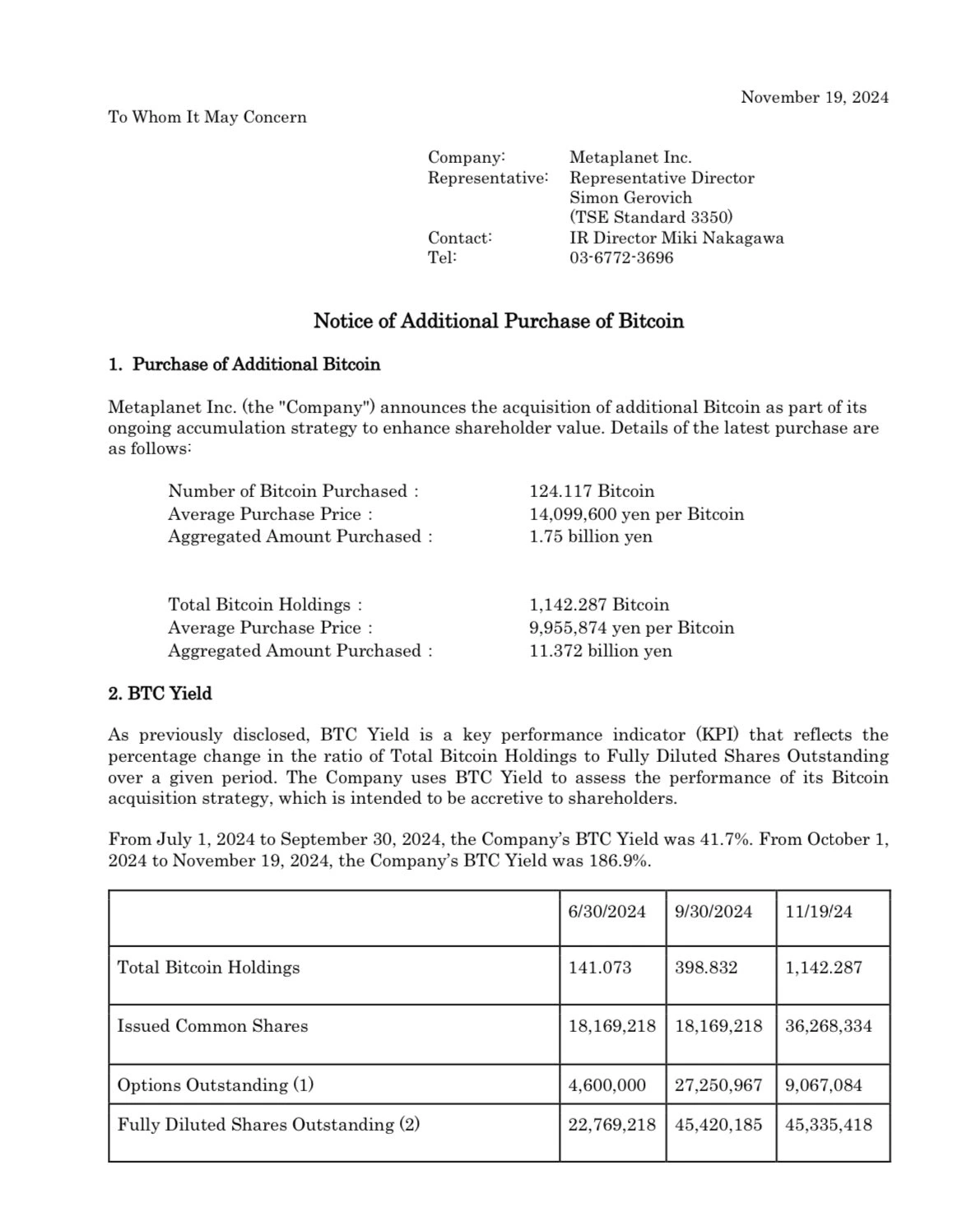

Metaplanet Inc., a Tokyo-listed investment firm, has made another bold move in its Bitcoin acquisition strategy, purchasing 124.117 BTC for ¥1.75 billion (approximately $11.3 million). This purchase pushes the company’s total Bitcoin holdings to 1,142.287 BTC, solidifying its reputation as one of Asia’s leading corporate Bitcoin holders. The investment is part of Metaplanet’s ongoing commitment to adopting Bitcoin as a core treasury reserve asset.

The disclosed document provides a transparent breakdown of the purchase, including an average acquisition cost of ¥9.96 million per Bitcoin. Such clarity underscores Metaplanet’s dedication to building confidence among stakeholders and reinforcing the strategic importance of its Bitcoin-first treasury approach.

Metaplanet funded this acquisition through a ¥1.75 billion bond issuance, featuring an annual interest rate of 0.36% and a maturity date of November 2025. The exclusive allocation of these funds to Bitcoin demonstrates the company’s focused financial planning. This strategy has been in place since April 2024, inspired by MicroStrategy’s cryptocurrency playbook.

Advertisement

The results speak volumes. Since adopting its Bitcoin-centric strategy, Metaplanet’s stock has surged by 950 percent, showcasing investor confidence in its ability to leverage Bitcoin as a long-term value driver.

A unique metric employed by Metaplanet is BTC Yield, which measures the growth of Bitcoin holdings relative to fully diluted shares. Between October 1 and November 19, 2024, the company’s BTC Yield surged to 186.9 percent, up from 41.7 percent in the previous quarter. This significant increase highlights the positive impact of Bitcoin acquisitions on shareholder value and emphasizes the company’s effectiveness in executing its strategy.

A Model for Future Bitcoin Adopters

Metaplanet’s achievement of surpassing 1,000 BTC reflects more than just a milestone in cryptocurrency holdings. It marks a pivotal shift in corporate treasury strategies, with Bitcoin being treated as a strategic reserve asset. By using bonds to fund acquisitions and maintaining transparency in its operations, the company sets an example for other firms exploring the integration of Bitcoin into their financial frameworks.

For crypto-savvy audiences, Metaplanet’s success underscores the growing role of Bitcoin in traditional finance, serving as both a store of value and a tool for corporate growth. The company’s journey is a testament to the increasing mainstream acceptance of digital assets.

Advertisement

cryptonewsz.com

cryptonewsz.com