Bitcoin (BTC) saw early-week gains erased at the Nov. 18 Wall Street open as a liquidity hunt targeted late long positions.

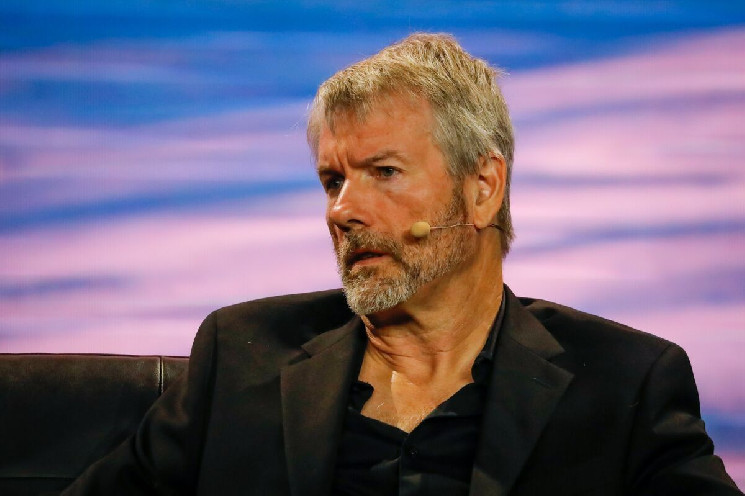

BTC price reacts to MicroStrategy’s major purchase

Data from Cointelegraph Markets Pro and TradingView showed a 3% drop in BTC price, pushing BTC/USD below its weekly close.

This weekly close had been Bitcoin’s highest ever, but news of MicroStrategy acquiring $4.6 billion in BTC over the past week seemed to dampen sentiment.

“Usually we get a short-term dump on Saylor’s buy announcements as it explains a lot of the buying that was done,” trader Daan Crypto Trades commented on X.

BTC/USD had reached a new all-time high near $93,500 on Nov. 13, before volatility took over, with intraday lows dipping below $87,000.

“Nothing changed with BTC,” stated trader Josh Rager.

“Bitcoin is just ranging and is very healthy after a 40% move up in just over a week. In the meantime, let altcoins/memecoins fly and find price discovery. Current market win-win for the entire crypto industry.”

Traders eye deeper retracement opportunities

Some analysts speculated on a more significant BTC price retracement, with dip-buying targets extending toward $70,000.

“Bitcoin dips are still ready to be bought,” said trader Michaël van de Poppe.

“I think we’ll see a substantial dip across markets in the coming 1-2 weeks, but for now, enjoy the upward ride.”

Opportunists struggle as support is retested

As Bitcoin dipped below $90,000, liquidity shifted, with short positions increasing.

“A lot of shorts just opened here into price & still chasing ~2K+ BTC in shorts. Some minor long capitulation as well on that move,” noted trader Skew.

Data from CoinGlass indicated 24-hour BTC-long liquidations stood at approximately $35 million at the time of writing.