Bitcoin is on the verge of reaching $100K. To many, this may seem like the ultimate milestone and it’s been one that investors have been looking forward to for a long time.

Technical Analysis

By Edris Derakhshi (TradingRage)

The Daily Chart

In terms of daily timeframe, it is evident that the price has been rapidly climbing since the beginning of November.

It has already broken past multiple resistance levels, including $90K.

Meanwhile, as the price approaches $100K, the Relative Strength Index (RSI) is showing a worrying signal, as the market is clearly overbought according to this oscillator. Therefore, significant volatility can be expected when the price reaches $100K, as it is the take-profit area for many short-term and long-term Bitcoin holders.

The 4-Hour Chart

The 4-hour chart clearly shows Bitcoin’s path toward $100K. A few days ago, the price was consolidating in a symmetrical triangle pattern, but it has finally broken the level to the upside.

Unlike the daily chart, the RSI is just entering the overbought region in the 4-hour timeframe, and there’s seemingly more upside to be expected in the short term.

Therefore, the market might even go beyond $100K before experiencing any significant correction.

Sentiment Analysis

By Edris Derakhshi (TradingRage)

Funding Rates

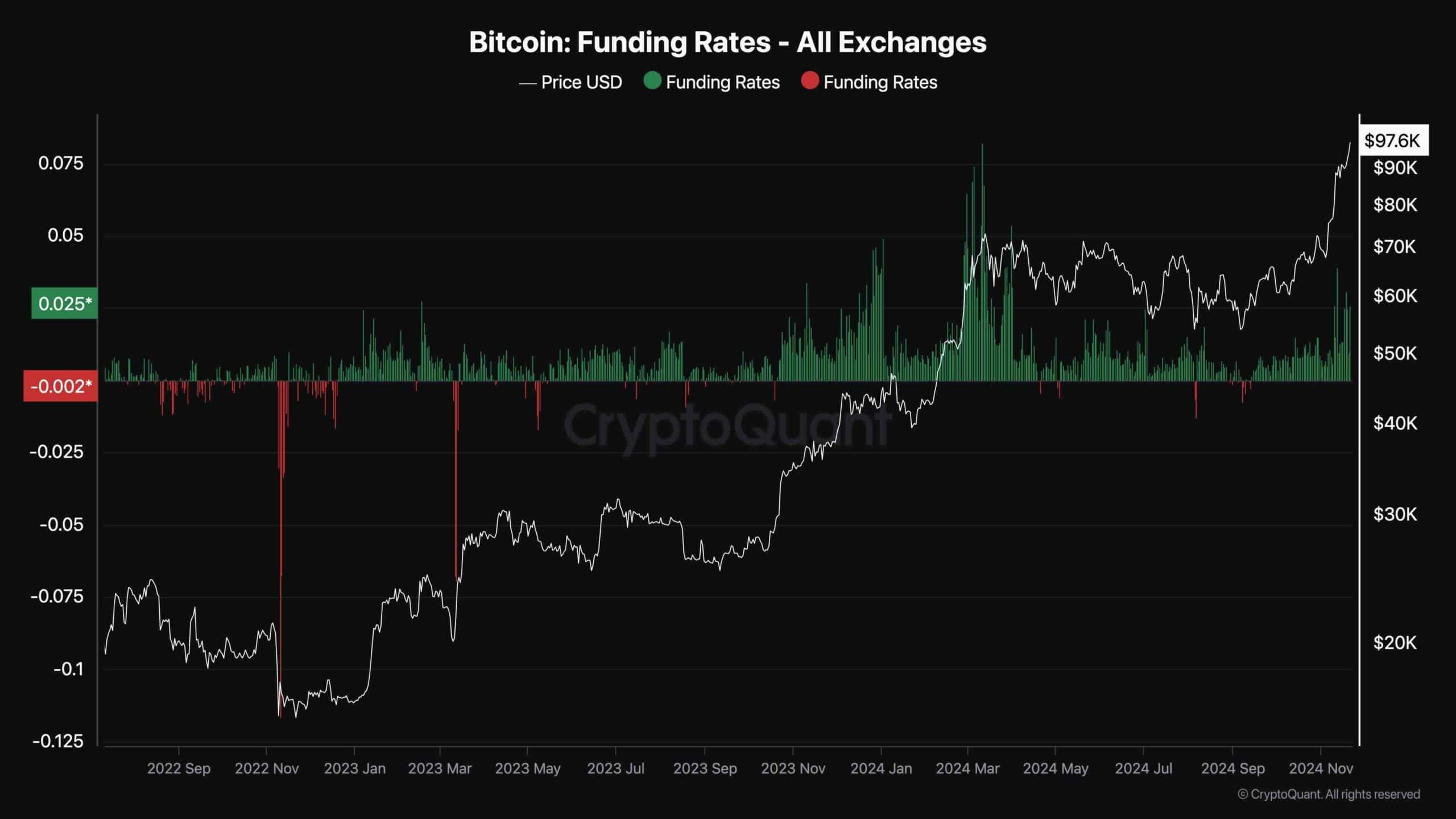

As Bitcoin’s price continues to rally and break past several resistance levels, investors are optimistic about the short term. This is evident in the funding rates chart, which measures futures market sentiment.

Funding rates indicate whether the buyers or the sellers are dominant in aggressive buying or selling in the futures market. Positive values are interpreted as bullish sentiment, while negative values show fear and bearish sentiment.

As the chart suggests, funding rates are rising significantly compared to the past few months. However, they have yet to reach the values seen during the last all-time high of $74K earlier this year. Therefore, while funding rate spikes can always lead to sudden crashes due to long-liquidation cascades, it seems that there is still room to grow for both price and market sentiment.

cryptopotato.com

cryptopotato.com