An analysis has suggested that the recent Bitcoin pullback from $72,680 may indicate a further 16% decline, with a potential V-shaped recovery targeting $74,600.

Bitcoin experienced a notable downturn after encountering strong resistance in its attempt to surpass its all-time high. Earlier today, the cryptocurrency fell below the $69,000 mark, following a rally that peaked on Tuesday when BTC surged to $73,600.

This abrupt decline saw Bitcoin lose over $3,000 from its peak, though it has since regained some stability. Nevertheless, it remains significantly under the $71,000 threshold.

Previous BTC/USD Patterns

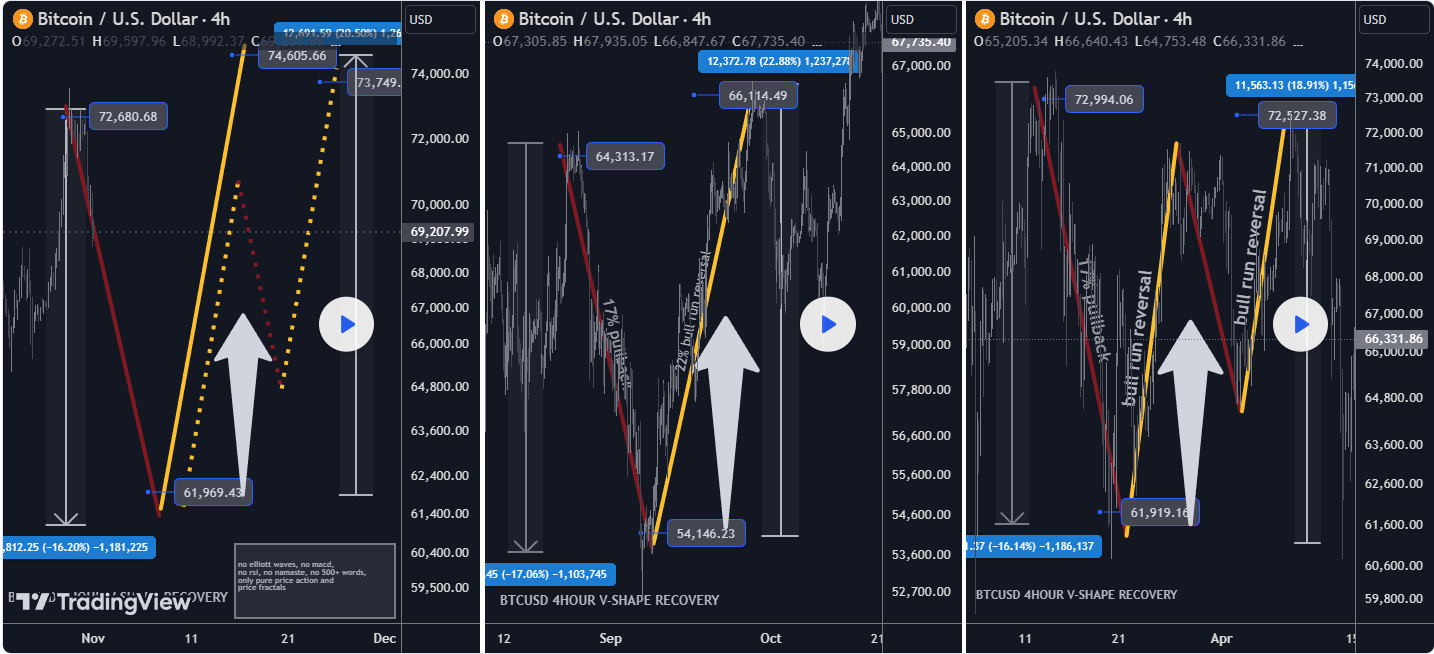

Amid this recovery, an analyst on TradingView provided detailed observations on the BTC/USD four-hour price chart, focusing solely on price action without technical indicators such as MACD or RSI. The analysis highlighted two recent V-shaped recovery patterns that occurred this year.

The September-October instance involved a high of $64,300, followed by a 17% pullback to a low of $54,146. This sequence culminated in a recovery to a new high of $66,114, marking a 23% gain from the low.

A similar pattern emerged in March when Bitcoin reached a high above $72K before a 16% pullback brought the price down to $61,919. Subsequently, Bitcoin recovered and reached a high of $72,520, representing a 19% gain from the low. This analysis provided the context for understanding the current market structure, where BTC set a high at $72,680 this week.

Current Analysis and Expected Recovery

In the current market structure, the analyst suggested that BTC is expected to pull back 16% from its recent high of $72,680, aligning with past V-shaped recovery trends. This leads to expectations of a potential low near $61,969.

According to the TradingView analysis, a price increase of 20% to 21% from this low could complete the anticipated V-shaped recovery, projecting a potential new high at or near $74,600.

The recommended strategy for bullish investors includes waiting for a pullback to the $62,000 range before entering a buy or hold trade, targeting a rise to approximately $74,000. This approach suggests potential gains of 20% on an unleveraged position with minimal risk involved.

Bitcoin Forecasts from Other Analysts

Market analyst Ali Martinez offered a separate perspective, emphasizing that Bitcoin’s current price movements aligned with his forecast. He noted that maintaining support at $69,000 would be crucial for further upward movement.

Last month, Martinez noted that if BTC held above $65,000, it could rise to $72,000, dip back to $69,000, and eventually aim for $78,000.

With Bitcoin currently testing the $69,000 level, maintaining this support and rebounding as predicted could signify a new phase in its price trajectory, potentially advancing toward the $78,000 target outlined by Martinez.

thecryptobasic.com

thecryptobasic.com