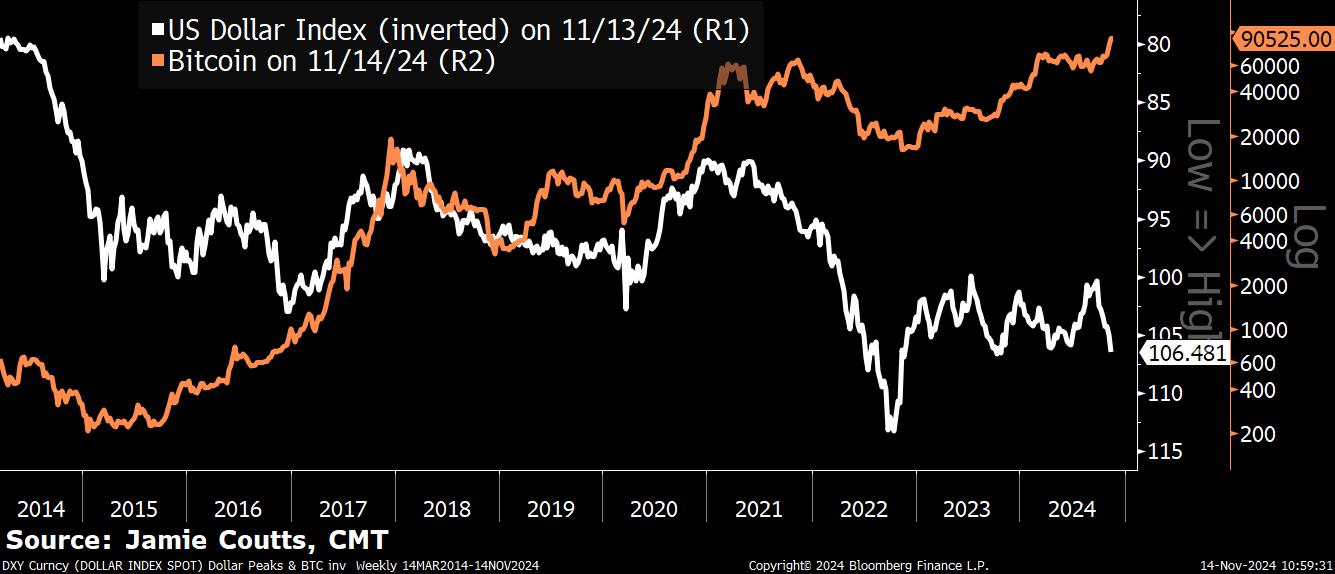

Real Vision’s head crypto analyst Jamie Coutts says that the US dollar is on the verge of foiling the rally for Bitcoin (BTC) and digital assets.

While the long-term bullish structure is still intact, Coutts says that a strong dollar is threatening to derail BTC’s movement in the short term.

“The macro backdrop has soured. Dollar strength is not good for Bitcoin. Ann Funding rates hit 40% 2 days ago. My liquidity framework is sensitive to the short to medium-term changes in momentum. In the long term, the picture is Bullish; in the Short term, they suggest caution.”

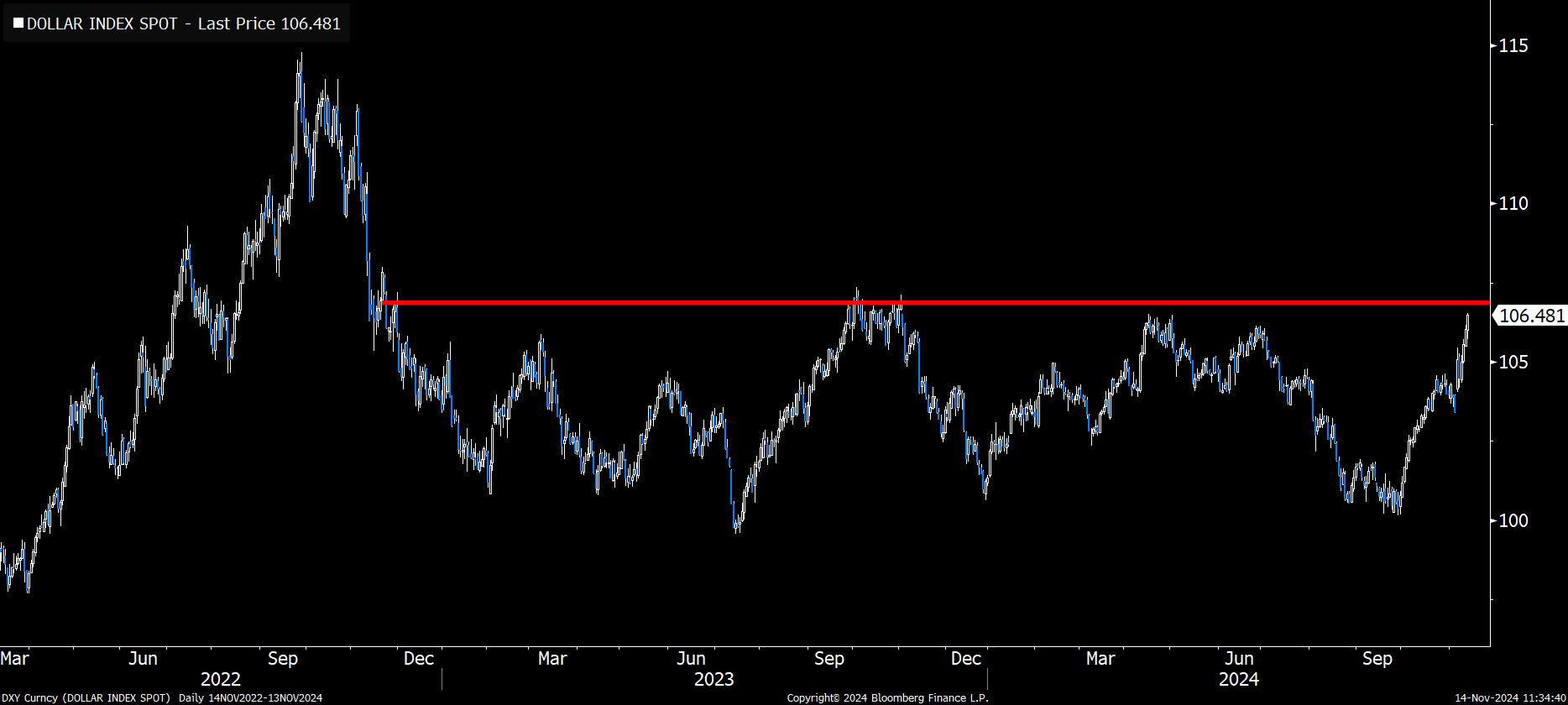

Zooming in on the dollar index (DXY), which pits the USD against a basket of other major foreign currencies, Coutts says it’s trading just below a critical resistance level at 106 that wouldn’t bode well for BTC if it breaks.

“DXY is right at the resistance level. A break above here would not be good for risk assets.”

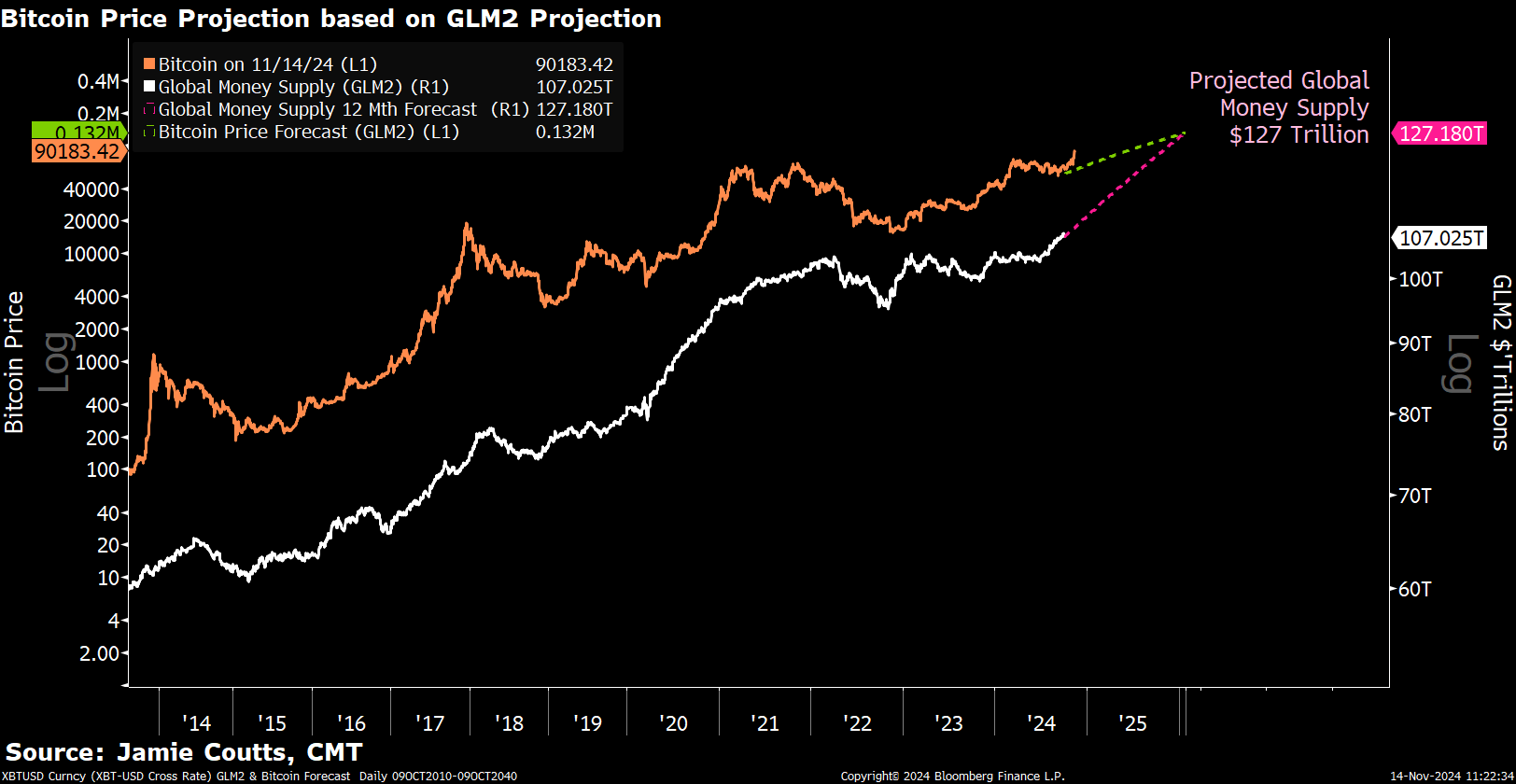

Over the longer term, Coutts believes there is a strong relationship between Bitcoin and global liquidity, or the amount of money sloshing around in the world’s economy. The analyst says that regardless of shorter-term volatility, BTC should continue to run higher over the next year or two along with a rise in M2 money supply.

“Longer term, this is where I am at for this cycle; a 12-month forecast based on linear relationship with liquidity. But Bitcoin cycles are not linear. I think we go much higher than this.”

At time of writing, Bitcoin is trading at $91,350.

Generated Image: DreamStudio

dailyhodl.com

dailyhodl.com