Bitcoin’s ($BTC) potential push toward $100,000 might face further delays as the asset will likely encounter volatility later in the week driven by macroeconomic signals.

This anticipated volatility arises as Bitcoin’s chart pattern shows the maiden digital asset is consolidating, and this week’s labor report data might not cast the asset in the spotlight, according to professional cryptocurrency trading expert Michaël van de Poppe in an X post on December 2.

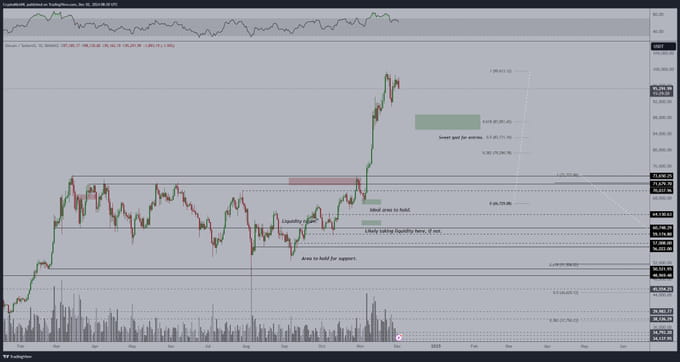

Poppe suggested that volatility caused by labor market data could push Bitcoin below $90,000, potentially creating new entry opportunities.

“Bitcoin is nicely consolidating, and it’s labor data week. That isn’t the best period for Bitcoin to shine, through which the optimal spot for entries (if corrections happen) is coming back into play,” he said.

Suppose Bitcoin fails to break the six-figure resistance and labor market dynamics trigger a price drop, he predicts the asset may find support at $85,000–$88,000, levels he considers ideal for accumulation.

Regarding the impact of the upcoming report, strong data may signal economic resilience but also raise inflation concerns, increasing the likelihood of interest rate hikes and reducing the appeal of risky assets such as Bitcoin.

Conversely, weaker data could ease inflation fears and boost risk assets. After October’s jobs report fell short, with only 12,000 jobs added (compared to a forecast of 100,000), expectations for November are bullish.

Beyond the labor market, historical data suggests Bitcoin often dips at the start of each month, followed by a strong rebound.

Insights shared by Bitcoin commentary platform Bitcoin Archive in a December 2 X post, this trend has persisted for six months.

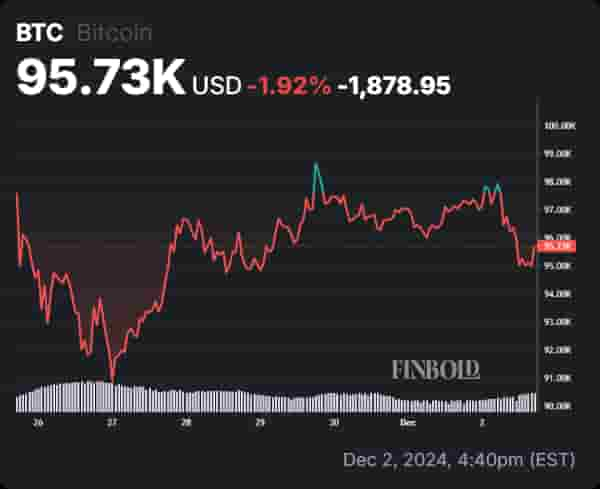

December appears to follow suit, with $BTC retreating to trade near $95,000 after approaching the $100,000 mark. Such short-lived corrections may present investment opportunities.

Bitcoin to start parabolic run

Despite the bearish sentiment at the start of December, historical price trends indicate that this month could also signal the beginning of a parabolic move for Bitcoin.

In this case, decentralized finance (DeFi) researcher CryptoNobler suggested that this December might usher in Bitcoin’s largest bull run yet, with conditions resembling the rallies of 2016 and 2020.

Key drivers of this optimism include expected pro-Bitcoin policies in the United States, anticipated Federal Reserve rate cuts, a potential reversal of China’s cryptocurrency ban, and a $16 billion FTX payout scheduled for early 2025.

Overall, Bitcoin’s trajectory toward a new record high appears to have stalled. The asset is striving to hold the $95,000 support level to keep the $100,000 target within reach.

This pullback has prompted figures like author and investor Robert Kiyosaki to caution about a potential crash to $60,000, which he views as an accumulation opportunity.

Bitcoin price analysis

Bitcoin was trading at $95,730 at press time, showing daily and weekly losses of 1.5% and 1.9%, respectively.

On a technical level, Bitcoin remains well-positioned for an upside move, supported by its position above the 50-day and 200-day simple moving averages (SMA).

However, caution is warranted, as the Relative Strength Index (RSI) of 67 and the Fear & Greed Index of 80 (Extreme Greed) suggest the market may be nearing overbought conditions.

Featured image via Shutterstock

finbold.com

finbold.com