Four years ago, as the world grappled with the economic fallout from the COVID-19 pandemic, the U.S. government issued $1,200 stimulus checks to eligible Americans under the CARES Act.

While many recipients used these funds to cover immediate needs, others saw an opportunity for long-term investment—particularly in Bitcoin ($BTC), which was trading at a fraction of its current value.

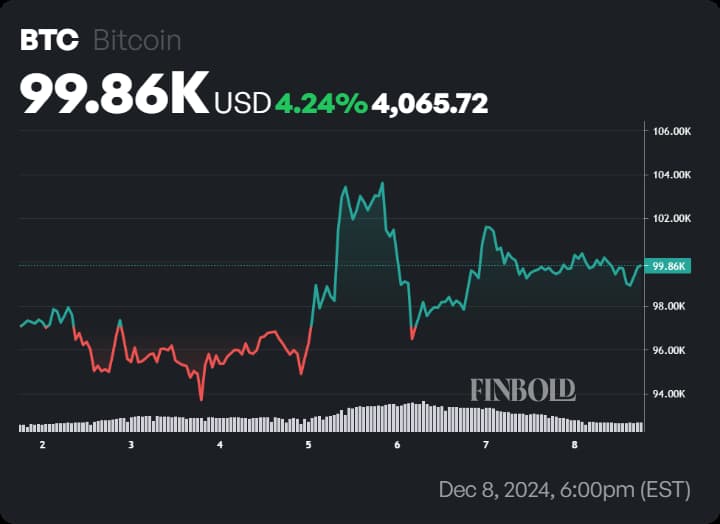

Fast forward to 2024, Bitcoin has achieved a historic milestone, crossing the $100,000 mark amid robust interest from both institutional and retail investors.

At press time, Bitcoin is trading at $99,866, reflecting a 7% weekly gain. On the monthly chart, the cryptocurrency has surged 31%.

From relief to returns: How much would $1,200 invested in $BTC be worth now?

If you had invested the entirety of your $1,200 stimulus check in Bitcoin on April 15, 2020, when $BTC was priced around $6,966, you would have acquired approximately 0.1723 $BTC.

Fast forward to today, with Bitcoin hovering near $99,773, that initial investment would now be worth a staggering $17,187—a return of nearly 1,387%.

The first stimulus checks were part of a series of Economic Impact Payments aimed at alleviating financial stress during the pandemic. Subsequent rounds, such as the $600 check in December 2020, presented similar opportunities.

Investing this second round in Bitcoin, when the cryptocurrency was trading at approximately $33,098, would have resulted in a portfolio worth $2,144 today—an impressive 257% increase.

Meanwhile, American households are grappling with record-high debt, which surged to $17.9 trillion in Q3 2024, driven by mounting student loans, credit card balances, and auto loans, as reported by Finbold.

Although income growth has slightly outpaced debt accumulation—reducing the debt-to-income ratio from 86% in 2019 to 82% in 2024—financial stress remains a significant concern for many families.

The narrative, however, might have played out differently if most citizens had poured their stimulus payments into Bitcoin during the pandemic.

The leading cryptocurrency’s exponential growth could have provided households with a substantial financial cushion. These returns highlight the asset’s potential to serve as a hedge against inflation and economic uncertainty.

Bitcoin’s market evolution

Bitcoin’s meteoric rise over the past four years has been fueled by increasing adoption, institutional interest, and market developments such as the approval of spot exchange-traded funds (ETFs) in the United States.

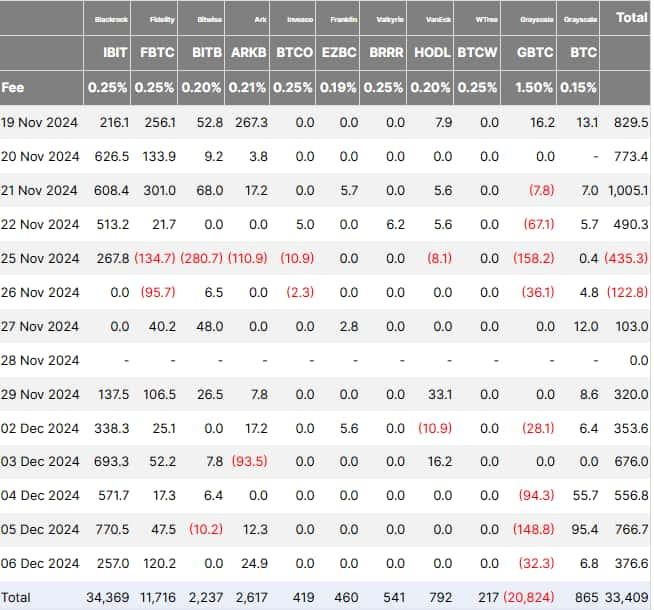

Recent data highlights this momentum, with ETF inflows surpassing $2.7 billion in a single week, pushing Bitcoin prices to an all-time high of $103,630.

Major players like BlackRock (NYSE: BLK) and Fidelity have contributed to this surge, with BlackRock’s iShares Bitcoin Trust (IBIT) registering cumulative inflows of $34.4 billion since its January 2024 launch.

This influx of institutional capital has elevated U.S. $BTC-spot ETFs to the position of the largest Bitcoin holders, surpassing even Satoshi Nakamoto’s estimated stash.

Regulatory winds and the road ahead

Political developments also favor Bitcoin’s trajectory. President-elect Donald Trump’s appointment of Paul Atkins, a pro-crypto advocate, as SEC Chair has further bolstered market optimism.

The U.S. government’s shifting stance on Bitcoin, including plans to designate it as a strategic reserve asset under President-elect Donald Trump, adds another layer of intrigue. Such moves, coupled with bullish ETF inflows, could drive Bitcoin prices toward $120,000.

However, market risks remain, with potential oversupply concerns stemming from U.S. government transfers and Mt. Gox’s creditor reimbursements.

For those who chose to invest their stimulus checks in Bitcoin, the returns have been extraordinary, far outpacing traditional asset classes.

As Bitcoin continues to gain institutional traction and regulatory clarity, its role as a transformative financial asset appears increasingly solidified.

Whether Bitcoin’s journey will lead it to $120,000—or face downward pressure from market oversupply—remains a key question for investors navigating this evolving landscape.

Featured image via Shutterstock

finbold.com

finbold.com