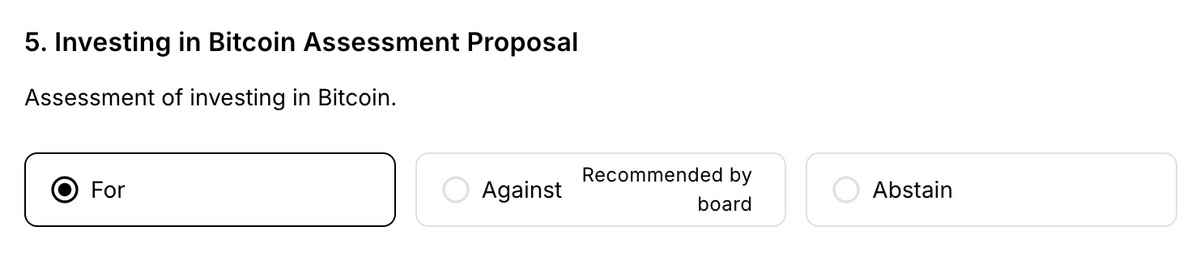

Microsoft shareholders have begun holding preliminary votes on whether the tech giant should explore investing in Bitcoin (BTC).

The proposal, which is among the topics of Microsoft’s annual shareholder meeting, proposes that the company consider Bitcoin as a hedge against inflation and other macroeconomic factors. The proposal was detailed in a Form A filing with the U.S. Securities and Exchange Commission (SEC) on Oct. 24.

The proposal argues that Microsoft’s current investment in corporate bonds is not efficiently outpacing inflation and suggests Bitcoin as a potential strategy to diversify the company’s asset portfolio and increase shareholder value. Shareholders will formally vote on the issue at the annual meeting on Dec. 10.

However, Microsoft’s board of directors recommended that shareholders reject the proposal. The board of directors noted that the company already has a solid asset management strategy and does not see a need to invest in Bitcoin. “Microsoft’s management team carefully considered this issue and determined that the company’s current investment strategy is well suited to achieve its long-term goals,” the board said, adding that the current diversified portfolio can withstand macroeconomic changes without exploring additional investments.

*This is not investment advice.