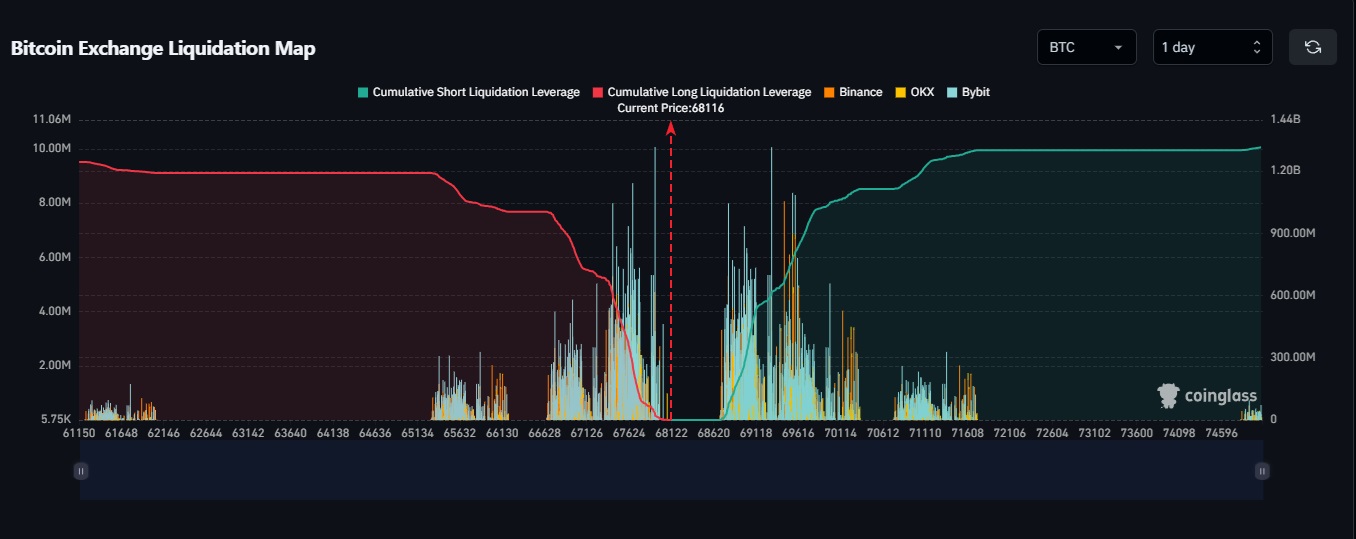

If Bitcoin surpasses $69,000, the cumulative short order liquidation intensity on mainstream centralized exchanges (CEX) could reach $101 million, according to Coinglass data.

However, if Bitcoin falls below $68,000, the cumulative long order liquidation density on these exchanges could rise to $293 million.

It is important to note that the liquidation table does not give the exact number or value of contracts to be liquidated. Instead, it shows the relative importance of each liquidation cluster compared to neighboring clusters and highlights the intensity of each potential price move. A higher liquidation bar indicates that the market is likely to react more strongly to a liquidation wave at that price level.

Coinglass liquidation data over the past hours reveals the following for the entire cryptocurrency market:

- 1-Hour Data: $4.62 million was liquidated, including $3.94 million worth of long orders and $680,000 worth of short orders.

- 4-Hour Data: $9.21 million was liquidated, including $6.32 million worth of long orders and $2.89 million worth of short orders.

- 12-Hour Data: $26.29 million was liquidated, including $18.62 million worth of long orders and $7.67 million worth of short orders.

- 24-Hour Data: $60.59 million was liquidated, including $31.31 million long and $29.28 million short.

*This is not investment advice.