Here is yet another stab from Italy towards Bitcoin: the Consob Commissioner Federico Cornelli has urged savers to exercise maximum caution on the crypto.

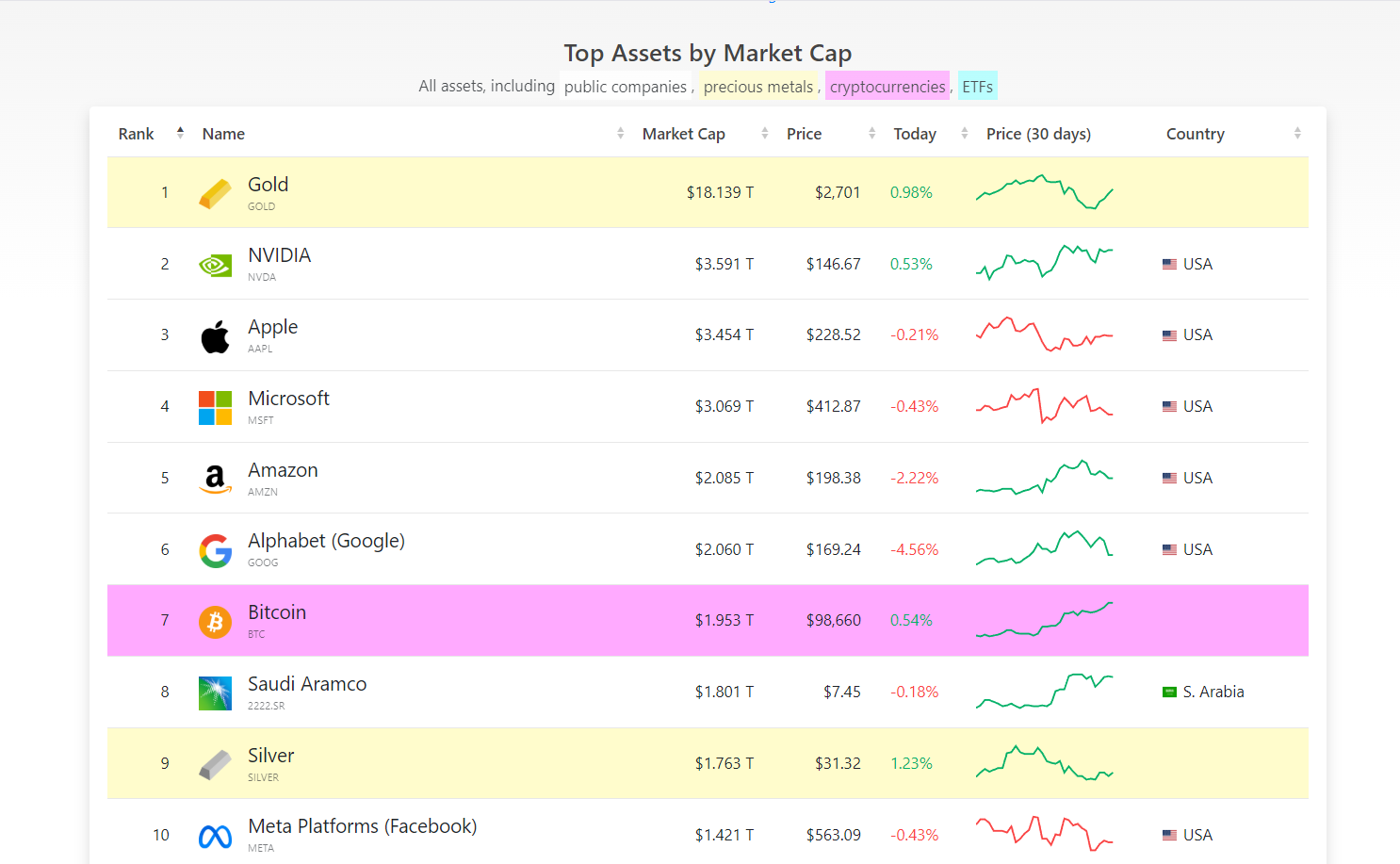

Under the 7th largest asset in the world by capitalization, according to the “brain” forged by the Bocconi path, there would be nothing solid.

Only speculation and activities still poorly regulated to which all of us should pay the utmost attention to avoid ending up with the match in hand.

Setting aside the chatter, however, Bitcoin responds with facts and marks further all-time highs close to 100,000 dollars, attracting worldwide media attention.

It is evident that these so-called Italian crypto experts cannot face reality.

Summary

Consob Commissioner raises alarm on Bitcoin: there is nothing solid underneath

Overseas, there are already those who see Bitcoin as an opportunity not to be missed. In Italy, however, there are those who continue to be skeptical, like Commissario Consob Cornelli.

The illustrious member of the market supervisory authority emphasized in a recent interview with Sole 24 Ore how cryptocurrencies are essentially without value.

Here is what was literally reported by Cornelli, resuming the speech made by Consob President Savona on the risks of cripto-attività:

“It must always be remembered that these instruments are highly, extremely speculative: there is nothing underneath, as President Savona has already said, there is no debtor.”

The Commissario has invited all savers in Italy to pay maximum attention to Bitcoin and other speculative products.

From the Consob research, it has emerged that many young people in Italy have Bitcoin and other cryptos as their preferred asset class.

Put this way, it seems like a tragedy for the Bel Paese. It’s a pity that these young people are trying to find new earning opportunities in such a toxic job market context.

Not to mention the fact that as of today cryptocurrencies are not yet properly regulated, despite the prompt regulatory intervention by institutions in Italy.

Cornelli concludes his speech with a provocation:

“if anything should happen with these instruments, no one should go to the authorities or governments to be reimbursed”.

Rightly, it is outrageous to ask for investor protection in Italy, especially where a stifling 42% tax on capital gains has been proposed.

In short, Italy demands substantial bribes on the profits of crypto investors, but at the same time offers no service capable of supporting blockchain innovation.

We can only say “CHAPEAU” to Cornelli and to Consob.

Boomers in Italy do not trust Bitcoin: but the numbers speak clearly

The skepticism in Italia about Bitcoin does not come only from Consob, but generally from the entire category of boomer who govern this country (in disarray).

In 14 years of history, Bitcoin has demonstrated on 11 occasions to be the most performing asset in the WORLD, above the big numbers of players like Nvidia, Amazon, Facebook, and Alphabet.

Bitcoin is worth almost 2 trillion dollars today and represents, as mentioned before, the 7th asset in the world by market capitalization.

Comparing it to Ferrari, the largest listed company in Italy, the queen of crypto is more than 26 times larger in terms of market cap.

Obviously, there is absolutely nothing under Bitcoin. It is truly strange that every day trades occur for 90 billion dollars in an asset that underlies the cosmic void.

It is also strange that US investors, objectively more intelligent than us, have made the ETFs on Bitcoin a tool with 105 billion dollars in NAV in just 1 year.

Really so bizarre that the same ETFs have outperformed what was done by the counterparts on gold in 2006, recording a significantly higher growth.

Satire aside, it is evident that the Italian boomer leaders just cannot face reality and admit the superiority of Bitcoin.

We are not talking about personal ideologies, nor subjective thoughts, but about data that objectively speak clearly and see Bitcoin as one of the best asset classes for performance.

However, there is no need to be surprised by the blindness of these people, the same ones who nowadays govern our country, making it increasingly subservient to foreign dominance.

The same people who from 2008 to today have contributed to the decline of the PIL, while other countries like Germany, Canada, and the USA are taking off.

Do not be fooled by the usual media bullismo to which unfortunately Bitcoin is subject in Italy.

To be clear, the target is clear: those who think that the only sensible investment is in “real estate”.

It’s up to you now to decide, regardless of your age, whether to side with opinions built on air or with real data.

ECB, Consob and Media: all against cryptocurrencies

We have become accustomed to making fools of ourselves in Italy over the years, but those made by Consob and other institutions far exceed our entire track record.

In the past, the supervisory authority has warned repeatedly about the instability of Bitcoin, comparing the asset to the well-known “tulip bubble”.

Now those people who listened to the advice of Consob find themselves having missed the easiest and most profitable train of their lives.

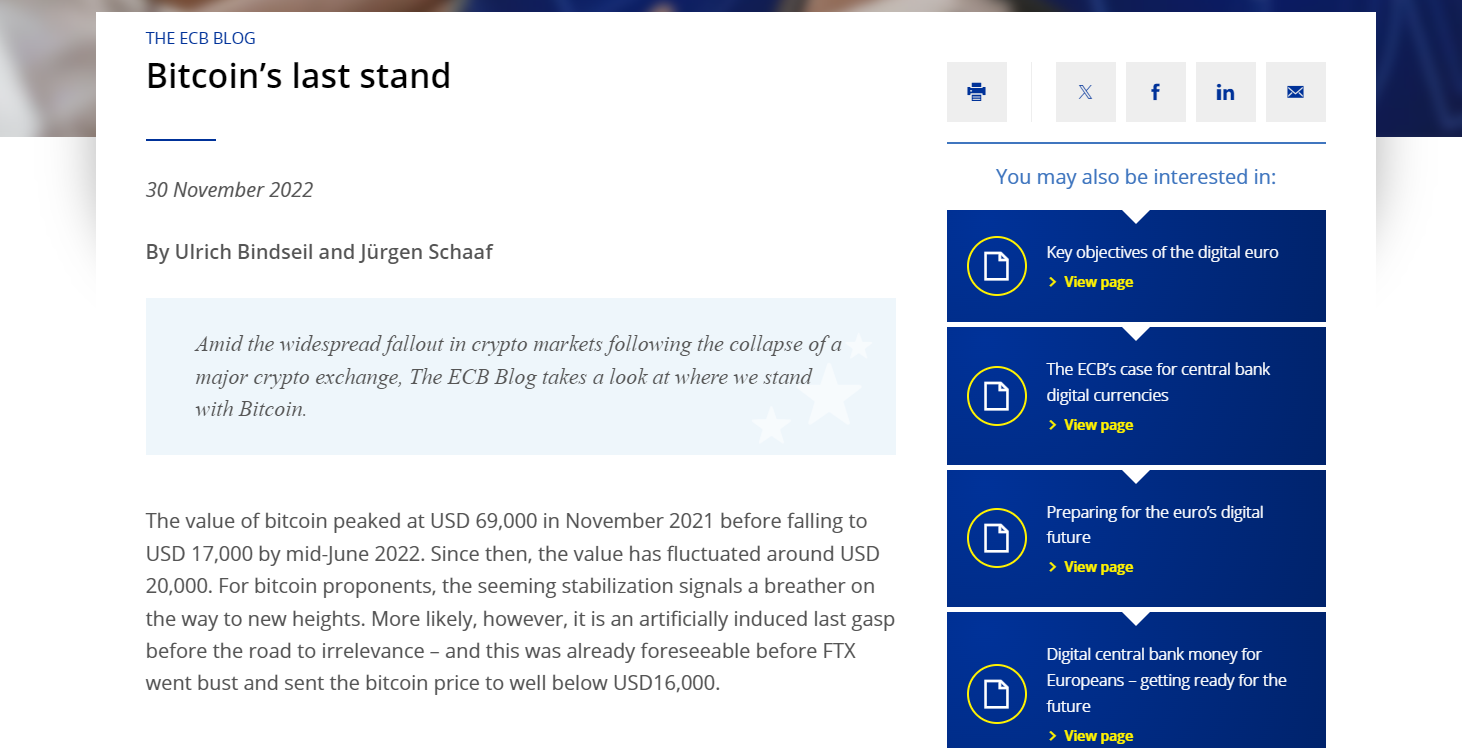

Even the ECB, a well-known European institution, has urged Italy and its neighbors not to invest in Bitcoin, given its strong volatile component.

In December 2022, just as Bitcoin reached the bottom at 15,000 dollars, the European Central Bank signaled the advent of the so-called “ultimo atto del Bitcoin”.

Today, that statement that implied a crash down to the zeroing of the value seems to have aged poorly.

The dislike towards Bitcoin in Italia does not come, however, only from professional entities (fortunately), but also from entertainment figures like Fiorello and Eleazaro Rossi.

The two comedians, who expressed their opinion on BTC and crypto, have obviously been chastised by time.

The legendary Eleazaro talked about cryptocurrencies in relation to fairies and mystical situations far from reality. Today, the reality is that Bitcoin is worth 1000 times the company that pays Eleazaro’s salary (Mediaset). Those who were able to distinguish poor comedy from investments now find themselves in one of the best fairy-tale scenarios for the profits they have made.

The great Fiorello, on the other hand, in one of his shows “Made in italy” talked about Bitcoin as something that: “today is at 40 thousand but tomorrow it could be worth 3 euros”.

Dear fiorello, from 3 euros to 100,000 dollars, however, there’s a big sea in between!

Mentre $BTC continua a scrivere la sua storia leggendaria, ecco una raccolta di epiche "perle" Made in Italy!

— Hard Rock Crypto (@hardrockcrypto) November 22, 2024

Non tenetele per voi, condividete e fate girare: certe chicche vanno celebrate!

0:00 Fiorello

1:02 Eleazaro Rossi

3:05 Luca Dann

18:36 Davide Serra pic.twitter.com/yemq0vkn9Q

en.cryptonomist.ch

en.cryptonomist.ch