Bitcoin’s rally above the $95,000 mark triggered a strong phase of accumulation among retail investors.

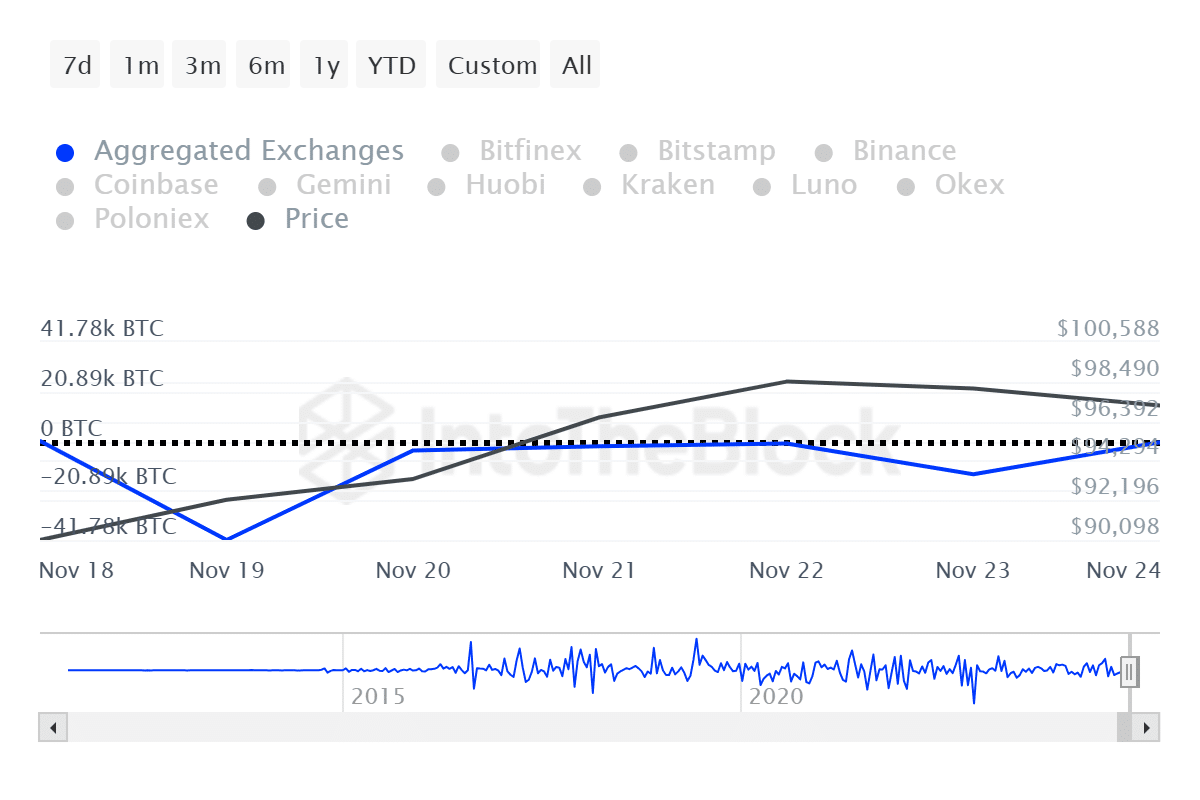

Bitcoin ($BTC) recorded an exchange net outflow of $6 billion over the last seven days — $3.9 billion on Nov. 19 alone — according to data provided by IntoTheBlock. The impressive accumulation wave sent Bitcoin to an all-time high of $99,655 on Nov. 23.

The $3.38 billion weekly net inflow into spot $BTC exchange-traded funds in the U.S. also played an important role in sending Bitcoin close to the $100,000 mark.

On the other hand, the whale activity around Bitcoin started to cool down before the price reached its ATH.

Data from ITB shows that large transactions consisting of at least $100,000 worth of $BTC fell from 32,000 to 19,500 between Nov. 21 and 24 — the volume plunged from $136.4 billion to $53.6 billion in the mentioned timeframe.

Last week, Bitcoin recorded a total of $243.67 billion in whale transactions.

The movements show that retail investors have been more active than large holders.

Despite the declining whale transactions, according to ITB data, the Bitcoin large holder net flow shifted from a net outflow of 9,190 $BTC to a net inflow of 4,090 $BTC on Sunday, Nov. 24.

The surge in whale accumulation could potentially trigger the fear of missing out among market participants. A surge above the $100,000 mark could potentially increase the buying pressure among both small and large Bitcoin holders.

Bitcoin has been consolidating close to the $98,000 zone in the past 24 hours. Its daily trading volume, however, saw a 27% surge, reaching $55 billion.

The global crypto market cap slipped 2.3% over the past day to $3.47 billion. Moreover, liquidations reached $494 million as Bitcoin’s fall below the $98,000 mark earlier today triggered a market-wide decline, majorly affecting small-cap altcoins.