On-chain data shows that Bitcoin open interest, or the volume of open contracts in futures, is currently near all-time highs at 264k BTC. On the contrary, Bitcoin’s price has been trending downward for the last couple of days. This suggests that the majority of market speculators are betting against BTC.

In such a scenario, a sudden uptick in prices could trigger stop losses and result in a near-term short squeeze.

Bitcoin Price is Struggling

Bitcoin price briefly dropped below $40,000 at the start of the week. It has since managed to slightly recover, as BTC is currently trading at around $41,700. However, experts claim that market sentiment is not great, with some even expecting more sell-off happening in the coming days.

For one, Yuya Hasegawa, a crypto market analyst at Japanese bitcoin exchange Bitbank, said he anticipates the leading cryptocurrency to extend its losses. He argued that this could continue until the broader market, which has also been in decline since the Fed’s latest announcement, digests the possibility of rate hikes by as soon as March.

Last week, minutes from the Fed’s December meeting were released, which indicated that officials could be ready to aggressively scale back its bond purchases. The measure is part of the central bank’s policy to cope with rising inflation.

Meanwhile, the markets took a hit following the news. Bitcoin, as well as the stock market, tanked on Wednesday and has since been performing badly. Hasegawa warned that the government’s consumer price index (CPI) report expected on Wednesday could further exacerbate the sentiment if it shows inflation increased because it would then justify the Fed’s decision. He said:

“Bitcoin remains vulnerable to a breach of the $40,000 level, and it could get bad for ether if it breaks the $3,000 level. The long-term outlook is still bullish for both the top two cryptocurrencies, but the short-term is looking ugly.”

As reported, Bitcoin might even be on the cusp of undergoing a death cross, which is a bearish price indicator that happens when the 50-day moving average (MA) dips under the 200-day MA.

Join our Telegram group and never miss a breaking digital asset story.

Short Squeeze Seems “Reasonably Likely”

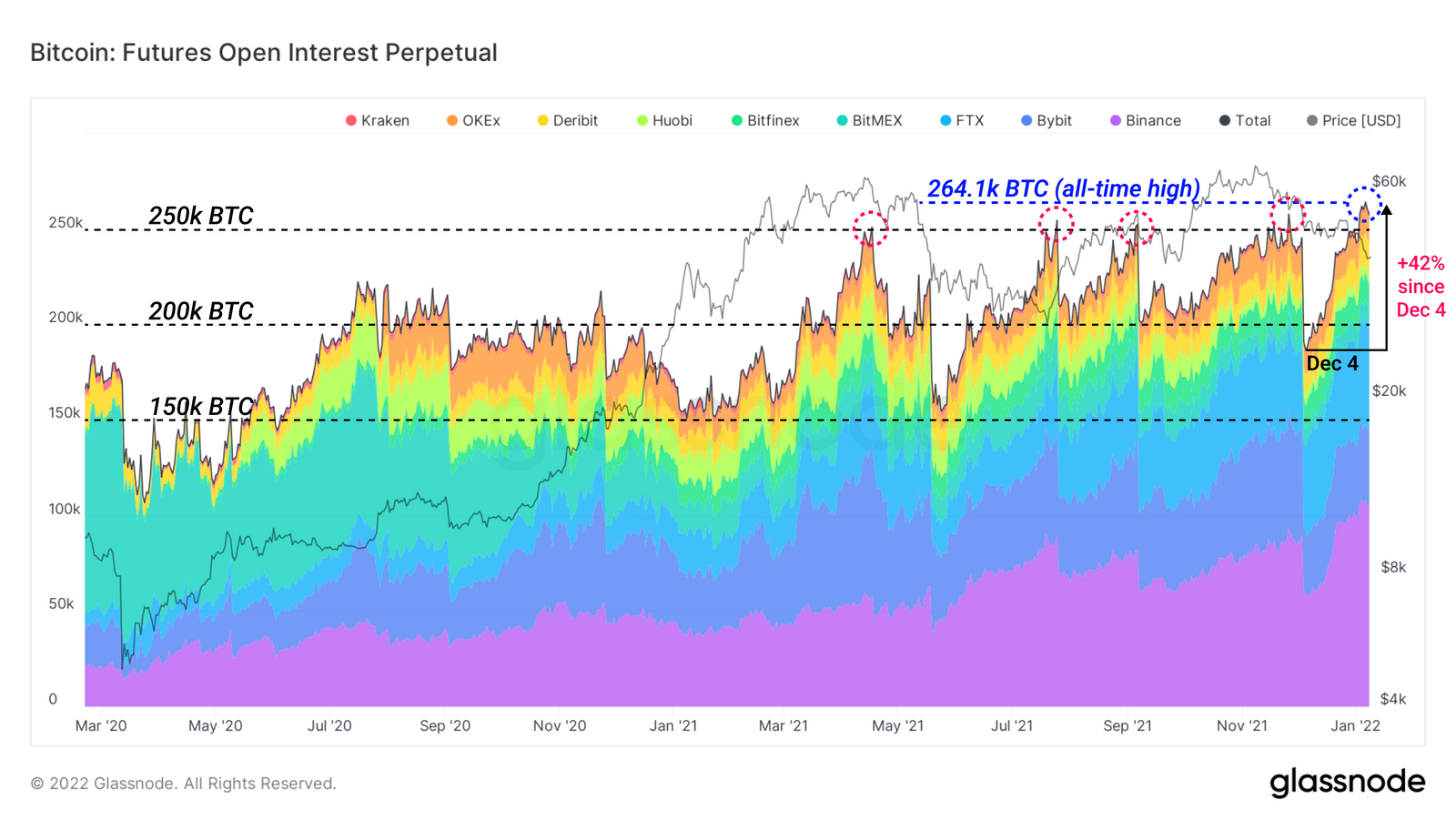

Despite the fact that Bitcoin price has been trending downward, on-chain activity is hitting new highs. As per a recent report by crypto analysis firm Glassnode, the leverage in the Bitcoin derivatives market is at all-time highs.

The report noted that “Futures Perpetual Open Interest, which is the sum value of all open contracts in the continuous contracts market,” has risen by more than 40% since December 4, 2021. In BTC terms, it has reached a new all-time high of 264,000 BTC despite the recent price declines, exceeding the previous high of 258k BTC set on November 26.

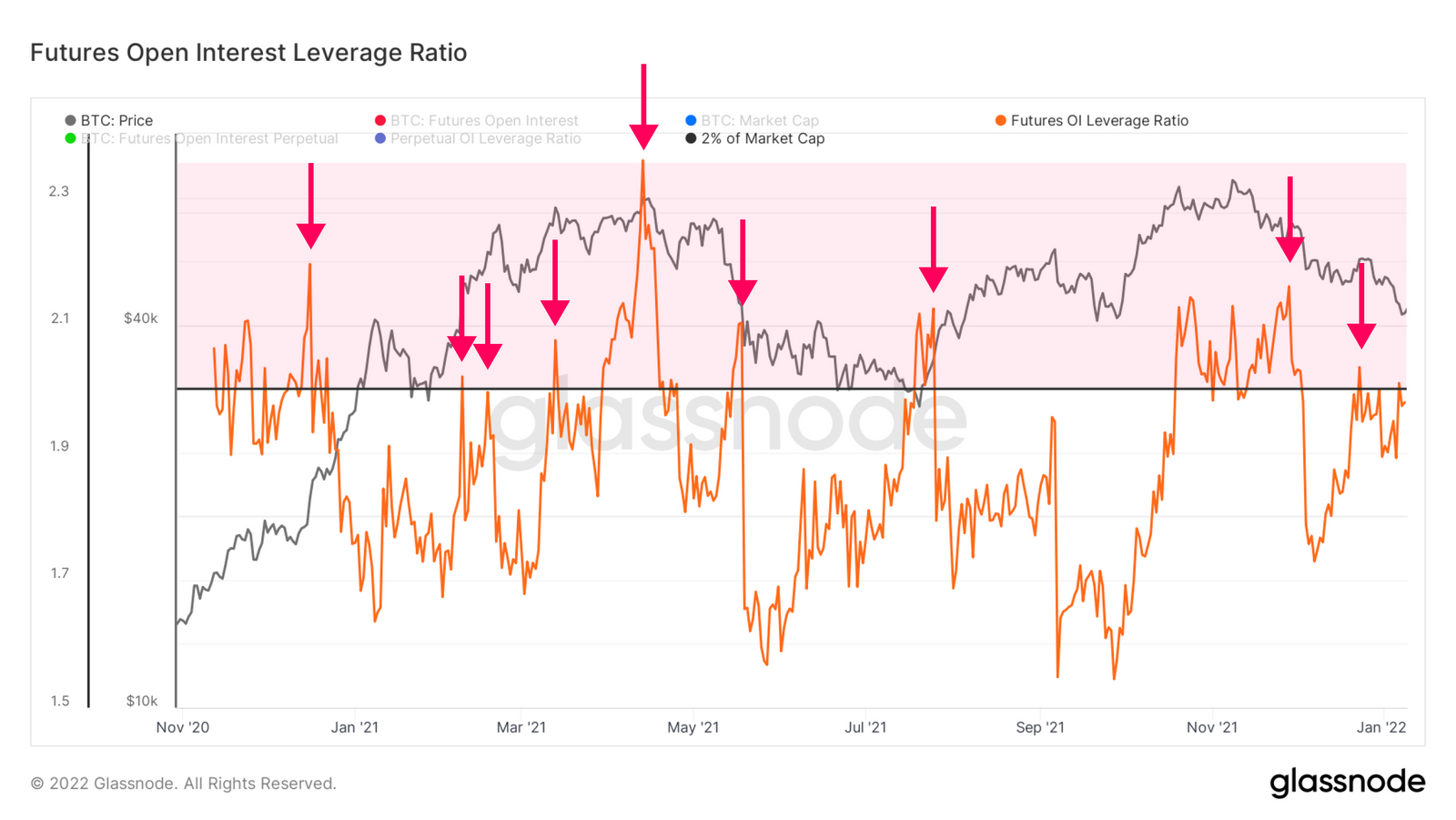

Given that price drops liquidate long positions, the recent growth in Open Interest implies that the majority of traders are betting on market weakness and are shorting BTC. Glassnode also noted that a de-leveraging event can happen, saying:

“The dramatic leap in Futures Open Interest can be viewed in another way: representing itself as a leverage ratio against the Market Cap. Typically, periods where Futures Open Interest exceeds >= 2% of Market Cap are short-lived, and tend to end with a dramatic flush of margin.”

These events can even be triggered when the Open Interest leverage ratio is below 2%, and can also occur in either direction. “However, each instance where leverage exceeded 2% in the past year ended with a swift liquidation of contracts,” Glassnode said, adding that the ratio is currently at 1.98%.

In such scenarios, experts view a flush as a reasonable near-term resolution for the market. And since short positions are currently dominating the derivatives market, a short squeeze event could be forthcoming. Echoing the same point of view, Glassnode concluded:

“Alongside very oversold indicators in onchain spending activity, this suggests a short squeeze is actually a reasonably likely near-term resolution for the market. Whether it can overcome macro headwinds, and reestablish a convincing uptrend will be a focus for upcoming newsletters.”

Do you think Bitcoin will experience a short squeeze within the coming days? Let us know in the comments below!

tokenist.com

tokenist.com