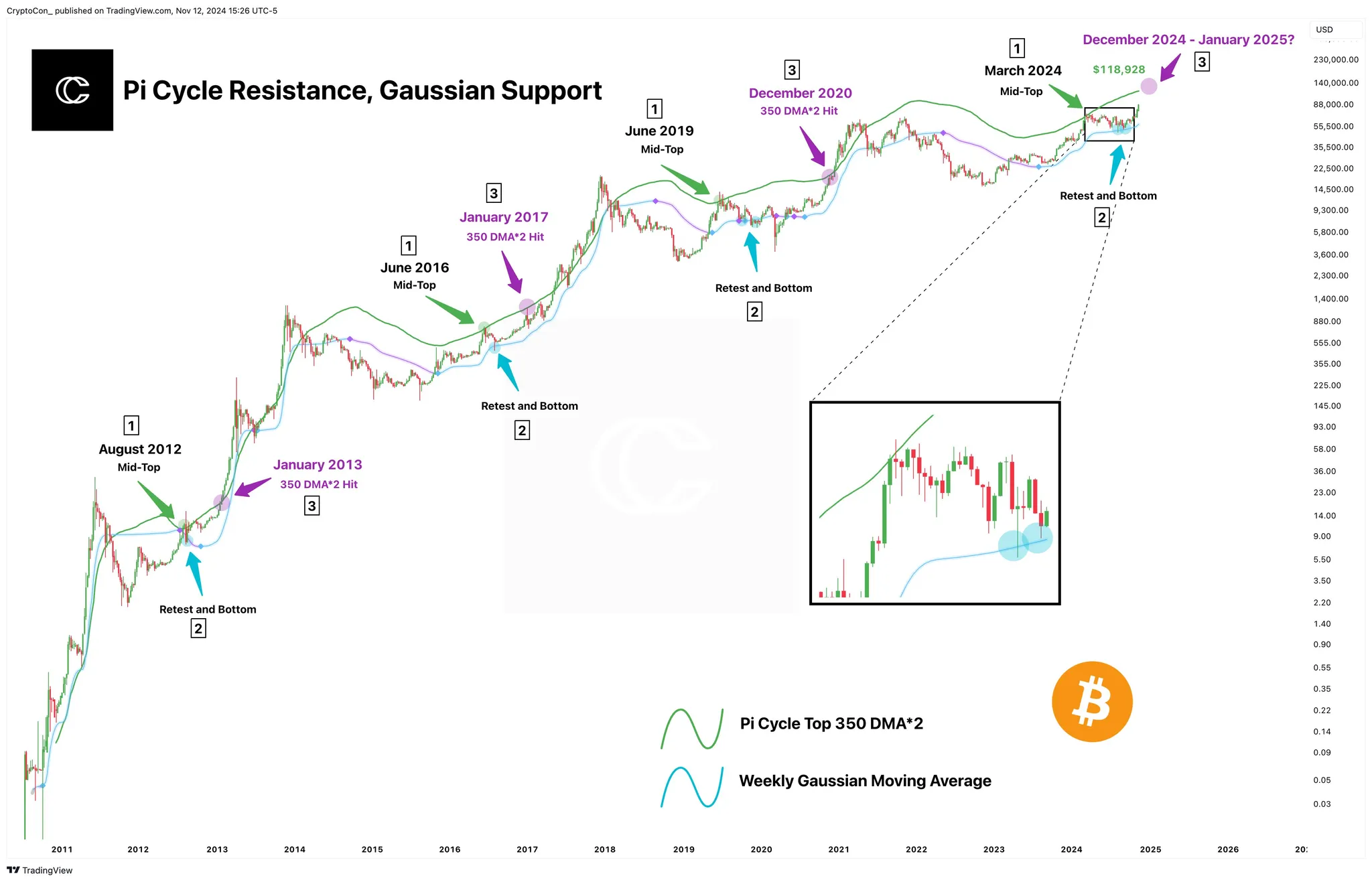

CryptoCon’s analysis stated that Bitcoin may rise as high as $118K based on historic cycles and following the Pi Cycle Top Indicator.

The prediction remained in harmony with the past mid-tops. More high Bitcoin patterns, which indicated that there is a high potential for upside going into 2025.

CryptoCon Sees Bitcoin Hitting $118K Amid Historic Cycle Patterns

CryptoCon’s post outlined a very promising outlook for Bitcoin based on the historical price cycles. Pi Cycle Top Indicator also suggests further growth for the cryptocurrency.

The estimation, based on the Pi Cycle Top 350 DMA 2 model, Bitcoin is likely to peak at $118,928 the rally after next.

This model suggests that this moving average line will be achieved in the December or January of ‘red years’ from which CryptoCon infers the price of Bitcoin will peak over the year or early next year.

He also notes that the recent price action of Bitcoin fits well within the framework of history, as past cycles formed a top midway and have always been successfully tested at Gaussian support before fulfilling full growth potential.

Such patterns were observed in a multitude of previous cycles. Most notable one was in June 2019 and January 2017. At the time, Bitcoin placed a mid-top and retested support, eventually increasing in price.

Looking back at these previous cycles, CryptoCon suggests that Bitcoin may be taking a similar route. This makes it possible for a sizeable upside in the price of the cryptocurrency.

The chart reinforces the projection that the anticipated target would be reached around December of 2024. There is incessant speculation that a new peak is set to emerge, consistent with Bitcoin’s cyclic history.

Bitcoin Holders Show Restraint Amid Price Rise, No Extreme Greed Yet

At the same time, analyst Ali studies the actions of Bitcoin’s long-term holders through the Net Unrealized Profit/Loss (NUPL) metric. It reflects investor sentiment based on unrealized profits or losses.

Despite the fact of an increase in the Bitcoin price, Ali states that the long-term holders are not showing any signs of ‘extreme greed’ at least for now.

Such a level of sentiment is typically one associated with a great number of sell-offs as well as market tops.

Ali’s findings suggest that in general, Bitcoin’s purportedly biased sentiment is located closer to the greed zone. This can be described as a cheerful mood without moving to the levels that would make some people want to sell out.

This means that long-term holders are still slowly optimistic. As a result, they are not active sellers, preventing a boom and bust that is more feasible.

It can be observed that throughout history the market would noticeably decline right after everyone got too greedy. But now the ‘greed’ that is observed should in effect be less of a concern as users are holding out.

BTC Weekly Spike Over 25% Signals Market Selling Pressure Ahead

In contrast, analyst Axel Adler Jr. notes the recent price increase of Bitcoin by more than 25% in the last week, which as a result has influenced a sell in the market.

According to Adler, losses are recorded on a percentage of Bitcoin over the one-week metric, but the one-week sample also indicates sharp growth.

It is common knowledge that the market was volatile whenever there were sharp weekly increases. There were great chances of the prices going through phases of consolidation or even corrections.

Adler, however, proposes that the price surge currently being witnessed may clean the market such that should the price surge again, a revival will be witnessed.

Adler’s chart displays Bitcoin’s price in USD. Blue markers indicate instances in the past when weekly price growth of more than 25% was recorded.

These spikes, observed at the beginning of 2021 and 2020, were regularly followed by aggressive selling pressure. Such phases of price contraction in the current market are upcoming ones.

thecoinrepublic.com

thecoinrepublic.com