An ARK Invest analyst is saying that three indicators are currently flashing bullish for Bitcoin (BTC).

ARK analyst David Puell tells his 68,900 followers on the social media platform X that there have been “interesting market events in the last few weeks” signaling a potential Bitcoin breakout.

He also says that Bitcoin appears to printing a bullish pattern on the daily timeframe.

“Bitcoin bounced off its 200-day moving average and its short-term holder cost basis. [On Friday], it seems to be breaking out of a broadening wedge that began to develop since last March.”

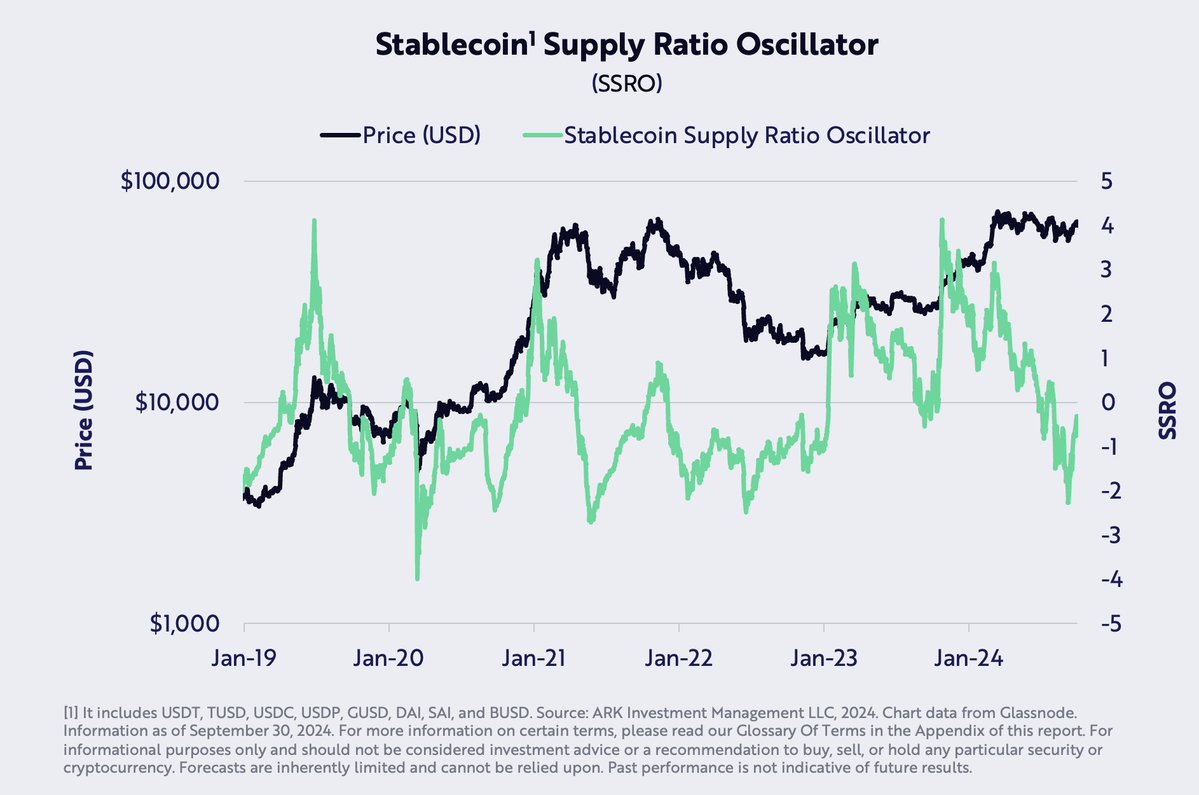

The analyst looks at the trends of the Stablecoin Supply Ratio (SSR) indicator, the ratio between Bitcoin supply and the supply of stablecoins. When the SSR is low, the current stablecoin supply has a relatively larger capacity to purchase BTC.

“The stablecoin supply ratio oscillator suggested Bitcoin’s oversold conditions relative to stablecoin’s purchasing power – lows not seen since mid-2022.”

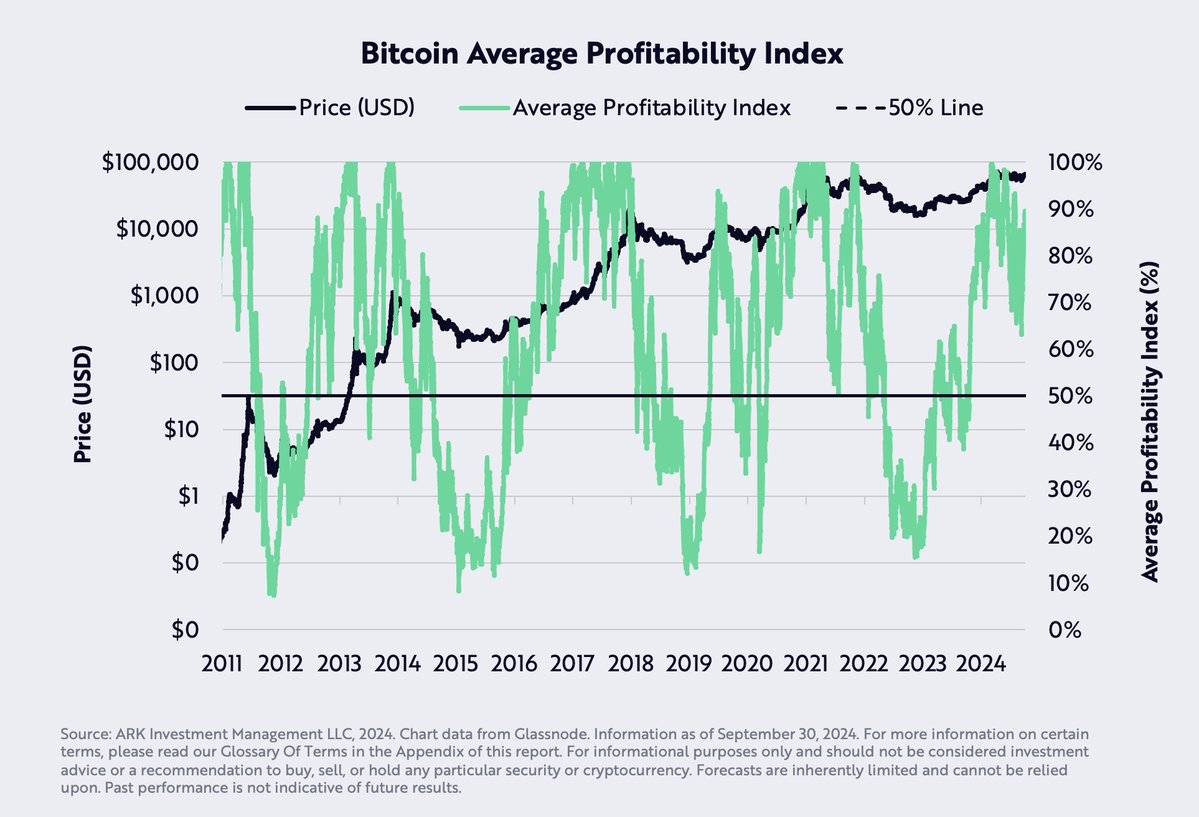

Next up, the analyst says Bitcoin is showing the usual signs of a market uptrend based on one of ARK’s own indicators.

“ARK’s own average profitability index for Bitcoin, the multiple of percent supply in profit and percent network profitability, has been always stayed within historically expected parameters for a broad bull market.”

Lastly, he says that the global money supply (M2) is increasing, which may be a bullish catalyst for Bitcoin.

“September saw a strong recovery in Chinese equities, one of many signs that global M2 liquidity is hitting the market. We believe Bitcoin could be benefited by this general liquidity.”

Bitcoin is trading for $67,260 at time of writing.

Generated Image: Midjourney

dailyhodl.com

dailyhodl.com