Bitcoin remains volatile below the $100,000 level as the market forces and macroeconomic factors determine its trends. Robert Kiyosaki expressed his opinion on X, concerning which he stated that there might be a correction to $60,000.

Kiyosaki Sees Bitcoin Correction as a Buying Opportunity

Recently, Robert Kiyosaki, the author of the famous book series ‘Rich Dad Poor Dad,’ has expressed concern about the Bitcoin price remaining below $100,000. He predicted that there may be a price dip soon. Nevertheless, Kiyosaki considers this a ‘Bitcoin sale,’ where he wants to acquire more Bitcoin instead of selling.

According to Kiyosaki, the price of Bitcoin in the short term is not as important as holding the asset in the long run. He remains optimistic about Bitcoin settling at $250,000 in 2025.

Macroeconomic Factors Tighten Liquidity for Bitcoin

Bitcoin’s performance has also been impacted by macroeconomic factors, including the U.S. Federal Reserve monetary policy. The recent data indicates that investors anticipate a slower pace of future rate cuts, which reduces market liquidity and supports the dollar.

Investor appetite for high-risk assets, such as Bitcoin, can be reduced when the dollar is stronger. The CME FedWatch tool has hit down the expectation rate for a Dec. cut by 67% to 61%.

This change is associated with the potential for a more restrictive monetary policy affecting the sentiment of risk in financial markets. Such macroeconomic factors can be seen in Bitcoin’s failure to rise above $100,000.

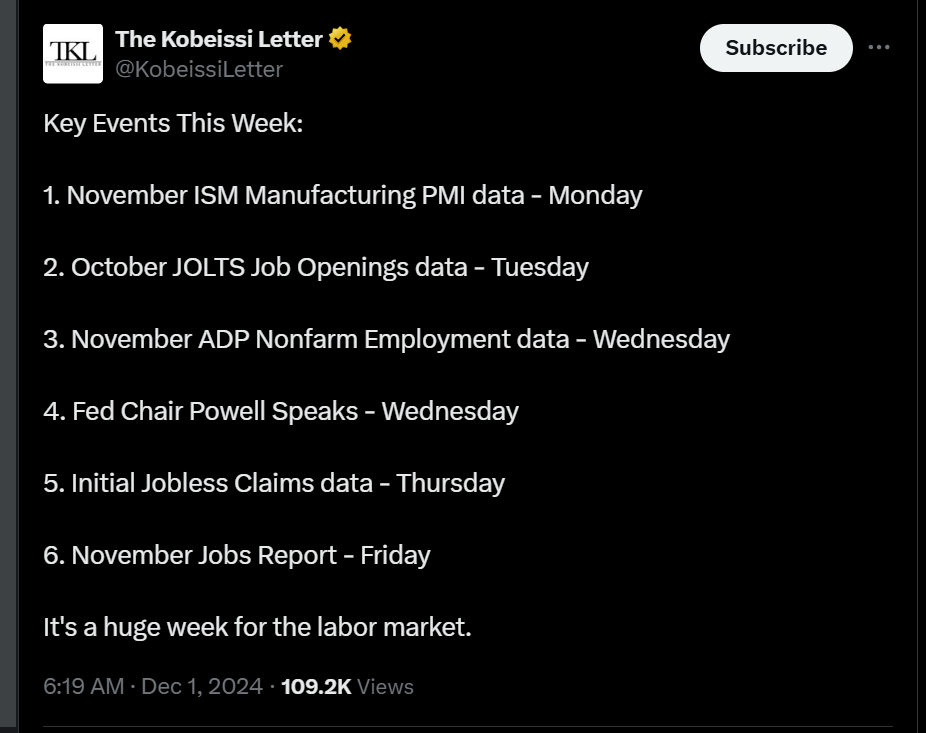

Other events this week, such as average weekly hours worked in manufacturing and non-farm payroll data, may also put pressure on policy rates.

Additionally, speeches from Federal Reserve officials, including Chair Jerome Powell, can shed light on inflation and rate policy.

Resistance at $100,000 Attributed to Profit-Taking

There is a significant sell wall at $100,000, which is an estimate of $384 million in Bitcoin. This level has become a psychological and technical barrier as investors lock in profits.

Technical analysis reveals that profit-taking has interrupted the BTC rally at certain price levels in the past, thus triggering a correction period.

Another challenge is the dollar’s recent rally because global liquidity for risk assets has become scarce. After November 5, the U.S. dollar index increased from 103.42 to 106.22 due to lower chances of deep Fed rate cuts. A strong dollar normally negatively impacts the demand for Bitcoin as an alternative asset.

At this point, investors are closely observing market indexes, focusing on such factors as ISM manufacturing and Powell’s speech regarding potential further monetary policy tightening.

These developments could further prolong Bitcoin’s efforts needed to break past the $100,000 level. The result of these events will most probably determine the further dynamics of Bitcoin’s price in the near future.

Major Developments to Influence the Near-Term Bitcoin Movement

This week’s economic activities include the release of non-farm payrolls and Federal Reserve updates that influence Bitcoin. Positive payroll data could lead to the strengthening of the dollar which in turn triggers more of a downtrend for Bitcoin.

Conversely, signs of economic weakness might revive expectations of monetary easing, offering relief for risky assets. The U.S. ISM manufacturing data on Monday and PMI reports on Tuesday will also be closely watched for insights into economic activity. Federal Reserve Chair Jerome Powell’s speech on Wednesday at the New York Times DealBook Summit could provide further clarity on rate policy.

Market participants are still being cautious as Bitcoin struggles with its strength and other macroeconomic factors.

thecoinrepublic.com

thecoinrepublic.com