In the face of global economic uncertainty, two assets have captured the attention of investors seeking refuge from inflation, Bitcoin ($BTC) and gold.

Traditionally, gold has been the preferred inflation hedge, yet Bitcoin, with its capped supply and potential for exponential gains, is fast emerging as a compelling alternative. However, each asset carries distinct risk and reward profiles, fueling ongoing debate over which truly serves as the ultimate inflation hedge.

To bring clarity to this debate, Finbold consulted ChatGPT-4o for insights into which asset offers the strongest inflation-hedging potential in today’s complex economic landscape.

In 2024, Bitcoin has risen 60% year-to-date to a current price of $67,683, while gold has surged to near-record highs at $2,758.45 per ounce, achieving a 33% gain year-to-date.

Despite these impressive gains, geopolitical tensions and socioeconomic factors have introduced complexities that affect each asset’s role as a store of value.

$BTC vs. Gold: A tale of diverging paths

The Bitcoin-to-gold ratio, a metric that compares Bitcoin’s value to gold per ounce, reveals that $BTC’s outperformance of gold has waned since March 2024.

Data from Bloomberg Intelligence points to a declining trend, with Bitcoin now equating to 24 ounces of gold.

“Gold Outperforming Bitcoin and Elevated Risk Assets – Bitcoin lagging gold despite the record-setting S&P 500 may augur headwinds for risk assets. At 24 ounces of the metal equal to the crypto on Oct. 22, the Bitcoin/gold ratio is below a high of 34 in March and a 2021 peak of 37, with a big difference — the S&P 500 remains relatively elevated.”- Mike McGlone

This shift underscores gold’s steady appeal amid global economic pressures, with analysts from Bank of America recommending it as the “last safe haven” due to rising U.S. debt and Treasury supply concerns.

Moreover, the U.S. dollar index recently climbed to 104.24, supported by strong economic data and the Fed’s cautious stance on rate cuts, while the 10-year Treasury yield peaked at 4.24%.

Typically, this setting would reduce interest in non-yielding assets like gold. However, demand for gold remains robust amid broader market uncertainty, disrupting traditional asset correlations.

In support of gold’s long-standing appeal, central banks have ramped up their gold holdings, with gold now making up 10% of global reserves, a significant increase from 3% a decade ago.

Key economic reports scheduled for next week, including core PCE data, could also influence the Fed’s rate strategy and impact gold’s price trajectory. Analysts are now eyeing a potential year-end target of $3,000 per ounce.

Meanwhile, Bitcoin’s status as an inflation hedge continues to polarize investors, as it is influenced by geopolitical tensions and traditional financial system uncertainties rather than direct inflationary trends.

Institutional demand and geopolitical risks: The Bitcoin perspective

Bitcoin’s journey as a hedge asset has seen heightened demand from institutional investors, with a 10-day inflow streak in BlackRock’s IBIT ETF.

Simultaneously, open interest in Bitcoin derivatives has risen, with an estimated 9.58% chance that $BTC could reach $100,000 by December.

However, Bitcoin’s performance is highly sensitive to geopolitical events. As tensions rise in the Middle East, analysts from Standard Chartered note that $BTC might struggle to retain its value, potentially dipping below $60,000.

Standard Chartered also emphasizes $BTC’s unique role as a hedge against traditional finance concerns like bank instability and de-dollarization, as opposed to direct geopolitical hedging.

Still, with the U.S. presidential election on the horizon, many expect that a Trump victory could boost Bitcoin due to his pro-crypto stance, though volatility remains likely in the interim.

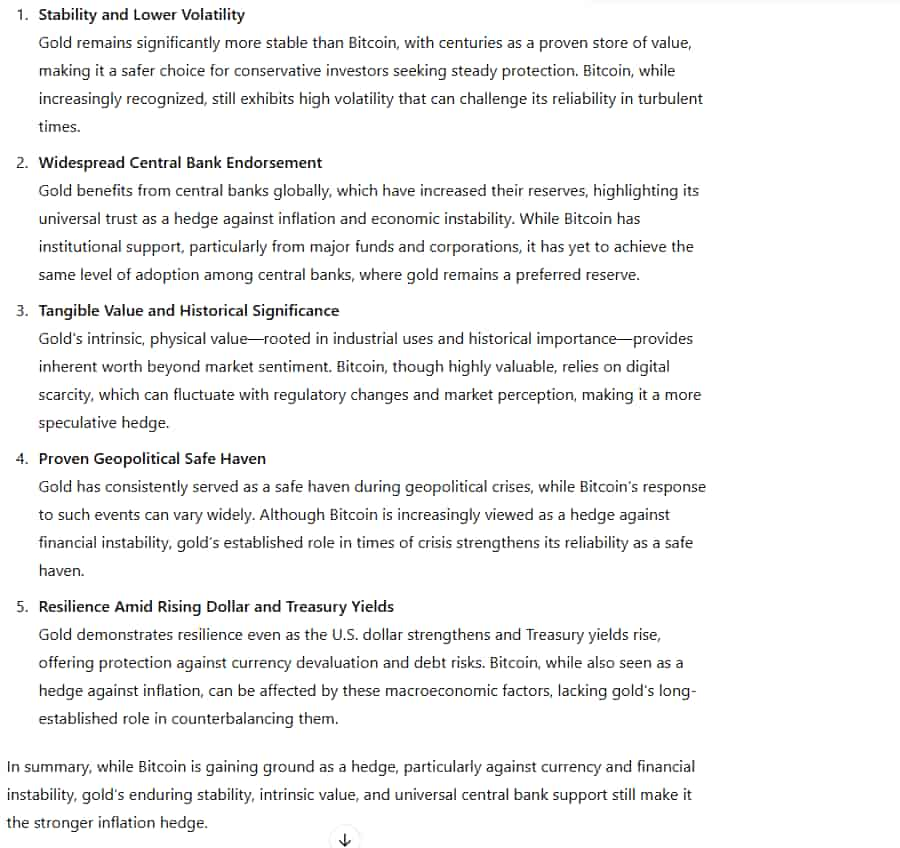

ChatGPT’s analysis: The final verdict

According to the AI model, Gold’s resilience and established safe-haven status make it a strong inflation hedge as the global economy contends with fiscal uncertainty and geopolitical unrest.

Meanwhile, Bitcoin, with its capped supply and high growth potential, presents a digital alternative that continues to attract risk-tolerant investors.

For those willing to embrace volatility, Bitcoin offers the allure of outsized returns.

In summary, while Bitcoin captures the digital-age investor with its growth and speculative appeal, gold’s steady track record in turbulent markets solidifies its status as the ultimate inflation hedge in 2024.

finbold.com

finbold.com