Since November 21, Bitcoin (BTC) has hovered near the $100,000 mark but hasn’t hit it, with BeInCrypto attributing this to increased realized profits.

Recent data shows that profit-taking activity has slowed. What does this mean for Bitcoin’s price?

Bitcoin Holders Step Back from Booking Gains

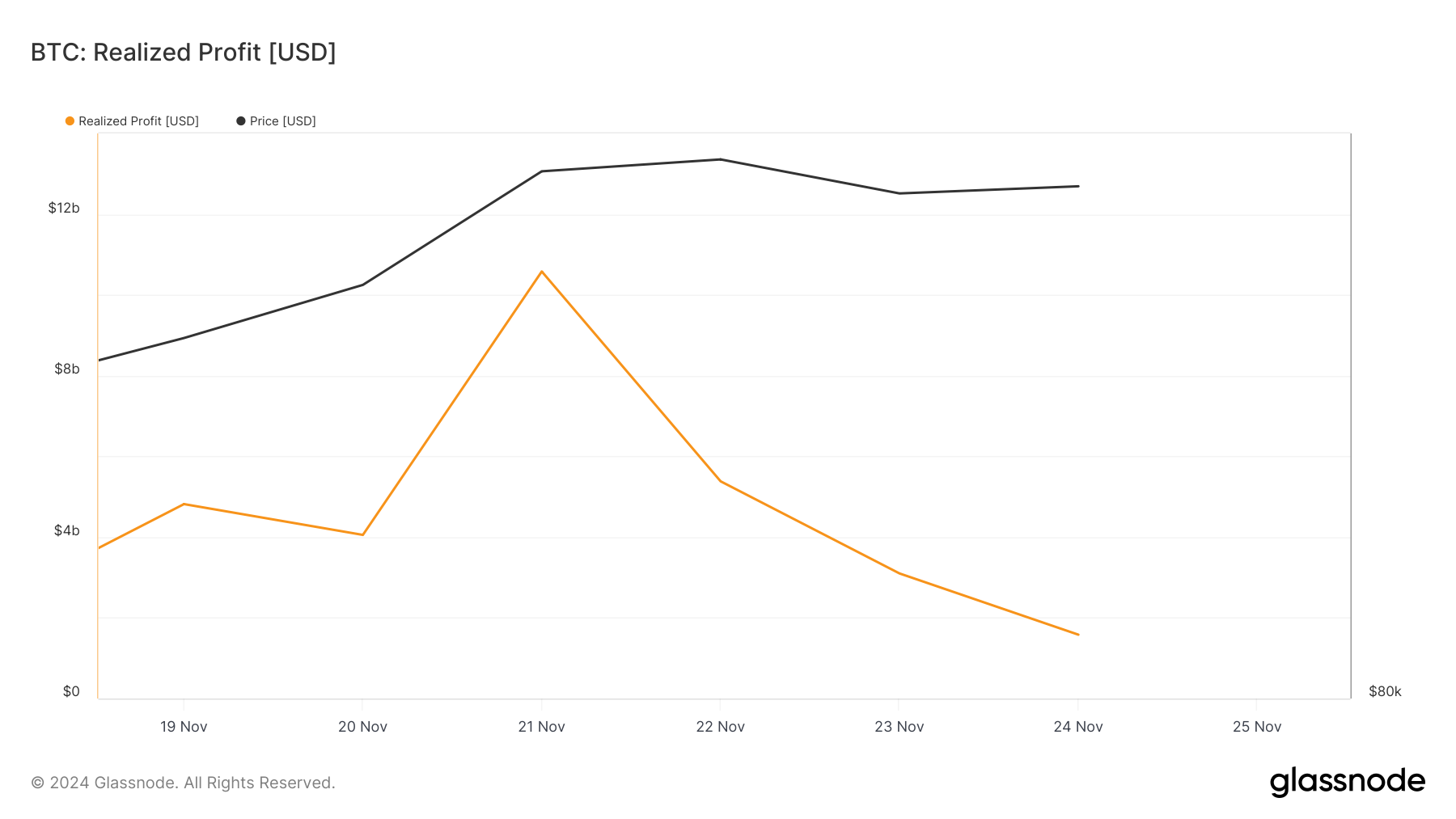

Data from Glassnode shows that Bitcoin realized profits surged to $10.58 million on Thursday, November 21. However, as of this writing, the value has dropped to $1.58 million, a $9 million difference.

As the name implies, realized profit is the value of coins sold after their price has increased. Therefore, when this metric rises, it becomes challenging for the cryptocurrency’s price to continue its rally.

However, since the realized profit has dropped, most BTC holders have halted selling in large volumes. If this trend continues, Bitcoin’s price could bounce and probably rise to the $100,000 milestone.

This sentiment is further supported by the Coins Holding Time metric, which tracks how long a cryptocurrency has been held without being transacted or sold.

When the Coins Holding Time decreases, it means holders of a particular crypto are selling. If this continues, the trend becomes bearish. However, over the last seven days, BTC Coins Holding Time has increased by 65%.

This increment reinforces the bias by the Bitcoin realized profit that selling pressure has decreased. Interestingly, IT Tech, an analyst on CryptoQuant, agrees with the thesis that Bitcoin might continue to climb.

“The green bars showing STH selling in profit have yet to reach levels seen during the previous $72,400 peak. This suggests that profit-taking pressure hasn’t peaked, leaving room for further upward movement in price,” IT Tech said.

BTC Price Prediction: $102, 500 Seems Close

On the daily chart, BTC continues to trade within an ascending channel, suggesting that it has the potential to climb higher.

BeInCrypto also observed that the Supetrend indicator has remained bullish. The Supertrend is a technical indicator used to spot the direction in which an asset moves.

If the red part of the indicator is above the price, the trend is downward, and the price can decrease. However, since the green area is below the price, the value might rise above $99,780. If that were the case, Bitcoin’s price might climb to $102,500.

On the other hand, if Bitcoin realized profits surge again, this might not happen. Instead, the value could decline to $84,466.

beincrypto.com

beincrypto.com