The following is a guest post from Shane Neagle, Editor In Chief from The Tokenist.

Bitcoin pushed the financial innovation envelope in many directions. As a distributed digital ledger, it opened up space for transparency and offered a viable alternative to banking. Relying on its proof-of-work algorithm, Bitcoin established digital scarcity. Digital but still anchored to the physical world of hardware assets and energy requirements.

All this while being open-source. And Bitcoin’s open-source nature birthed over a hundred hard forks. These are ledgers governed under different rulesets, so much so that they are incompatible with previous blocks, resulting in a new blockchain version.

When a new hard fork is created, propelled by different visions of P2P money and incentives, a new version of Bitcoin is born. By market cap, the largest ones are Bitcoin Cash ($BCH), Bitcoin SV ($BSV), Bitcoin XT (BTCXT) and Bitcoin Gold (BTG). Although none of them come even close to the massive Bitcoin ($BTC) market cap of $1.47 trillion, they have injected many ideas that are relevant to Bitcoin’s future.

What Are Bitcoin Forks All About?

From the very onset of Bitcoin mainnet launch in January 2009, with the first mined genesis block, it became apparent that changes will have to take place to make Bitcoin A Peer-to-Peer Electronic Cash System as Satoshi Nakamoto originally intended.

For that kind of vision to work in the world of near-instant online payments, Bitcoin’s network would have to perform on par with Visa or Mastercard networks. The problem is, those networks rely on centralized databases (ledgers), such as VisaNet, emphasizing efficiency in transaction processing above all else.

After all, as a money intermediary between banks, Visa is not concerned with any kind of financial sovereignty, in contrast to Bitcoin’s vision.

But how would that be possible with a decentralized computer network? To remain so, each transaction has to be verified by other nodes to arrive at the proof-of-work consensus. Bitcoin’s current performance is around 7 transactions per second, as it takes 10 minutes to confirm each block stuffed with transactions (3,347 transactions per block at present).

There are several implications of this approach to ledger management:

- With the increase in transactions, Bitcoin transaction fees go up. Bitcoin miners inject this friction because they get to set the new level of fee priority in the available Bitcoin mempool space, as the demand for the Bitcoin mining network increases.

- If the popularity of Bitcoin increases transaction fees, it makes Bitcoin a poor substitute for “daily money” which ideally should have minimal friction to be adopted at mass scale.

- If the obvious solution of increasing transaction block sizes is implemented, the Bitcoin network would get more centralized because more computing and storage would be required to process transactions.

In other words, Bitcoin hard forks have been mainly concerned with the balancing act of block sizes. Case in point, when Mike Hearn launched Bitcoin XT as a fork of Bitcoin Core in August 2015, this version of Bitcoin was supposed to increase block size from 1 MB to eventually 8 MB, which could double further every two years.

If we take a look at other Bitcoin hard forks, we see a similar pattern of failure.

How Are Hard Forks Created?

Bitcoin hard forks are created by the introduction of new Bitcoin Improvement Proposals (BIPs). Alongside bug fixes, they are the staging ground for new features. However, those new features are implemented only if an activation threshold is reached, constituting ~95% miner support.

Effectively, the last 2,016 blocks (about two weeks of mining) would have to signal their support for a new BIP to be implemented.

When Mike Hearn and Gavin Anderson introduced their BIP 101 proposal to increase maximum block size, from 1 MB to 8 MB, it failed to pass the activation threshold. This caused some controversy as Hearn declared that “Bitcoin has failed”, but only his BIP 101 failed. The resulting hard fork, Bitcoin XT, is the aborted version.

Forks like these lead to new coins, unlike tokens – the latter of which are often created on pre-existing blockchains. In turn, it was Bitcoin Classic (BXC) that subsequently emerged from Bitcoin XT, as the block size was reverted from XT’s 8 MB to 2 MB. Once again, this showcases that Bitcoin hard forks manifest the balancing act of block sizes.

From these “block wars”, Bitcoin Cash ($BCH) also emerged in August 2017, having eventually increased block size to 32 MB. Out of all the hard fork, $BCH remains the most successful one, presently at a $7.26 billion market cap.

Even such moderately successful splits have their own forks. Australian entrepreneur Craig Wright introduced a $BCH fork called Bitcoin Satoshi Vision ($BSV) a year later, in November 2018. Claiming to be the person behind the pseudonym Satoshi Nakamoto, he was later revealed as a fraud in the UK High Court, having leveraged extensive forgery and lawfare tactics against critics.

Forged In the Crucible of Adversity

Given that Gavin Anderson was once a key member of Bitcoin Core, the primary framework for Bitcoin, it is fair to say that even failed BIP contributions in the form of hard forks serve their purpose.

Although Block Size Wars ended up on the side of “small blockers”, the contested debate did result in Segregated Witness (SegWit) implementation as a soft fork, having been activated at block 477,120 in August 2017.

Through BIPs 91, 141, and 148, SegWit made Bitcoin transactions more efficient by segregating witness metadata from the main transaction. This effectively increased the block size by introducing block weight, which allowed for 4x more transactions per block.

Most importantly, SegWit paved the road for Bitcoin’s own layer 2 scaling solution, Lightning Network, because it enabled Schnorr signatures. These not only make it possible to have Atomic Multi-Path Payments ($AMP) for LN, which splits large payments into tiny bits, but they minimize on-chain data footprint with more efficient, smaller signatures.

The $AMP feature also allows users to optimize payment routing through LN channels, as the payer only has to know the public key of the recipient. Ultimately, what started as a series of Bitcoin hard forks, with most failing to gain traction, facilitated another type of Bitcoin scaling.

The frictionless scaling enabled by LN, combined with smart contracts, may even lead to futures contracts indirectly, as they would require such speed and deeper liquidity. Even the Federal Reserve Bank of Cleveland recognized that Lightning Network gets Bitcoin closer to “daily money” in the paper titled The Lightning Network: Turning Bitcoin into Money.

“Our findings suggest that the off-chain netting benefits of the Lightning Network can help Bitcoin to scale and function better as a means of payment. Centralization of the Lightning Network does not appear to make it much more efficient, though it may increase the proportion of low fee transactions.”

In the payments arena, it may be likely that specialized hard forks could find their niche. There is always a need for online invoice factoring or obtaining trade credit for small to medium business (SMBs).

But the fact that Bitcoin remained with a conservative block size while adding LN as a scaling solution is not that surprising in hindsight.

Security Risks and Network Vulnerabilities

In the initial stages of Bitcoin’s development and adoption, as a major monetary novelty, it was vital to maintain a conservative approach. If the public is to perceive Bitcoin as sound money, it has to maintain core features, no pun intended.

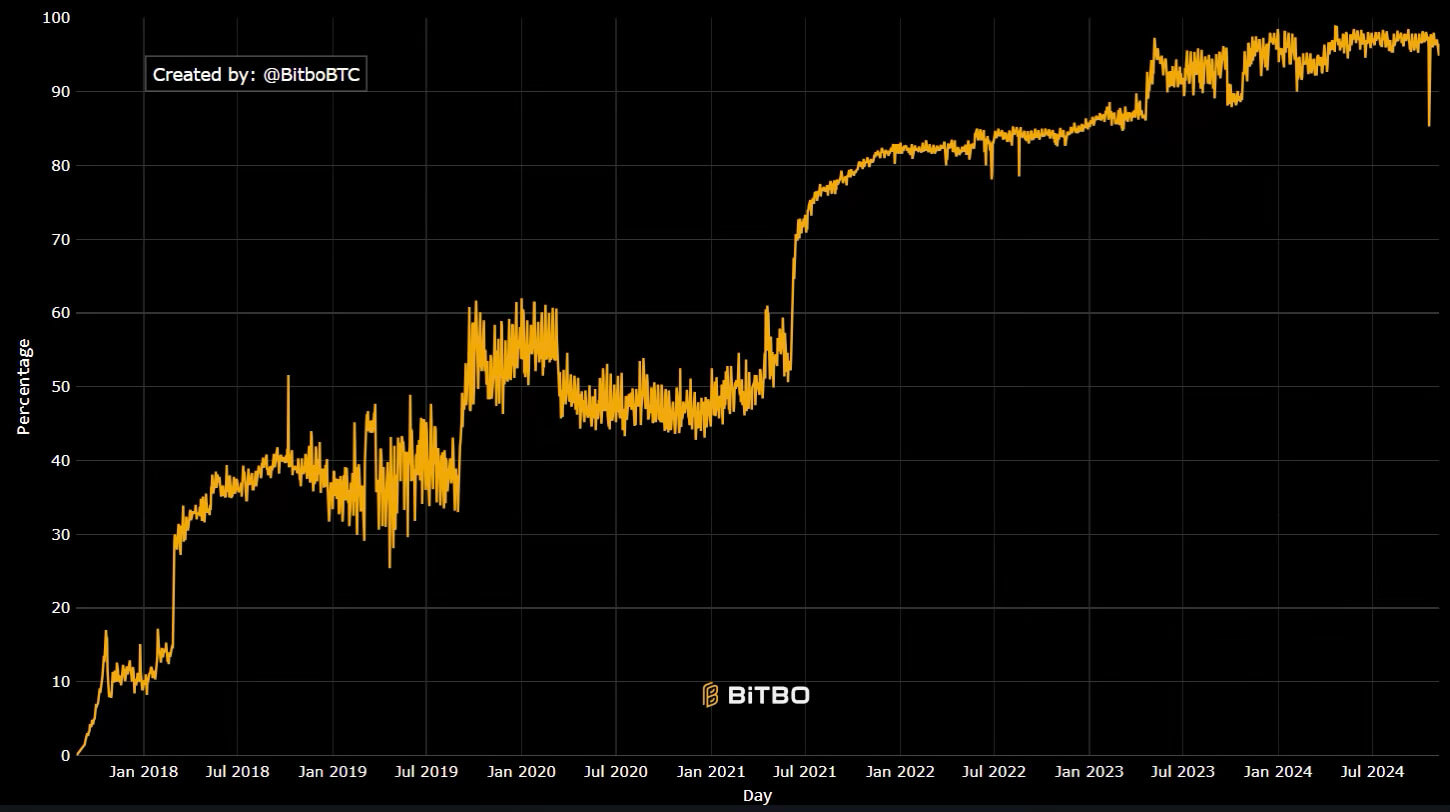

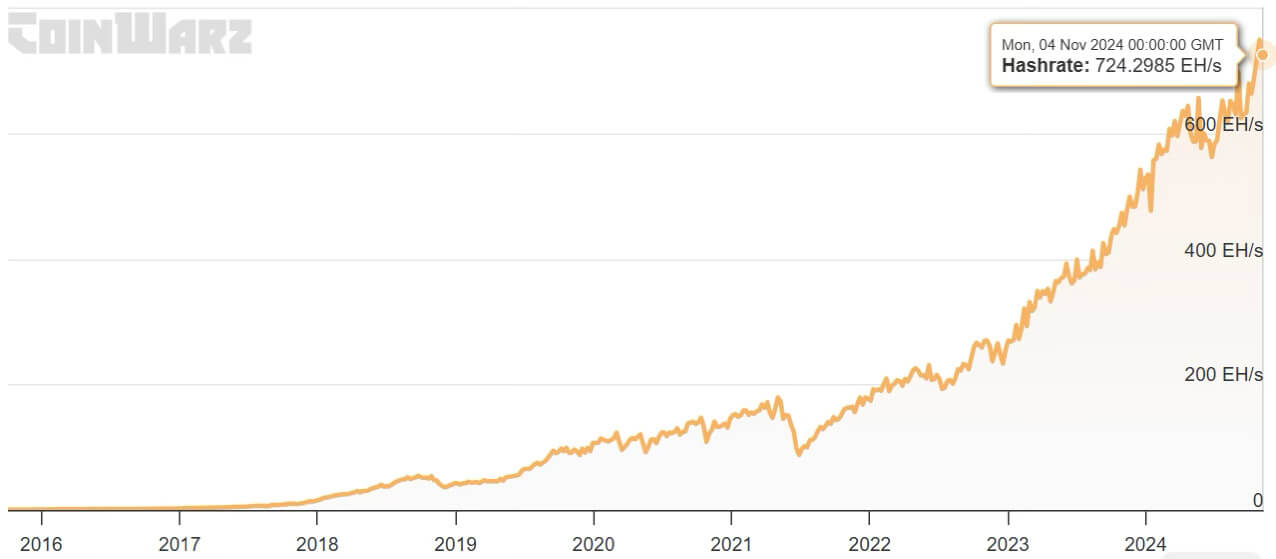

Inherently, by diluting the hash rate power, hard forks introduce a security vulnerability. The underlying value of Bitcoin comes from the mining network’s hash rate power. It is the measure of calculations needed for mining rigs to solve cryptographic puzzles and add a valid transaction block, in return for $BTC as block reward.

During this mining competition, those with higher hashrate have a greater chance to earn $BTC. And as more computing power is added to the network, Bitcoin’s network difficulty auto-adjusts every 2,016 blocks, or around two weeks.

Conversely, a drop in hash rate power would make it more likely for a 51% network attack attempt to succeed. A new hard fork would not only siphon away computing power, but this divergence and dilution would create a heightened state of risk during the new version rollout.

What this amounts to is that Bitcoin miners are biased toward network security over innovation.

After all, even if there is a single publicized instance of a successful hack of the Bitcoin network, this would serve as a value-deflating force in perpetuity. And if that happens, any innovation would take a back seat. Accordingly, the Bitcoin hashrate has only one trajectory – up.

At this point in time, Bitcoin mainnet’s computing power is so abundant that even a severe $BTC price drop would not represent a vulnerability. In such a scenario, it is possible that some mining operations could exit the network due to losses, thus ending up lowering the mining difficulty.

But due to prior conservative approach and bias toward security, the Bitcoin network would weather it.

Market Volatility and Investor Sentiment

Seven years ago, the aforementioned Bitcoin Cash ($BCH) had its all-time high price of $4,355, as the most successful hard fork launch. Having launched in August 2017, the peak happened at the end of that year. Following the fate of many altcoins, alongside Bitcoin SV, the pattern is familiar:

- Initial speculative boost.

- More distant, ever lower price peaks from the previous ones.

Notably, during the period of +$6 trillion M2 money supply boost by the Federal Reserve in 2020 and 2021, alongside stimulus checks, both hard forks mirrored that spike. But after the liquidity spigot was turned off with the beginning of the interest rate hiking cycle in March 2022, $BSV and $BCH returned to high risk-off territory.

This makes sense considering the following factors:

- In total, there is only so much capital to go around.

- There is even less capital in the crypto sphere.

- As digital monetary novelty, cryptocurrencies are perceived as riskier than stocks.

Consequently, the beneficiary of most capital would go to the original and most secure cryptocurrency – Bitcoin.

Conclusion

As this valuation pattern becomes more apparent, it is exceedingly unlikely that future Bitcoin hard forks, or existing ones, would gain traction over Bitcoin. In the eyes of investors, altcoins are juxtaposed against stocks which are based on companies with hard assets and earnings.

The original Bitcoin is the exception here, precisely because of its vast computing network that brings hard assets into play. Although hard forks attempted the same, they pale in comparison, which levels them with generic proof-of-stake altcoins.

Within that ecosystem, heavyweights like ethereum have become the center of capital gravity. At best, Bitcoin hard forks could receive a momentary price boost, due to their lower market caps compared to Bitcoin. This holds speculative potential for profit, but the same holds true for the altcoin ecosystem as a whole.

cryptoslate.com

cryptoslate.com