Two weeks ago, on December 27th, Bitcoin (BTC) was trading at $51,665. Now, BTC is approaching a bearish price indicator, known as the infamous ‘death cross’. The indicator is nothing new, as BTC has experienced a death cross within the last year, only to recover. Here are three potential reasons why we’re seeing this indicator once again.

Bitcoin Approaching Death Cross

Crypto volatility is something investors are familiar with. In fact, many welcome it because it provides high yield trading opportunities in contrast to more static commodities like gold. After all, Bitcoin dropped by 40% in May only to rise to its ATH of $67,413 in November. However, multiple factors have had a compounding effect in the last two weeks, creating extreme fear sentiment on the Fear & Greed Index.

Before we dive into these factors, let’s first examine Bitcoin’s current price trajectory. Although chart indicators are just that – indicators – some are more visually useful than others. The dynamic between a bullish and bearish momentum is commonly displayed by two types of crossovers:

- Death cross – when the 50-day moving average (MA) dips under the 200-day MA.

- Golden cross – when the 50-day MA soars above the 200-day MA.

Moving averages are generally considered useful because they flatten out short-term fluctuations, i.e., noise. However, just like many others, MAs are lagging indicators. With that out of the way, it appears as if a death cross is imminent if the price of BTC doesn’t undergo an upward correction this week.

As you can see from the chart, Bitcoin already had a death cross convergence last year, on June 19th, at around $43k. However, it rallied nicely into a golden cross on September 15th, at $46k. On January 10th 2022, Bitcoin dipped below the $40k price resistance during mid-day, but recovered within an hour.

However, if the key support of $42k keeps slipping, we may see bottoming to July’s level of $30k. The question is, what’s the strength of external factors plaguing BTC price moves?

Join our Telegram group and never miss a breaking digital asset story.

3 Factors that Hindered Bitcoin’s Bullrun

1. Bitcoin Derivatives Market

As forecasted, futures-based ETFs have created a negative pressure on Bitcoin’s price. Futures contracts bet on Bitcoin’s future price, instead of investing in BTC ownership directly. In other words, investors make money if BTC goes up, but only if it is higher than the negative roll yield.

Negative roll yield means that the future price of BTC is higher than the expected future spot price, technically called ‘contango‘. The opposite of that is backwardation, when the spot price is higher than the futures price. For instance, in October 2021, BTC futures ETF roll yield rose to 17%, meaning investors underperformed BTC by 17%.

.#bitcoin futures ETFs launch today. Roll yield has spiked to 17% – which means investors underperfom BTC by 17% on an annualised basis. Writing about that today in ByteTree ATOMIC. pic.twitter.com/gwht8JFszx

— Charlie Morris (@AtlasPulse) October 19, 2021

In practice, such a dynamic between Bitcoin future and spot price creates an incentive structure that has a suppressive effect. Even if the negative roll yield is higher, and the investor makes money, the other side of the contract pockets the negative roll yield. Moreover, if the BTC price goes down, the investor loses both the money due to that price move and suffers extra loss due to the negative roll yield.

Although this causes frequent mass liquidations, it cannot go on indefinitely. However, this may be why Gary Gensler, the SEC Chair and former Goldman Sachs banker, has been so insistent on not approving any spot-traded BTC ETF, but only future-based ones.

2. Kazakhstan Turmoil

The story of political and economic instability in Kazakhstan is a long and complicated one. Suffice to say, the former Soviet Central Asian republic is of far more importance to Russia than Ukraine, in terms of resources, as a hub for Russia’s space program, and likewise holds immense strategic value.

First, Russia and Kazakhstan have the largest continuous land border on planet earth.

— Clint Ehrlich (@ClintEhrlich) January 7, 2022

If Kazakhstan destabilizes, a significant fraction of the country's 19 million residents could become refugees streaming across the border.

Russia is not willing to let that happen. pic.twitter.com/GTB3cwbF3W

Although rich in gas and oil, the Kazakhstan government released price caps on oil, causing fuel prices to double practically overnight. This sudden price spike followed 9% year-on-year inflation in 2021. After triggering upheaval on the streets, the government quickly restored the oil price cap.

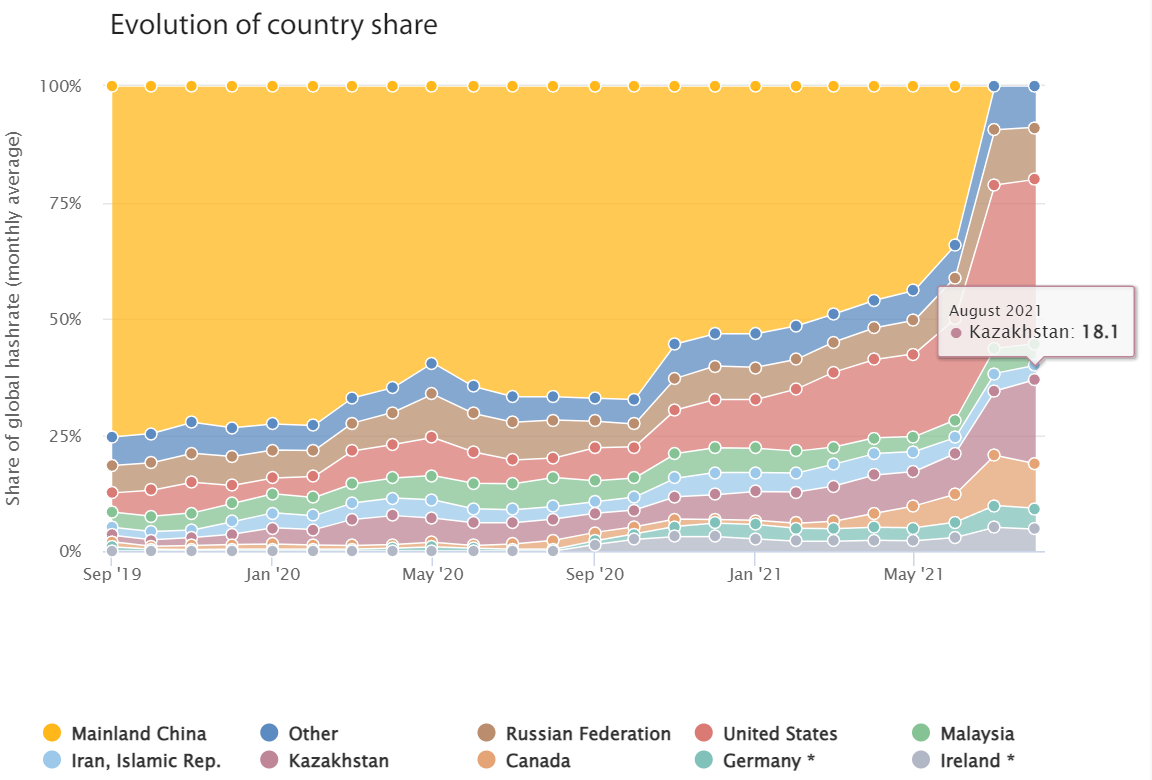

Unfortunately for Bitcoin, during that emergency period, the government also shut down the internet. In turn, this cut off Kazakhstan’s hashrate contribution to Bitcoin’s global network, at 18% as of August 2021.

Just within a few hours of the internet blackout, Bitcoin’s hashrate dropped by 12%, serving as another contributor to the fear side of the Fear & Greed Index.

3. Fed Minutes and Labor Report

The Federal Reserve released its December 14-15 meeting report on January 5th, the so-called Minutes of the Federal Open Market Committee (FOMC). The Fed’s core official objective is to maintain stable economic environment, which includes the unemployment rate. On Friday, January 7, The Bureau of Labor Statistics released the labor report, showing a decline in unemployment to 3.9%, which beat the Fed’s less optimistic projection of 4.1%.

The report set the stage for implementing the Fed’s objectives, emphasized during the Fed Minutes. Coupled with the concern about inflation and the labor market, the Fed Minutes meeting indicated the following:

“Participants generally noted that, given their individual outlooks for the economy, the labor market, and inflation, it may become warranted to increase the federal funds rate sooner or at a faster pace than participants had earlier anticipated.”

In other words, the Federal Reserve is heading to cease asset purchases (quantitative easing (QE)) by mid-March, which would effectively raise the federal funds rate. This had an immediate negative effect on the markets:

- Bitcoin dropped by 7% within a day, from $46,490 to $43,136

- S&P 500 Index by 1.4%

- Nasdaq Composite Index by 2.7%

The purpose of controversial QE was to increase the money supply which in turn reduces federal funds rate (interest rate) to near zero. Consequently, this builds a cheap money borrowing pipeline, encouraging lending. As a result, this creates a co-dependent relationship between the Fed and the stock market, which is why the latter has a history of negative reactions to shutting the money supply spigot off, popularly calledTaper Tantrum.

However, the Fed’s main goal in tapering is to get inflation under control. Within this new macro-economic environment, speculative assets suffer the most because investors turn to safe haven assets rather than risk-on assets like growth and tech stocks. Judging by BTC’s response to the news, it seems that investors still perceive Bitcoin as speculative.

Nonetheless, what the Fed says and what it does can be two different things. What can be realistically expected is for the Fed to only slightly increase the interest rate, but still keep it under 1%. Once the noise subsides and open interest exhausts its suppressive effect, Bitcoin’s strong fundamentals as sound money could be bound to manifest once again.

What happens to Bitcoin in 2022? Let us know what you think in the comments below.

tokenist.com

tokenist.com