 2025 Predictions: Bitcoin to Break $200K Barrier While Solana Becomes a 4-Figure Token

In its report, Presto Research paints a picture of the crypto market’s rollercoaster year, where meme coins were the unexpected heroes. Tokens like OM and PEPE zoomed to the stars with jaw-dropping gains of 6,118% and 1,231% respectively.

On the flip side, the report shows that venture capital-backed coins didn’t quite make the grade, revealing a shift in investor sentiment. There’s a new vibe in town where transparency and sustainability are the cool kids, overshadowing the old-school speculative bubble.

Real-world asset (RWA) tokens also made waves, with mantra (OM) leading the charge as a governance token for a blockchain that blends regulation with the tokenization of real-world assets. This success, according to Presto Research, reflects the community’s love for projects that have real-life appeal.

The report credits the late-year market lift-off to some big macro events like the launch of spot bitcoin exchange-traded funds (ETFs) and the U.S. presidential election. Presto’s October analysis had already called this party, pointing to a flood of liquidity, a friendlier regulatory environment, and low investor expectations as the main fiesta starters.

A standout moment was the U.S. Senate’s introduction of the Bitcoin Strategic Reserve Bill. Even though it’s not law yet, it’s already stirring up conversations worldwide about countries stacking bitcoin with Donald Trump’s approval.

Looking into the crystal ball for 2025, Presto Research envisions a boom across various crypto sectors. Bitcoin (BTC) might just hit $210,000, thanks to big players jumping in and its growing role as a reserve asset. Ethereum’s ETH/BTC ratio is expected to bounce back to 0.05, as it tackles user experience issues and cements its place in smart contract stardom.

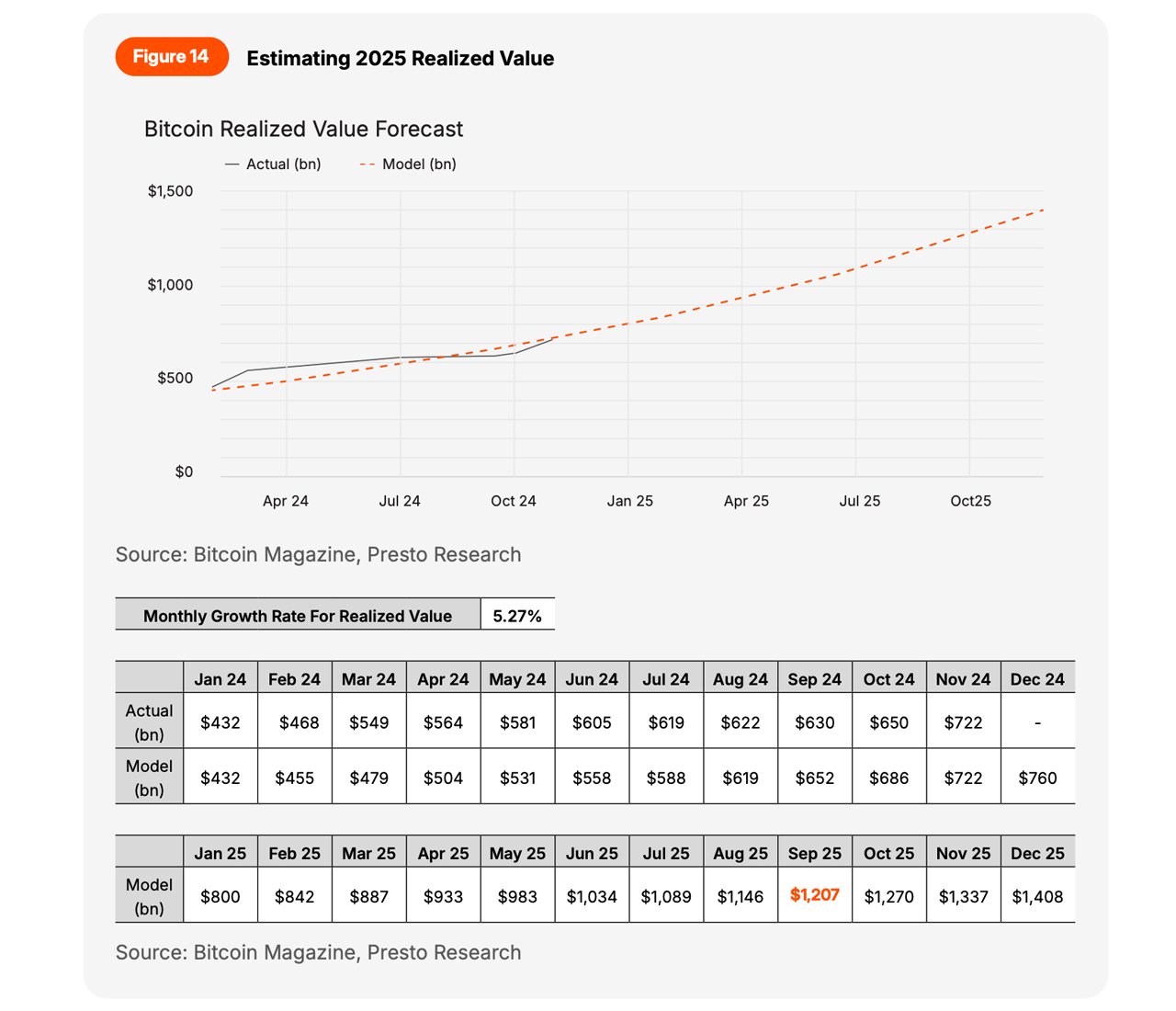

“I take a more conservative approach by applying 3.5x multiple to the RV forecast of $1.2tn by 3Q25, assuming a +5.3% MoM growth from today’s RV of $722bn,” the Presto Research analyst notes in the study. “The 5.3% is the compound monthly growth rate of RV between Jan through Nov this year, which captures the impact of easier institutional access enabled by the spot ETFs (the spot ETFs acquiring more BTC will result in rising RV).”

The report’s author adds:

This results in my 2025 target value of the Bitcoin network at $4.2tn (vs. $1.9tn today) or $210,000 (=$4.2tn / 19,986,416 BTC) per BTC.

As far as decentralized finance (defi), Presto also foresees decentralized exchanges (dexes) grabbing more of the spotlight, possibly taking over 20% of centralized exchange (cex) volumes by the end of 2025. Better looks and more openness are making these platforms the new hangout spots.

The report predicts the total crypto market cap could climb to $7.5 trillion in 2025, fueled by stablecoins, smart contract platforms going mainstream, and more big institutions diving in. Solana, for example, is expected to soar to $1,000 per token, riding on its ecosystem’s innovations and performance boosts.

Wrapping up, Presto Research talks about crypto getting a suit and tie. Clear regulations are seen as the key to making the U.S. the ultimate crypto playground. The idea of companies and countries hoarding Bitcoin is pegged as the next big thing, ushering in a new chapter where crypto becomes part of the global financial tapestry.

news.bitcoin.com

news.bitcoin.com