Bitcoin spot ETFs experienced a dramatic surge in inflows on November 11, attracting a total of $1.11 billion, marking the second-largest single-day inflow on record since their launch. This increase comes as Bitcoin continues to reach unprecedented price levels, having broken new records on consecutive days since the previous week.

On Friday, when Bitcoin peaked at $77,252, Bitcoin ETFs saw their largest-ever single-day net inflow of $1.378 billion. This highlights a renewed interest in crypto asset investment products among traditional investors.

With Bitcoin reaching $89,604 on Monday, the momentum for Bitcoin ETFs remained strong, with $1.11 billion in inflows recorded on November 11.

BlackRock Leads with $4.65 Billion in Daily Turnover

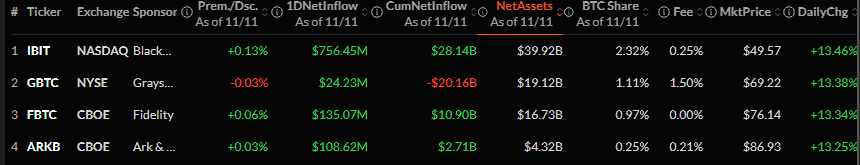

BlackRock’s IBIT ETF, listed on NASDAQ, led the inflows last Monday. It attracted $756.45 million that day. IBIT’s total inflows are now $28.14 billion. IBIT also set a new record because its daily turnover was $4.65 billion.

With net assets totaling $39.92 billion, IBIT now holds 2.32% of the total Bitcoin market share within U.S.-listed Bitcoin ETFs.

Other ETFs See Strong Inflows

Other Bitcoin ETFs also attracted large inflows. Fidelity’s FBTC, which trades on the CBOE, attracted $135.07 million last Monday. Its trading volume was $718.78 million. FBTC has $10.90 billion in total inflows, and its assets are $16.73 billion.

Meanwhile, Grayscale’s GBTC saw a smaller daily inflow of $24.23 million. Despite this, it remains one of the largest Bitcoin ETFs with $19.12 billion in net assets, although it has experienced a historically negative cumulative inflow of -$20.16 billion.

Because of this surge, the total inflows for all Bitcoin ETFs are $26.90 billion. On November 11th alone, the trading volume was $7.31 billion. The total assets in Bitcoin ETFs are now $90.60 billion.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

coinedition.com

coinedition.com