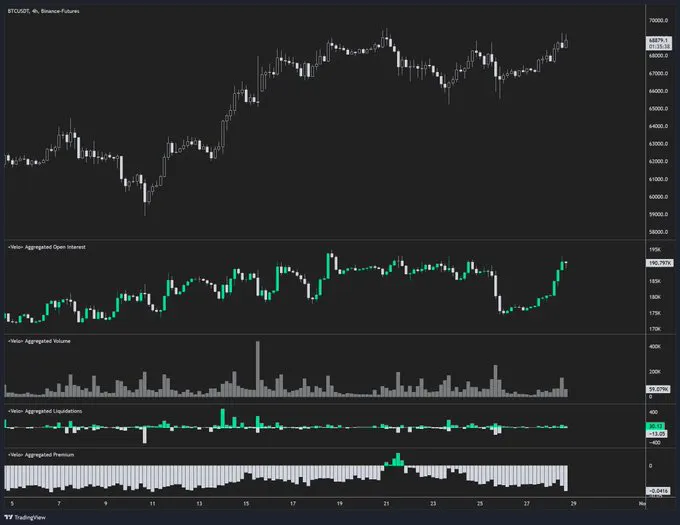

Bitcoin’s open interest just exploded by $1.94 billion today, with its price rallying toward the $70,000 mark. Coinbase has been dumping Bitcoin on the spot market since US markets opened.

It’s a stark difference from last week’s Tether chaos, where new FUD (fear, uncertainty, doubt) rumors of an investigation by the US government spooked traders, dragging Bitcoin briefly below $67,000.

Paolo Ardoino, Tether’s CEO, brushed off the latest investigation as more FUD, but markets reacted nonetheless. But even a whiff of uncertainty surrounding Tether always sends prices tumbling.

Oil and Middle East tensions drive crypto interest

Bitcoin surged by 3.2% between October 27 and 28, testing the $69,200 level for the first time in a week. The push came as global oil prices dropped by 5.5%, following escalated tensions in the Middle East that failed to disrupt energy channels.

Over the weekend, Israel launched strikes against Iran, but crucial oil or nuclear sites weren’t affected, according to CNBC. Traders initially turned to oil as a hedge against the conflict but are now reassessing, seeking alternative protective assets amid ongoing uncertainty.

For over a year, Israel and Iran have reportedly been locked in a covert “shadow war,” with US officials cautioning against targeting Iran’s nuclear sites. This regional volatility is driving investors to consider assets like Bitcoin, especially as traditional hedges become riskier.

The question is whether this uncertainty will continue to support Bitcoin’s price or merely create temporary market fluctuations.

Meanwhile, on October 31, the US will release its latest inflation report, and a Federal Open Market Committee (FOMC) meeting is scheduled for November 7.

Economists expect the Core Personal Consumption Expenditures (PCE) index, a favorite Fed metric, to rise by 0.3% for September, a jump from 0.1% in August. Higher inflation puts pressure on the Fed, influencing how it tweaks interest rates.

Inflows surge as US election nears

With the US presidential elections less than 10 days away, investors are playing it safe, opting for cash and short-term government bonds to manage potential surprises. The election season has always kept markets on edge.

Bitcoin and other cryptos could see a bump as post-election clarity drives risk-on sentiment. Historically, election results have surprised markets, leading to changes in risk appetite and massive influx.

Digital assets had a surge last week, with inflows reaching $901 million by October 25. According to CoinShares, Bitcoin saw $920 million in inflows in just that period, setting a year-to-date total at $27 billion. The report attributed this spike in Bitcoin’s favor to the upcoming US elections, saying:

“We believe that current Bitcoin prices and flows are heavily influenced by US politics, with the recent surge in inflows likely linked to the Republicans’ poll gains.”

The US led with $906 million in Bitcoin inflows, while Germany and Switzerland contributed $14.7 million and $9.2 million, respectively. In contrast, Canada, Brazil, and Hong Kong saw outflows, with Canada reporting $10.1 million in redemptions, Brazil $3.6 million, and Hong Kong $2.7 million.

Short-Bitcoin positions recorded minor outflows of $1.3 million in the same week. BlackRock’s iShares Bitcoin Trust exchange-traded fund (ETF) led the pack in asset holdings, sitting on more than $28 billion. Combined, Bitcoin ETFs are managing around $78.9 billion in assets.

cryptopolitan.com

cryptopolitan.com