At press time, with bitcoin floating comfortably above $76,000, the flagship cryptocurrency holds its ground as the ninth largest asset worldwide by market capitalization.

Bitcoin Overtakes Meta, Sets Sights on Silver in the Global Asset Race

On Fri., Nov. 8, 2024, bitcoin (BTC) officially takes its place as the ninth largest asset globally, overtaking Meta’s market cap—Meta, formerly known as Facebook, now holds around $1.48 trillion. At 12:30 p.m. Eastern Time that day, bitcoin trades at $76,349, giving it a solid $1.51 trillion market valuation.

Meanwhile, the precious metal silver ranks just above, holding the eighth-largest market cap at $1.771 trillion, with each ounce of .999 fine silver valued at $31.47. Silver’s recent value hike over the past few months keeps it ahead of BTC. But what would bitcoin need to dethrone silver?

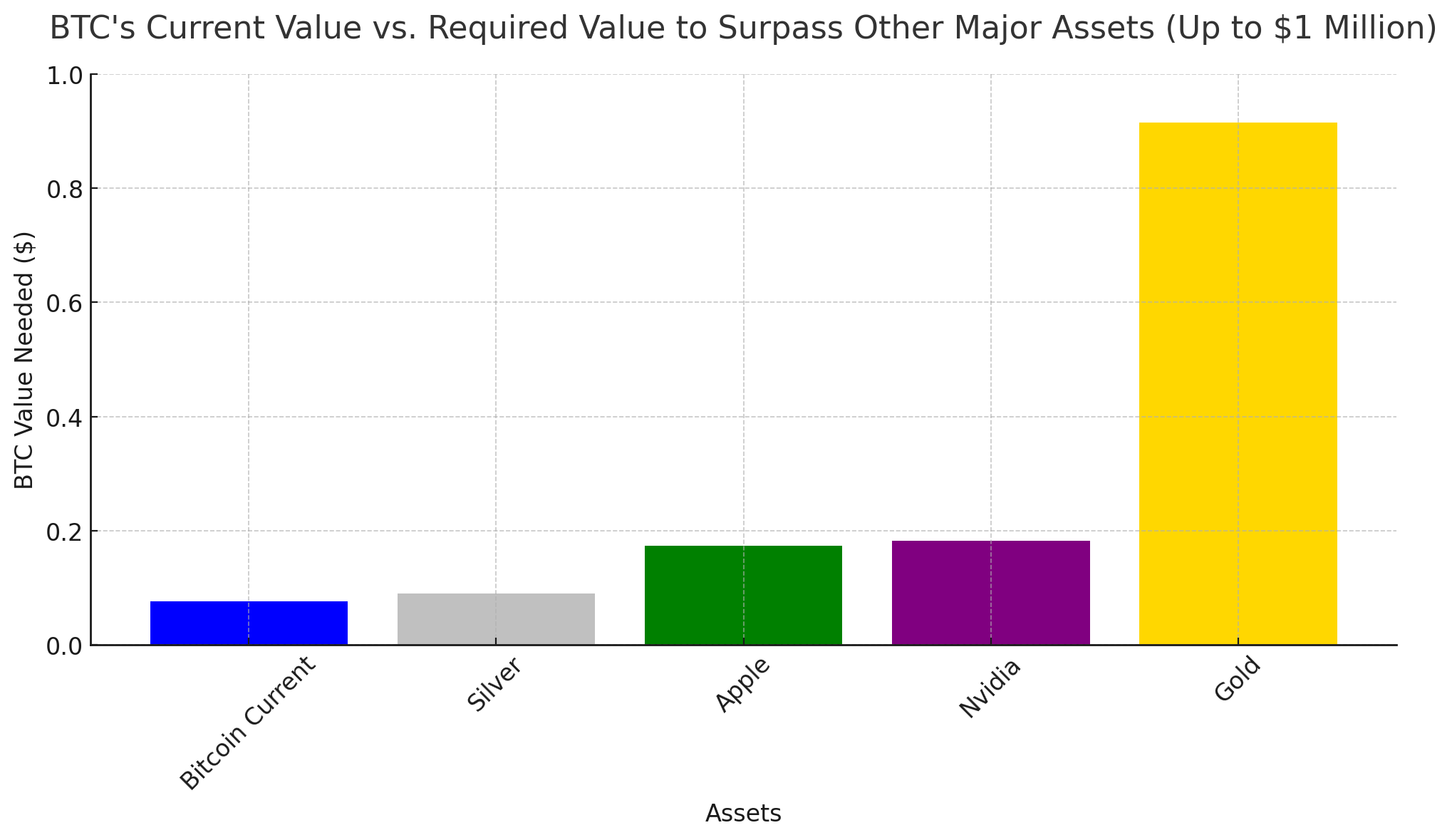

$89,581.70 per bitcoin—that’s the price needed for BTC to outshine silver’s market cap. Moreover, the tech giant Apple holds the position as the third largest asset globally, with a market cap of $3.429 trillion. For bitcoin (BTC) to overtake Apple’s valuation, its price would need to climb to around $173,444.60 per coin. However, surpassing Nvidia, the second largest by market cap, would require an even higher leap.

To edge out Nvidia’s $3.609 trillion valuation, BTC would need to hit $182,549.87 per coin. But to topple the reigning giant—gold, the safe haven asset—bitcoin has a monumental task ahead. As of now, with gold priced at $2,694 per ounce, its market cap stands at an astonishing $18.087 trillion.

BTC would need to approach the million-dollar mark per coin, though not exactly, to claim the crown. To surpass gold’s current market cap, bitcoin’s price would have to reach $914,850.58 per coin. While some bitcoin advocates anticipate this could happen, gold champions like Peter Schiff firmly disagree. Whatever the outcome, as the ninth most valuable asset globally, BTC has undeniably established itself as a formidable contender.

news.bitcoin.com

news.bitcoin.com