With a new all-time high formation at $81,888, the Bitcoin (BTC) price trend aims to cross $90,000 in this bull market.

With the crypto market reaching the $2.7 trillion mark, Bitcoin created a new all-time high near $82,000, resulting in a new altcoin season.

Currently, Bitcoin is trading at $80,878 with a market cap of $1.6 trillion. With a weekly increase of nearly 20%, BTC’s price trend teases a massive surge ahead.

Bitcoin Price Analysis

Looking at the daily chart, Bitcoin’s price action reveals a breakout from a falling channel, which acted as a flag pattern within the broader bull run of early 2024. Following the breakout, Bitcoin saw a post-retest reversal from the 78.60% Fibonacci retracement level at $67,690.

Since then, Bitcoin has surged by nearly 20%, with seven consecutive bullish candles. The price is now heading toward the 1.272 Fibonacci level at $82,663, which could act as the next key resistance.

Analyst Warns of ~$1B in Liquidations as Open Interest Nears $50B

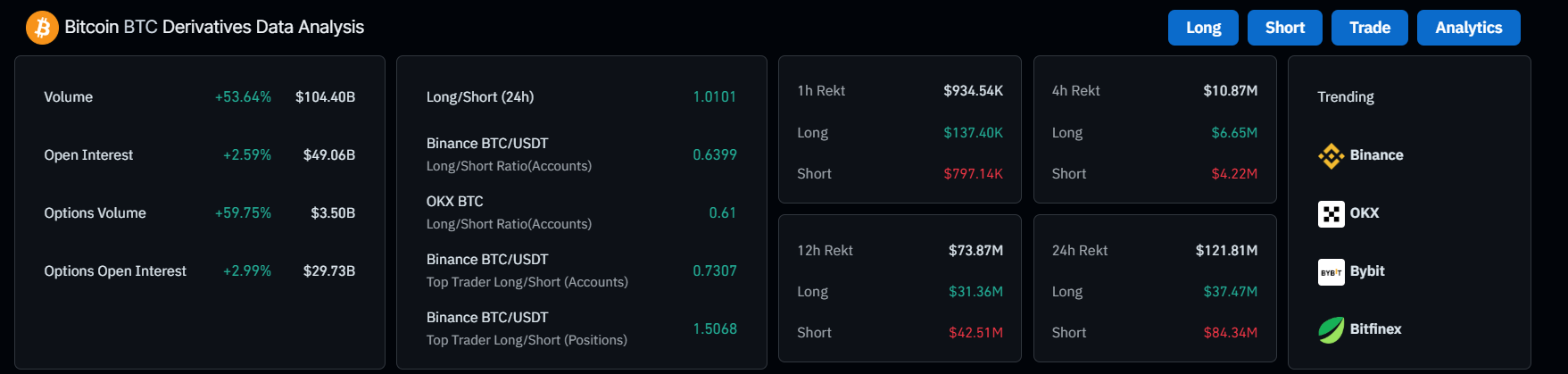

Amid the bull run, the Bitcoin open interest has risen by 2.59% in the past 24 hours, reaching $49.06 billion. With the volumes crossing above $104 billion with a 53% surge, the broader market sentiments for Bitcoin are extremely bullish.

Over the last 24 hours, $121 million worth of positions in Bitcoin derivatives were liquidated. Short-sellers incurred $84.34 million in losses, while long positions were hit with $37.47 million in liquidations.

On Binance, the top traders maintain a long-to-short ratio of 1.50 based on positions, which supports the bullish trend. However, the long-to-short ratio based on accounts is 0.73, suggesting a potential minor pullback.

Crypto analyst Ali Martinez recently tweeted that nearly $1 billion in liquidations could occur if Bitcoin’s price falls to $77,250. This would trigger a cumulative long liquidation of approximately $999.67 million.

Will Bitcoin Cross $90,000?

As the bull market continues, technical indicators point toward further upside. The 100-day and 200-day simple moving averages (SMAs) are signaling a potential positive crossover, while the MACD and signal lines remain in a bullish trend, confirming a “BUY” signal.

Institutional support is likely to increase, especially with potential U.S. Bitcoin Spot ETFs, which could fuel further bullish sentiment. The strong performance of crypto-related stocks, such as MicroStrategy, also adds to the optimistic outlook. MicroStrategy’s Bitcoin holdings are now valued at $20 billion, with MSTR stock climbing 17.42% last week, yielding 100% returns.

With a breakout above the 1.272 Fibonacci level at $82,663, Bitcoin could continue its rally toward $90,000. By the end of the year, Bitcoin’s bull run could reach $94,119, the 1.618 Fibonacci extension. However, a minor retest of the $80,000 mark is also a possibility.

thecryptobasic.com

thecryptobasic.com