Bitcoin ($BTC) recently brushed the $99,800 mark, making it tantalizingly close to the elusive $100,000 milestone. This achievement sparks reflection on past trends and the cryptocurrency’s potential trajectory in the months and years ahead.

Breaking Barriers or Cooling Down? Bitcoin’s $100K Struggle

Back in 2017, bitcoin ($BTC) approached $20,000, peaking between $19,475 and $19,695 but never quite hitting the round number target. A comparable scenario unfolded during the 2021 bull market, which, while less fervent than 2017, saw bitcoin climb to around $69,000—an improvement, yet lacking the unrestrained upward momentum of its earlier counterpart.

Fast forward to Nov. 21, 2024, when bitcoin reached $99,800. This echoes historical patterns, leading some analysts to interpret the tempered growth as a sign of the market maturing, driven by institutional involvement and clearer regulations. Others suggest that psychological thresholds like $100,000 serve as natural resistance levels, requiring a significant spark to overcome.

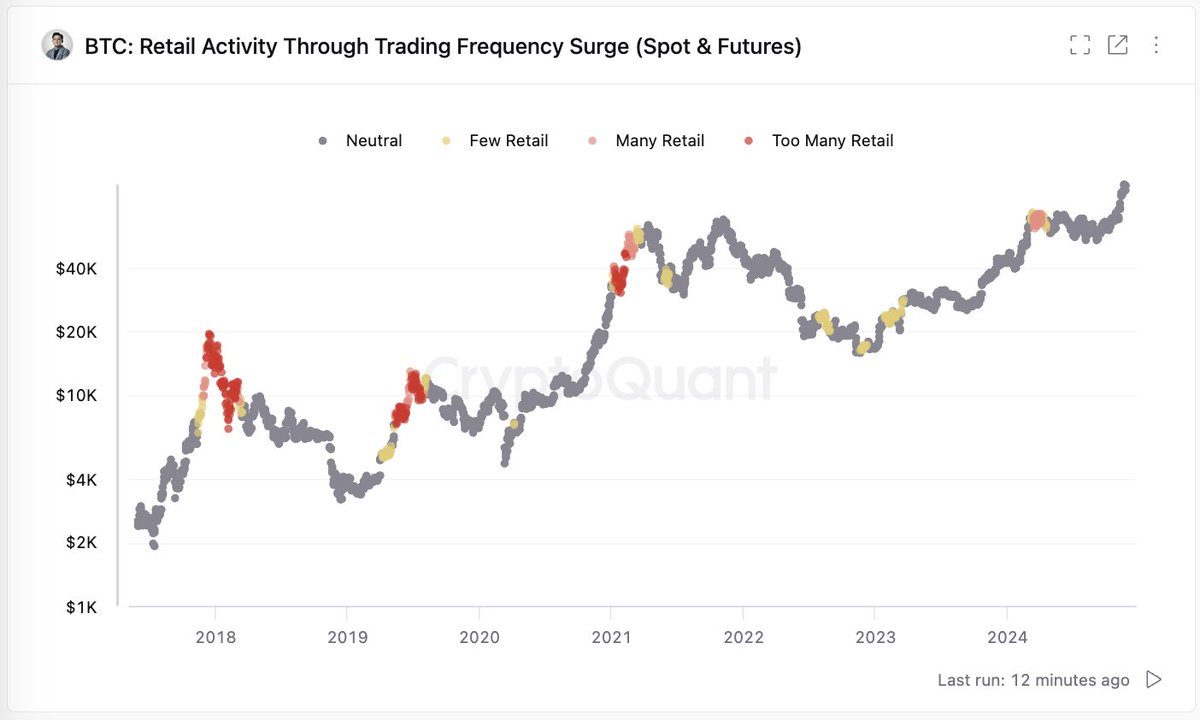

The progression of bitcoin bull markets appears to have mellowed with time, which might explain the elusive $100,000 mark. In 2017, the rally was fueled by retail investors, a wave of newcomers, and minimal regulatory oversight. Later cycles, while still bullish, have displayed a steadier pace, indicative of evolving dynamics and less retail participation. The founder and CEO of Cryptoquant, Ki Young Ju, explained on Tuesday that “bitcoin retail investors aren’t in FOMO yet.”

Bitcoin’s history of sudden corrections during bull runs adds context to its latest retreat from $99,800. In 2017 and 2021, the cryptocurrency endured multiple drops exceeding 20% before bouncing back. This latest dip could similarly be a temporary pause in a much larger upward trend. Historically, these setbacks have tested investors’ resolve while paving the way for future gains.

Lessons from the 2017 cycle provide a glimpse into what might come next. After failing to surpass $20,000, bitcoin entered an extended bear phase, with prices plummeting before recovering years later. If the pattern holds, the recent peak may signal a similar phase of consolidation, postponing any rise beyond $100,000. For instance, 12-month stats already show that bitcoin has jumped 149% against the U.S. dollar.

Yet, many analysts remain confident in bitcoin’s long-term outlook. Historically, the cryptocurrency has defied skeptics, bouncing back from sharp downturns to set new highs. Advocates of the stock-to-flow (S2F) model and similar price model frameworks foresee bitcoin exceeding $250,000 by 2025, driven by institutional adoption, mining halvings, and its growing role as a digital asset.

Bitcoin’s near-miss at $100,000 illustrates both its resilience and the hurdles it faces in conquering key psychological and technical levels. While historical trends hint that such milestones may remain out of reach for now, they also point to bitcoin’s ability to recover and evolve. Investors should stay cautious, as the future holds a mix of potential highs and lows, shaped by market forces, historical trends, and shifting sentiment.

news.bitcoin.com

news.bitcoin.com