Bitcoin ($BTC) has shattered expectations once again, reaching an all-time high ($ATH) of $106,803. This remarkable price surge has fueled fresh optimism in the crypto market, with speculators and investors wondering whether $BTC could soon cross the $110,000 mark. The catalyst for this surge is linked to President-elect Donald Trump's proposal to establish a U.S. strategic Bitcoin reserve, signaling a potential seismic shift in the adoption of Bitcoin by governments.

Bitcoin Newest $ATH

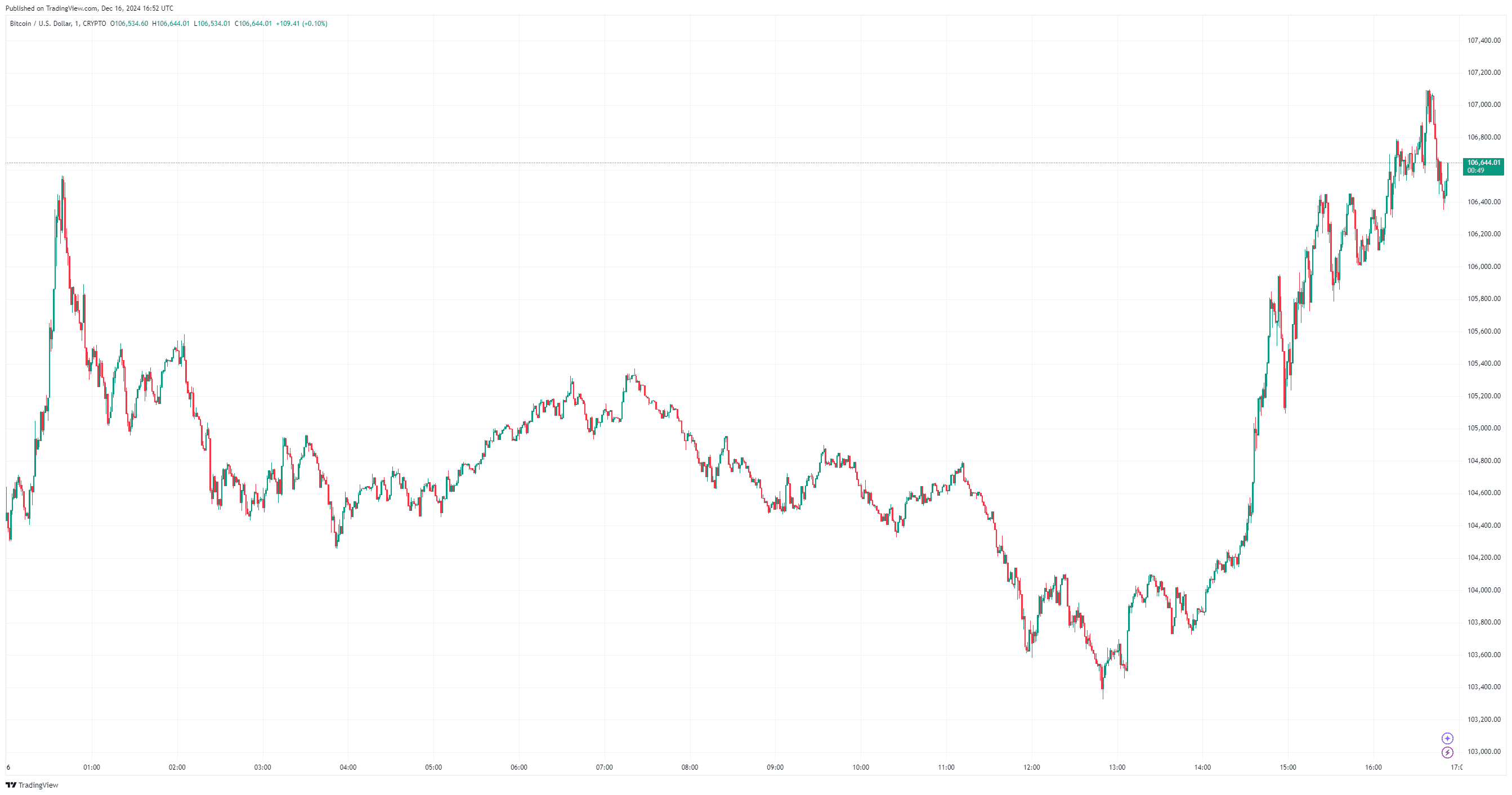

The cryptocurrency market witnessed an extraordinary surge as Bitcoin's price skyrocketed to a historic $ATH of $106,803. This new milestone was driven by increased institutional interest, whale accumulation, and a bullish shift in market sentiment. Notably, Bitcoin's trajectory aligns with broader macroeconomic factors, including discussions about potential U.S. adoption of $BTC as part of a national reserve strategy.

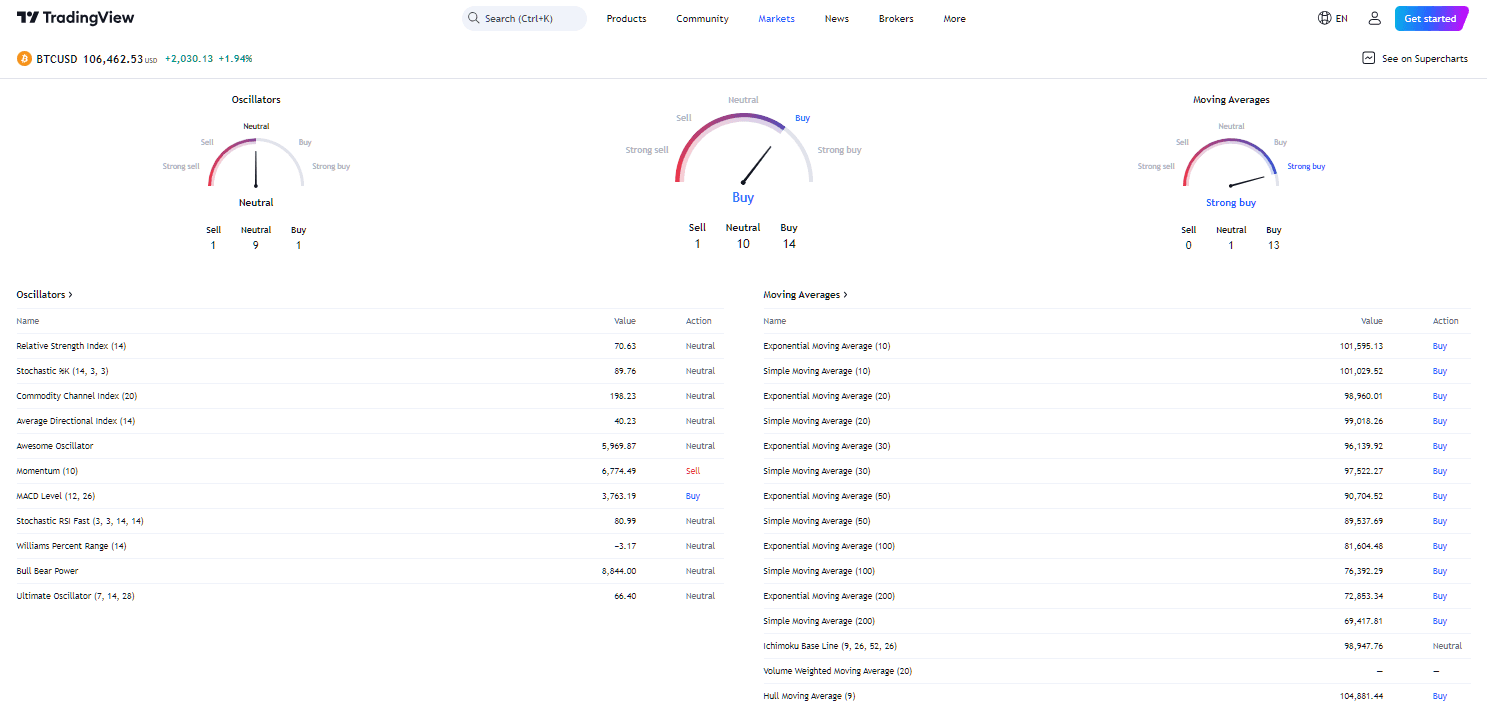

According to market analysts, the $100,000 psychological barrier was a crucial resistance level. Breaking past this threshold has now positioned Bitcoin for a potential rally toward higher price points. Technical indicators like RSI and MACD suggest bullish momentum remains strong, further reinforcing the potential for Bitcoin to continue its upward trajectory.

President-Elect Trump's Proposal for a U.S. Bitcoin Reserve

One of the key drivers behind Bitcoin’s recent surge is President-elect Donald Trump's proposal to create a U.S. strategic Bitcoin reserve. This move is viewed as a landmark moment for the broader cryptocurrency industry, as it signals potential government-level support for $BTC as a reserve asset.

This proposal comes at a time when countries like El Salvador and certain Middle Eastern nations are already adopting Bitcoin as part of their national financial strategy. If the U.S. follows suit, it could set a precedent for other nations to consider similar moves. Such an endorsement from one of the world’s largest economies would likely drive Bitcoin demand, creating upward price pressure.

President-Elect Trump's Proposal for a U.S. Bitcoin Reserve

One of the key drivers behind Bitcoin’s recent surge is President-elect Donald Trump's proposal to create a U.S. strategic Bitcoin reserve. This move is viewed as a landmark moment for the broader cryptocurrency industry, as it signals potential government-level support for $BTC as a reserve asset.

This proposal comes at a time when countries like El Salvador and certain Middle Eastern nations are already adopting Bitcoin as part of their national financial strategy. If the U.S. follows suit, it could set a precedent for other nations to consider similar moves. Such an endorsement from one of the world’s largest economies would likely drive Bitcoin demand, creating upward price pressure.

Bitcoin Price Predictions

Can Bitcoin Reach $110,000?

With $BTC’s current momentum, the $110,000 price target seems within reach. Market sentiment remains overwhelmingly bullish, with several technical and fundamental factors supporting this outlook:

- Institutional Interest: Institutional investors are actively accumulating $BTC, as evidenced by significant outflows from exchanges to cold storage wallets.

- Technical Analysis: Technical indicators, including Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD), point to strong upward momentum.

- Macro Environment: The Federal Reserve’s potential shift in monetary policy, combined with reduced inflation fears, has increased Bitcoin’s appeal as a hedge asset.

- Trump’s $BTC Reserve Proposal: The possibility of a U.S.-backed Bitcoin reserve could attract significant capital inflows, pushing $BTC’s price higher.

Although $BTC has displayed bullish momentum, it’s important to note that the cryptocurrency market is known for its extreme volatility. While many predict a move to $110,000, sharp corrections could occur as investors take profits.

Expert Price Predictions for $BTC

Market analysts have provided mixed forecasts on where Bitcoin’s price could head next. Some prominent predictions include:

- Bloomberg Analysis: Bloomberg analysts predict Bitcoin could reach as high as $150,000 if momentum continues and institutional adoption accelerates.

- Independent Analysts: Several independent analysts have forecasted a $BTC rally to $110,000 in the coming weeks if buying pressure remains consistent.

- Skeptics’ Take: On the other hand, skeptics warn of potential retracements, especially as retail investors seek to cash in on recent gains.

Bitcoin’s new $ATH of $106,803 marks a historic moment for the cryptocurrency market. Backed by President-elect Trump's proposal for a U.S. strategic Bitcoin reserve, $BTC's potential for further price growth is stronger than ever. While technical indicators suggest continued bullish momentum, investors must remain cautious due to the volatile nature of the crypto market.

With institutional interest rising, technical analysis signaling growth, and potential government adoption on the horizon, Bitcoin’s price could soon breach the $110,000 mark. However, as with any financial asset, past performance is not indicative of future results. Investors are advised to monitor market trends and stay informed about key policy changes, especially with the potential U.S. Bitcoin reserve initiative in play.

cryptoticker.io

cryptoticker.io