According to what was reported late yesterday by Bloomberg, the Nasdaq could very soon list options on spot Bitcoin ETFs.

After the SEC’s approval, only the authorization from the Options Clearing Corporation is missing, which could even open trading on BlackRock’s IBIT as early as today.

The quotation of this new instrument on Bitcoin represents a crucial step for the maturation of the asset, becoming increasingly appealing on the institutional front.

As reported by the data from the Deribit exchange, there is a strong notional value for BTC at 100,000 dollars by the end of December.

Can you be more bullish than this? Let’s see all the details below

Summary

Approved Bitcoin options on Nasdaq: the US exchange plans the listing

After the arrival of the spot ETF Bitcoin in January, 2024 might also bring us the first options listed on Nasdaq based on the cryptocurrency.

Yesterday, Eric Balchunas, a Bloomberg analyst, stated that only a few hours remain before the American stock exchange opens for trading.

With the SEC having approved the investment instrument on September 20, now only the authorization from the Options Clearing Corporation is missing

The equity derivatives clearinghouse has indeed clearly stated that it is completing the final paperwork before the official listing of Bitcoin options.

In a memo published yesterday, we read verbatim:

“The OCC is preparing for clearing, settlement, and risk management.”

For those who do not know, options allow investors to buy or sell an underlying asset at a predetermined price within a specified period of time.

Initially, only Bitcoin options will be launched on IBIT by BlackRock, being the only spot crypto ETF available on Nasdaq.

As for the other 11 spot ETFs present on other exchanges like NYSE and CBOE, the approval should come as a direct consequence.

James Seyffart, ETF analyst at Bloomberg Intelligence, began his comments on the good news as follows:

“It is likely that these things will start to be traded this week, potentially within a day or two. As far as we know, all regulatory and bureaucratic hurdles have been overcome.”

By now it’s only a matter of time: Alison Hennessy, head of ETP Listing at Nasdaq, said that Bitcoin options could arrive even today!

The intention of the Nasdaq is to open trading for the new instrument during the day, as the approval process is relatively quick

Nasdaq Head of ETP Listings Alison Hennessy discusses the iShares Bitcoin Trust ETF (IBIT) and tells @EricBalchunas the intent is to list and trade Bitcoin ETF options "as early as tomorrow" https://t.co/smCYb7696B pic.twitter.com/rqEa8SrtYj

— Bloomberg Crypto (@crypto) November 18, 2024

The market is experiencing a significant shift, with “bull” and “bear” trends influencing investor decisions.

Bitcoin spot ETF and the impact of new negotiations on institutional investment flows

It is believed that the arrival of Bitcoin options on IBIT at Nasdaq could trigger new institutional demand, pushing the price of the cryptocurrency upwards.

Since January, spot ETF investment instruments have generated inflows of about 48 billion dollars, with approximately 60% coming from BlackRock’s asset.

Currently, the exchange-traded funds are valued at 95.93 billion dollars in Total Net Asset.

With Bitcoin close to $92,000, the situation becomes even more interesting given the clear cognitive bias bullish of the traders.

The new professional trading model might not be any less and could generate significant volumes.

Thanks to the arrival of Bitcoin options, it further strengthens its reputation on Wall Street, increasingly appearing as a regulated and safe asset to trade.

The same Alison Hennessy from Nasdaq reported that she expects a strong wave of interest soon:

“I think that listing these options on IBIT on the market will be very exciting for investors because it is exactly what we have heard from them.”

Options are a particularly attractive tool for professional traders, as they allow for executing complex leveraged directional bets.

Generally, options are composed of call and put, and they offer the right (not the obligation) to buy or sell an asset at a specific expiration.

They are an excellent means for making deals in the market as they allow for accurately predicting what the maximum loss/gain will be.

Additionally, they offer the possibility to hedge against potential scenarios, serving for example as hedging against spot positions with a larger size.

We will see what the feeling of investors at Nasdaq will be with the first trades on IBIT.

The data from the Deribit options market: BTC at 100K by the end of the year

Given the bull atmosphere at Nasdaq following the latest news, we cannot overlook the Bitcoin options market on Deribit.

According to investors’ bets, Bitcoin is expected to reach price levels above 90,000 dollars by the end of the year.

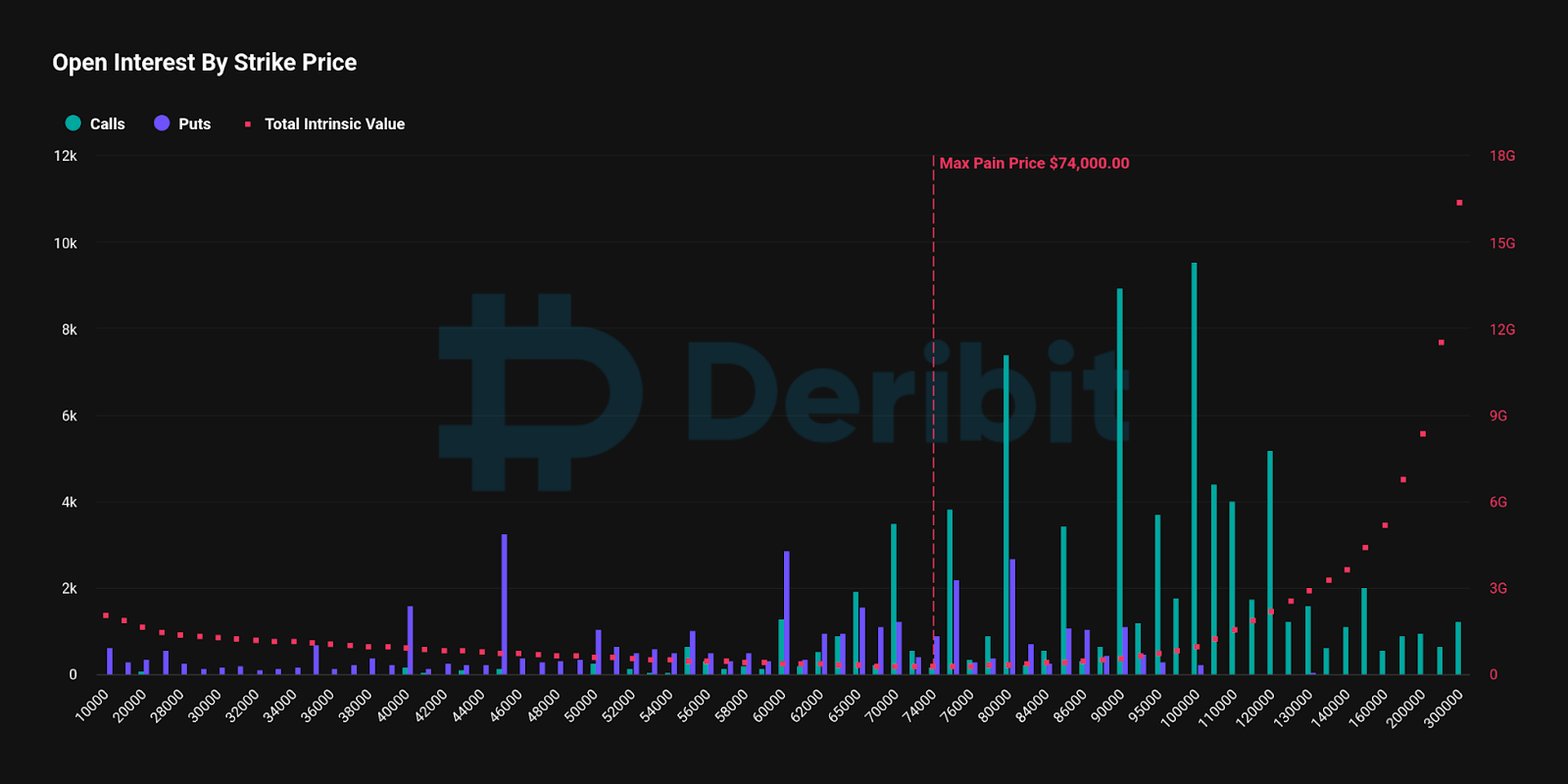

Observing the histogram of the open interest by strike price expiring on December 27, 2024, the predominance of call bets is evident.

In particular, we see 82,000 calls against 40,000 puts, for a total notional value of 11.2 billion dollars.

The most watched value is obviously that of 100,000 dollars, a psychological threshold that will likely determine the price action of the crypto in the coming months.

The traders have bet 878 million dollars that Bitcoin will be above that price level on the set date, providing an important signal for the speculative analysis of the asset.

There are even those who expect a higher price at 120,000 dollars, with 477 million dollars in calls.

Few and with low volumetric value, on the other hand, are the put bets, with the most substantial ones ranging between 60,000 and 80,000 dollars.

The max pain price is 74,000 dollars.

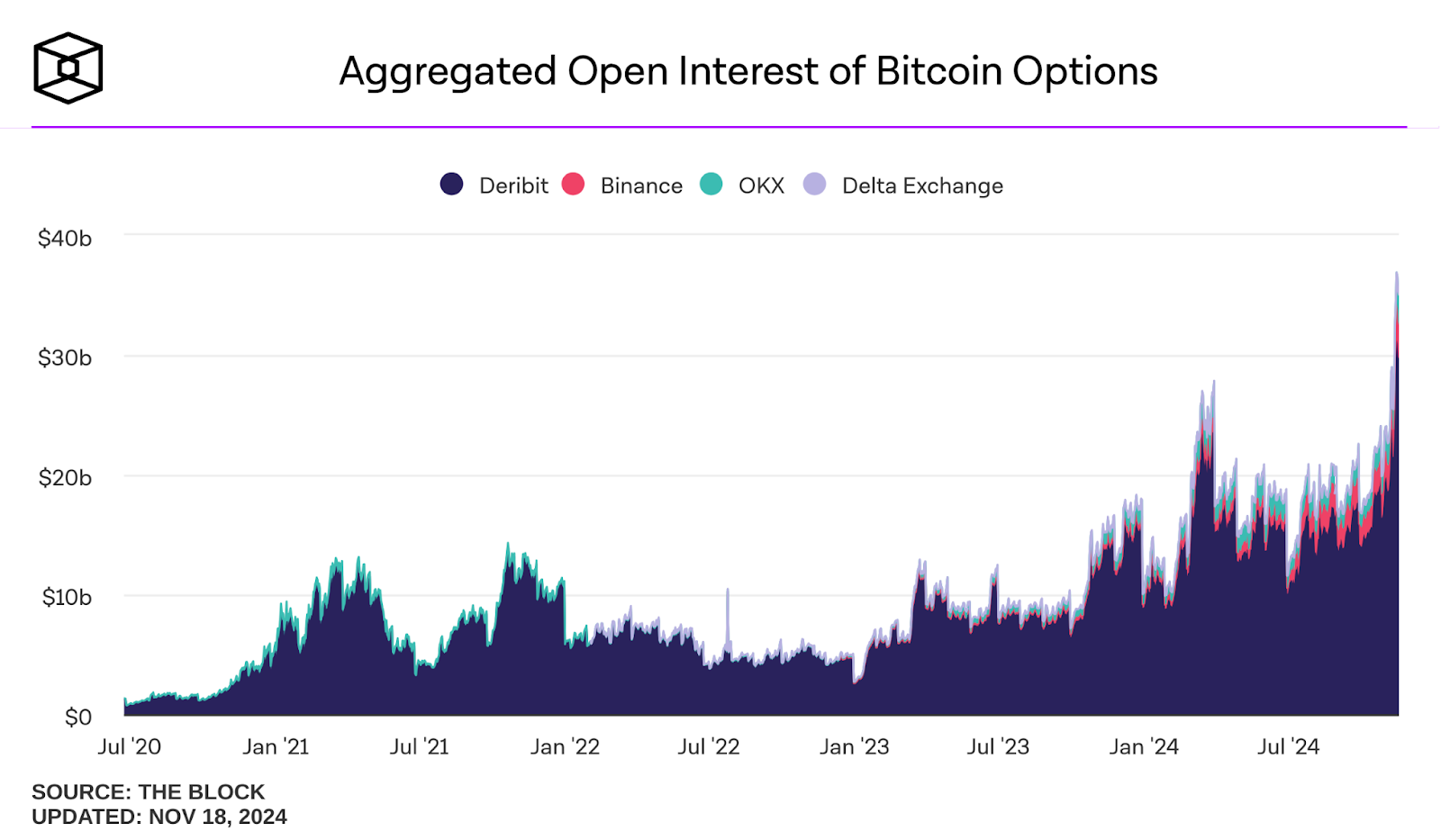

For those who are not aware, Deribit is the largest crypto options exchange with a market share of 84% on trades.

Consider that currently the aggregate open interest of this market is 29.6 billion dollars, against the 35 billion of the entire options sector.

Only the launch of options on IBIT at Nasdaq could throw a wrench in the works of this exchange and “steal” investment capital. It will be very interesting to see how trading dynamics will change in the coming days and which exchanges they will favor.

en.cryptonomist.ch

en.cryptonomist.ch