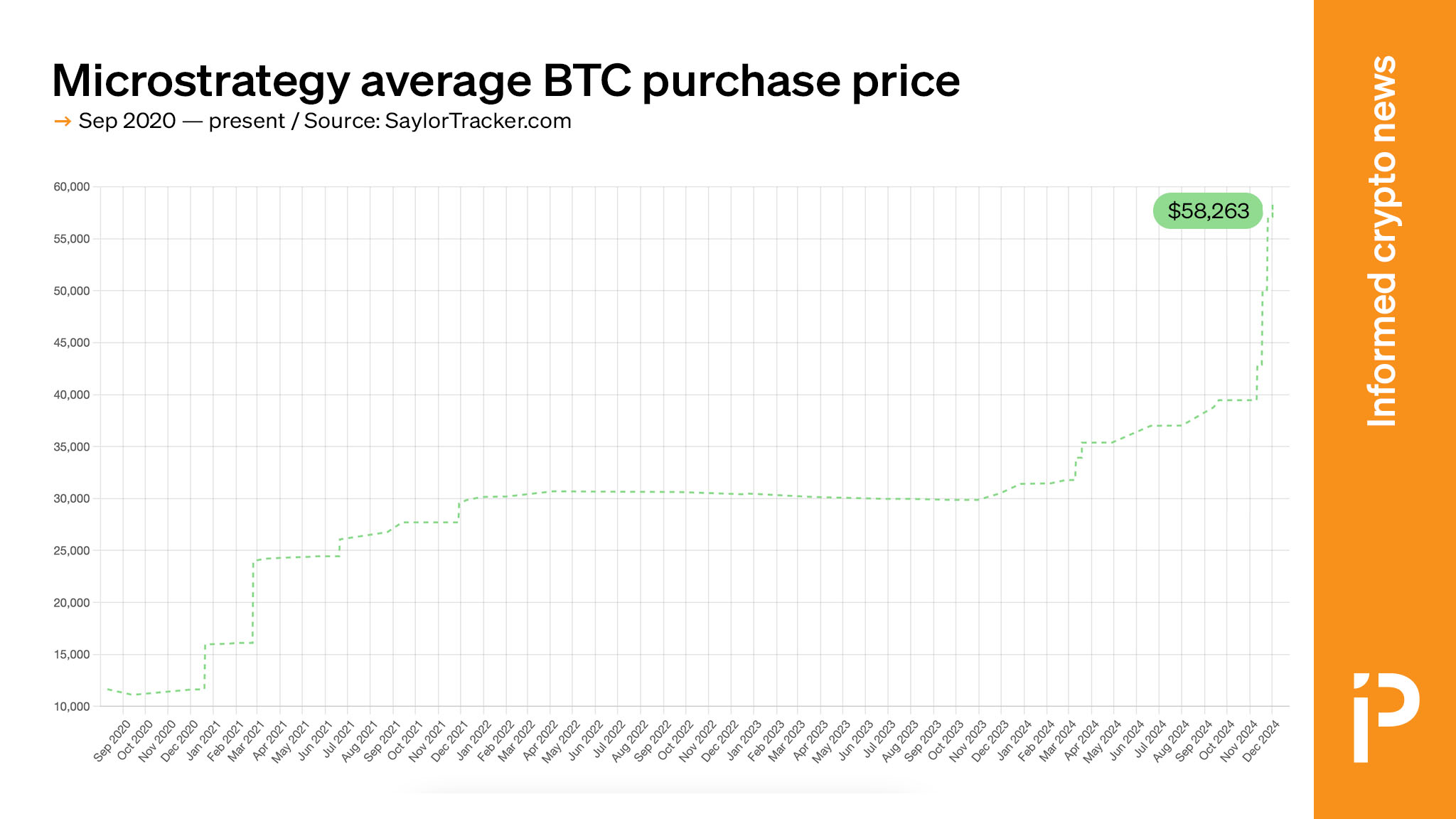

The average price MicroStrategy (MSTR) paid for its bitcoin purchases has risen to $58,263. Through tens of billions of dollars in dilutive and convertible stock offerings, the company has acquired 402,100 bitcoin – mostly in exchange for debt and future shareholder dilution.

Excluding those future obligations, CEO Michael Saylor boasts that the company’s currently outstanding shareholders have earned a yield of 38.7% during the month of November. This figure is calculated by dividing MicroStrategy’s bitcoin by its “assumed diluted shares outstanding,” a proprietary metric that excludes a variety of future obligations – especially if MSTR rallies above the conversion prices of debtholders.

The yield impresses his investors, nonetheless, who see MicroStrategy’s ability to tap corporate debt markets as a unique method to purchase bitcoin on a dilution-adjusted basis.

Some members of the self-aware fan club, Irresponsibly Long MSTR, go way beyond Saylor’s bullish projections of $180,000 per bitcoin near-term and $13 million by 2045. Its most degenerate and hyper-bullish members think that MicroStrategy’s market cap could even exceed bitcoin itself.

Michael Saylor earns billions personally this year amid bitcoin rally

Substantially all of Saylor’s wealth derives from owning a large stake in and operating MicroStrategy, the firm he founded decades ago. Forbes estimates Saylor’s personal net worth at $9.2 billion. Bloomberg does not estimate his net worth on its Billionaires Index, which lists its estimate of the world’s 500 richest people that ends at $6.35 billion.

As of publication time, MicroStrategy’s market capitalization is $86 billion, a 2.2X premium on its $38.2 billion worth of bitcoin holdings.

Although the stock is up an impressive 480% year-to-date, its multiple on its bitcoin holdings has fallen considerably from its all-time high of 3.5X premium on November 20.

Read more: What happens if MicroStrategy can’t sell enough bitcoin to repay lenders?

That MicroStrategy even trades at a premium to its bitcoin holdings still mystifies many financial commentators. “There is no downside!” wrote Jason Calacanis regarding Saylor’s strategy, sarcastically. “The best strategy humanity has ever created,” wrote another with equivalent sarcasm. “Using endless leverage never ends well,” said another.

There are several catalysts on the near-term horizon, including continued bitcoin purchases using its previously announced $42 billion capital raise. Moreover, MicroStrategy is hoping to gain exposure to passive investment flows through indexation. For example, a snapshot occurred on November 29 for its ability to join the prestigious NASDAQ 100.

A decision about that index inclusion will occur on December 13. If approved, it would actually join the ‘QQQ’ on December 20.

protos.com

protos.com