On Sunday, Nov. 17, at block height 870,770, a long-inactive bitcoin wallet—created on June 5, 2012—sprang to life, moving 400 $BTC valued at $35.7 million. The individual behind the transaction might be the same entity that transferred bitcoin acquired in 2011 and 2012 just last month.

2012 Legacy Wallet Moves $35.7M, 200 Bitcoin to Bitstamp, Echoing Similar Transfers Last Month

Onchain data from btcparser.com revealed an awakening: a dormant bitcoin wallet from 2012 stirred to life on Sun., Nov. 17, around 4:30 p.m. Eastern Time, moving 400 $BTC. These funds, first acquired on June 5, 2012, had rested in a legacy pay-to-public-key-hash (P2PKH) address. Back then, bitcoin traded for just $5.60, giving the 400 $BTC a value of only $2,240 at the time.

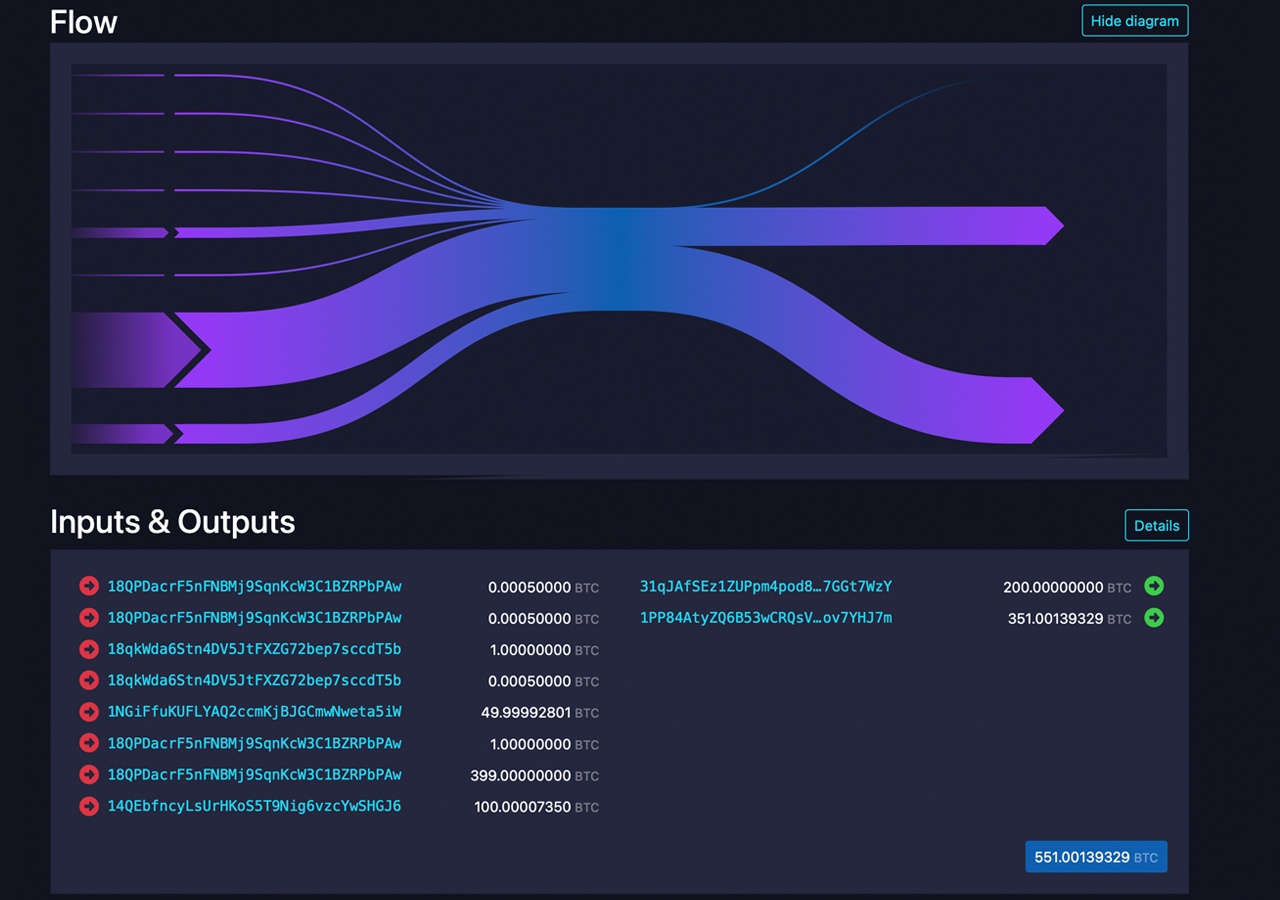

Fast forward 4,548 days to block height 870,770, and this stash made its first move. A clean-cut portion of 200 $BTC headed to centralized crypto exchange Bitstamp, which operates out of the U.K. and Luxembourg. Valued at $18.14 million, the coins were sent to a pay-to-script-hash (P2SH) address identified as belonging to Bitstamp. Meanwhile, the unspent transaction output (UTXO) change landed in a P2PKH wallet now holding 351 $BTC, worth $31.8 million at the time of writing.

The transaction left little to the imagination, earning a “critical” privacy score of zero out of 100 from Blockchair. Key privacy lapses included matched addresses and the use of a round number, tagging the entity as a likely match for the whale who shifted 399 $BTC on Oct. 25. Intriguingly, the October transaction also originated from a P2PKH address created on June 5, 2012.

On that earlier occasion, 100 $BTC made its way to the P2SH Bitstamp wallet. This same whale had previously moved coins from long-dormant bitcoin wallets established in 2011, continuing a pattern that has caught the crypto community’s attention. These movements shine a light on the unpredictable reawakening of dormant bitcoin wallets, sparking curiosity and intrigue.

After more than a decade of inactivity, such transactions lead to speculation about the intent—be it consolidation, cashing out, or an enigmatic strategy. They also remind us of the vast reservoirs of untouched bitcoin, each waiting for its own moment to resurface. According to timechainindex.com, there’s still approximately 47,786.76 $BTC in unspent 2011 coinbase rewards and 11,507.17 $BTC from 2012.

Similarly, bitbo.io data shows an estimated 11,109 unspent coinbase rewards from that year have not been spent. These figures suggest unspent 2012 rewards are dwindling. Recent patterns of activity may reflect a calculated plan, possibly influenced by market dynamics or personal milestones tied to these bitcoin movements.

news.bitcoin.com

news.bitcoin.com