Last day, MicroStrategy surprised many by making a massive $BTC purchase of 55,500 $BTC tokens – the highest it has ever made. This month alone, the company has amassed over 134,480 $BTC tokens. With the latest purchase, the total $BTC holding of MicroStrategy has increased to nearly 386,700 $BTC tokens, worth at least $36,496,204,620.

Recently, while speaking to media persons regarding the latest surge of institutional interest in Bitcoin, MARA CEO Fred Thiel revealed the similarities between his company’s $BTC strategy and that of MicroStrategy. Marathon Digital Holdings Inc also made a massive $BTC purchase last day. Currently, all eyes are on Bitcoin’s institutional investment scenario. Time to explore the situation deeper! Ready?

Growing Institutional Interest in Bitcoin

Recently, the Bitcoin market has seen a sharp surge in institutional interest. As mentioned in the introduction section, top institutional players like MicroStrategy and Marathon Digital have made huge $BTC purchases this month.

$MANA CEO recently noted that institutions are actively waiting to invest in Bitcoin. What this indicates is the confidence of institutional investors in the Bitcoin market has tremendously increased lately. Considering most of the sensational investments have come after Donald Trump’s victory in the US presidential election, the sharp price surge in $BTC post the election, creating new ATHs, have influenced institutional players’ interest in this leading digital asset positively.

MARA CEO @fgthiel on @CNBC: “I think what we’re going to see is essentially institutions just waiting to buy up #bitcoin." pic.twitter.com/sfmkABwkV7

— MARA (@MARAHoldings) November 26, 2024

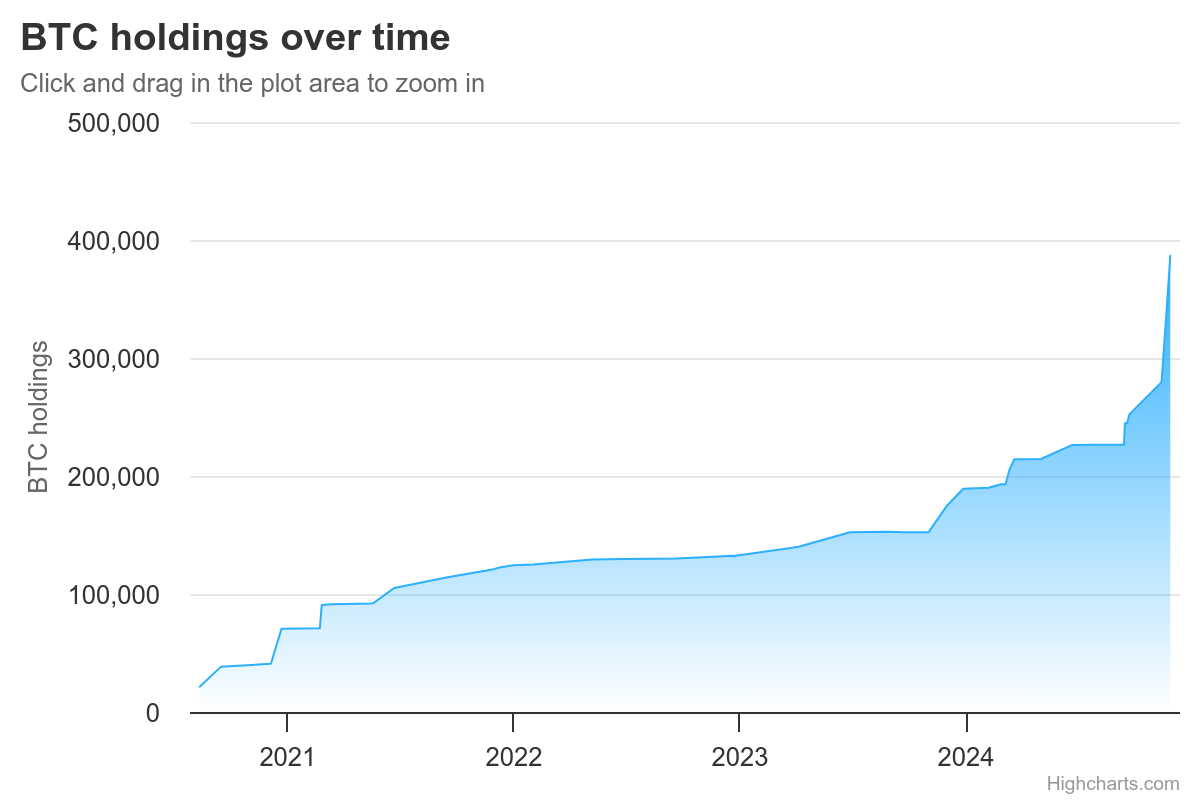

MicroStrategy’s Bold Bitcoin Purchases

Shedding light on the innovative strategy of MicroStrategy, Thiel pointed out that MSTR recently raised more than $3 billion through bonds to fund its Bitcoin purchases. As noted earlier, this month alone, MSTR has acquired over 134,480 $BTC tokens (27,200 $BTC on 11th Nov, 51,780 $BTC on 18th Nov, and 25th Nov on 55,500 $BTC). Notably, the year 2024 has been remarkable for MSTR as so far it has accumulated over 197,559 $BTC tokens.

The company’s first significant $BTC purchase of $12,000 occurred just before Bitcoin reached an $ATH of $73,000+ in mid-March. Notably, all the three purchases, which MicroStrategy has made this month, have come after the Bitcoin price crossed the previous $ATH on November 6. On November 11, the price was at $88,739.08, on Nov 18 at $90,528.02 and on Nov 25 at $93,012.66.

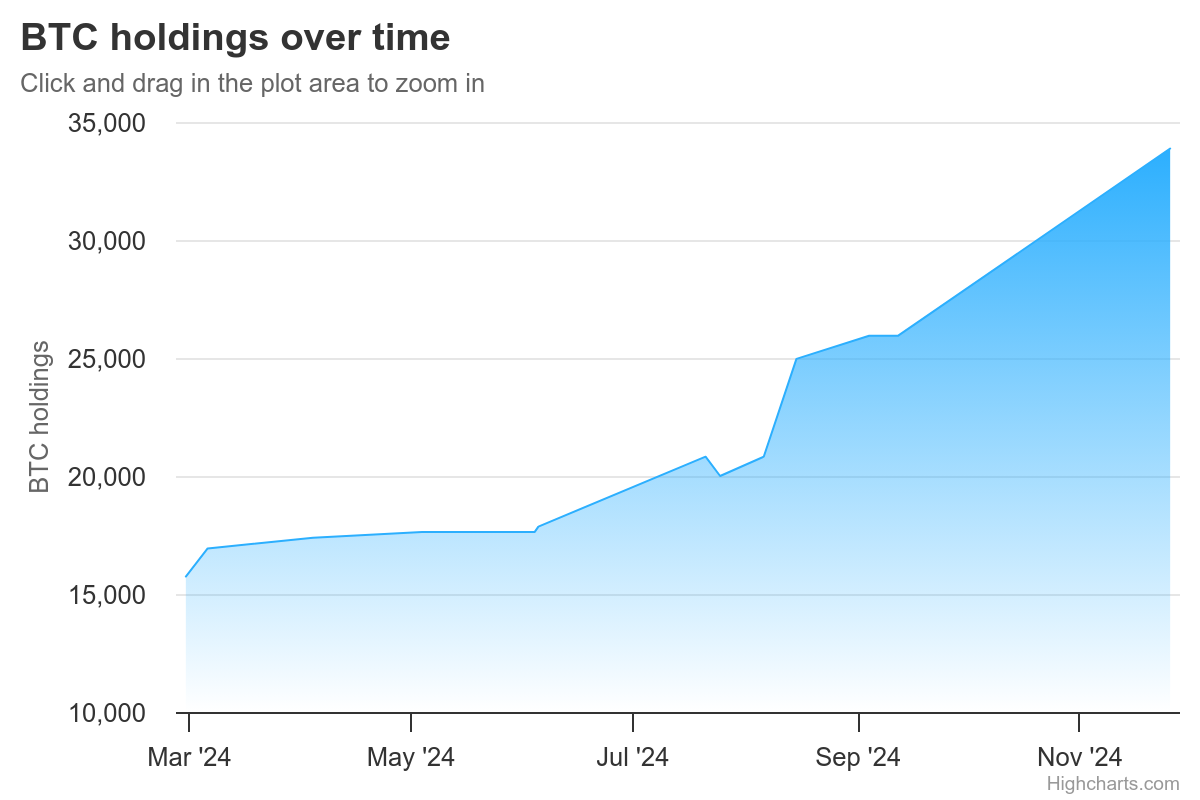

Marathon Digital’s Strategy in Action

Highlighting the resemblance of his company’s strategy with MicroStrategy’s, and also explaining how investment giants are leveraging low-cost capital to invest in Bitcoin, Thiel revealed that Marathon Digital raised at least 1 billion at a 0% coupon to acquire Bitcoin recently.

This month, Marathon Digital Holdings has raised its Bitcoin holdings from 25,945 $BTC to 33,875 $BTC, marking an impressive increase of at least 7,930 $BTC tokens. It was on February 29, 2024 that $MANA entered the $BTC market with a purchase of 15,741 $BTC. Before the mid-March $BTC price peak, the $MANA $BTC holdings had grown to 16,930 $BTC.

After the March Bitcoin peak, Marathon Digital Holdings have amassed over 16,945 $BTC tokens. The latest purchase of 7,930 $BTC is the largest it has ever made, and the August 15’s 4,144 $BTC is the second largest.

Bitcoin’s Future Price Movement

Though $MANA CEO acknowledged that the $BTC market may witness some price corrections in the future, he, emphasising how institutional purchases ensure consistent support for the Bitcoin market, asserted that the overall trend of the market would remain bullish.

In conclusion, Fred Thiel’s insights underline the growing role of institutional investment in shaping Bitcoin’s market dynamics.

coinpedia.org

coinpedia.org