BlackRock (NYSE: BLK)’s iShares Bitcoin ETF (NASDAQ: IBIT) had over $10 billion in trading volume in November’s first week. This amount hints at renewed institutional and retail interest in Bitcoin (BTC) over gold investments from traditional finance players.

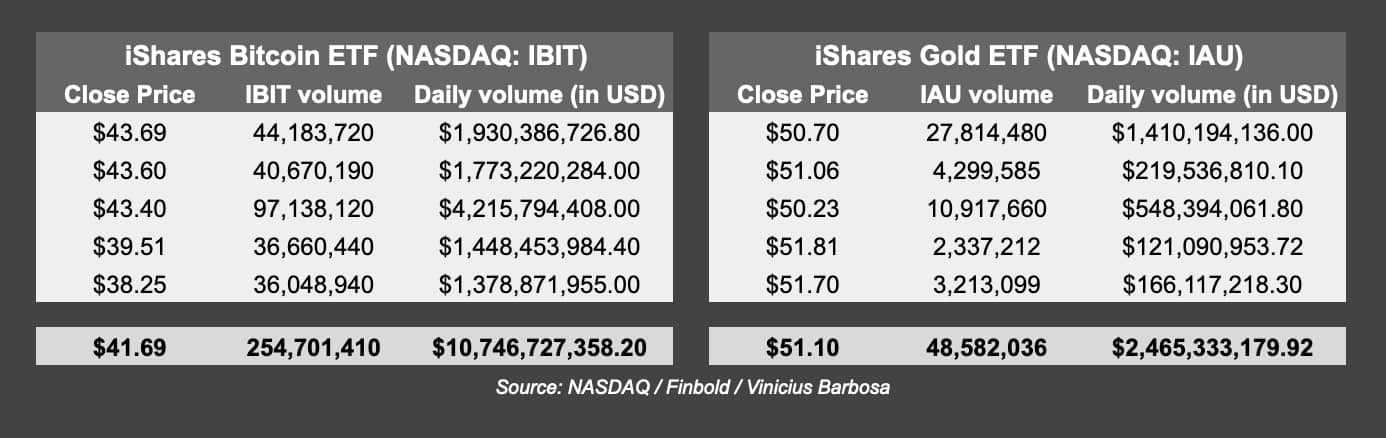

On November 9, Finbold retrieved market data for this last week from Nasdaq, examining the trading volume of iShares’s ETFs.

Overall, IBIT registered a 245.70 million volume from Monday to Friday at an average close price of $41.69. This results in an approximate volume of $10.74 billion worth of BlackRock’s Bitcoin ETF shares changing hands this week.

Meanwhile, the iShares Gold ETF (NASDAQ: IAU) has a Monday-to-Friday volume of $2.46 billion from 48.58 million shares. According to this data, traditional finance investors have shown 4.35 times more capital interest in trading IBIT than IAU.

BlackRock’s iShares Bitcoin ETF IBIT flow this week

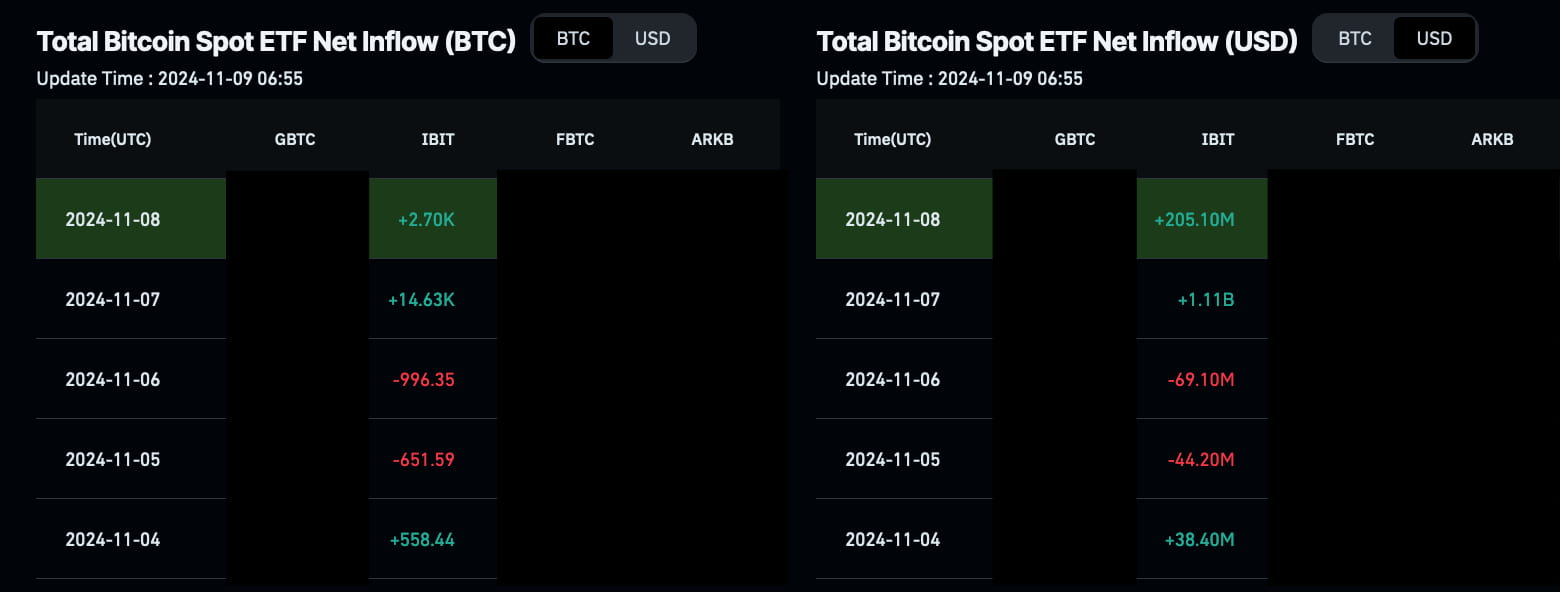

While high trading activities, measured by volume, can be either bullish or bearish, this week’s activity suggests a bull market. This is because BlackRock’s iShares Bitcoin ETF IBIT has seen a massive inflow during the volume’s surge, suggesting increased demand.

Notably, BlackRock acquired and added 16,241 BTC to its fund this week, worth $1.24 billion, according to data we retrieved from CoinGlass – addressing Bitcoin ETF flows from November 4 to 8.

Interestingly, it also means that IBIT traders exchanged 8.66 times more shares of the Bitcoin derivative than what BlackRock purchased of the underlying asset itself (spot BTC).

IBIT price analysis

On Friday, IBIT closed at 43.73 with a 44.18 million daily volume in shares, nearing $2 billion traded. BlackRock’s iShares Bitcoin Trust ETF started trading at $39.36 on Monday, consolidating an 11% surge this week.

Similarly, Bitcoin started trading at $68,748 on Monday and ended up trading at $76,558 on Friday for 11.36% gains after breaking out of its all-time high of $73,800 on Wednesday, November 6.

As things develop, the recent price action has renewed investors’ interest in Bitcoin and its derivatives products like BlackRock’s IBIT. With the increased demand, BTC could have started a new bull rally that would unfold in the following weeks.

finbold.com

finbold.com